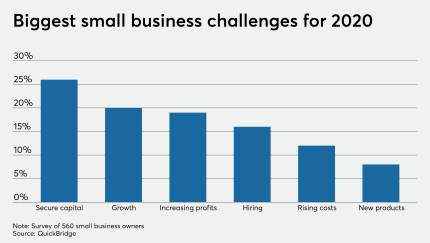

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

-

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

April 7 -

Fitch expects a majority of European CLO junior notes to be placed on a potential downgrade watch due to enhanced evaluation for coronavirus-related stresses.

April 7 -

Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

April 6 -

Lenders must balance the financial risk of extending credit without explicit backing from the Small Business Administration against the reputational risk of delaying aid for needy borrowers.

April 6 -

The central bank is creating a facility to provide financing to banks participating in the Small Business Administration’s Paycheck Protection Program.

April 6

-

In the last two quarters of 2019, according to Fitch Ratings, more U.S. managers of collateralized loan obligations (CLOs) had been structuring some of their transactions to comply with risk-retention rules.

April 6 -

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

April 6 -

Sen. Marco Rubio, R-Fla., said that $349 billion will likely not be enough meet loan demand from small businesses seeking a lifeline to help them weather the economic downturn brought on by the coronavirus outbreak.

April 5 -

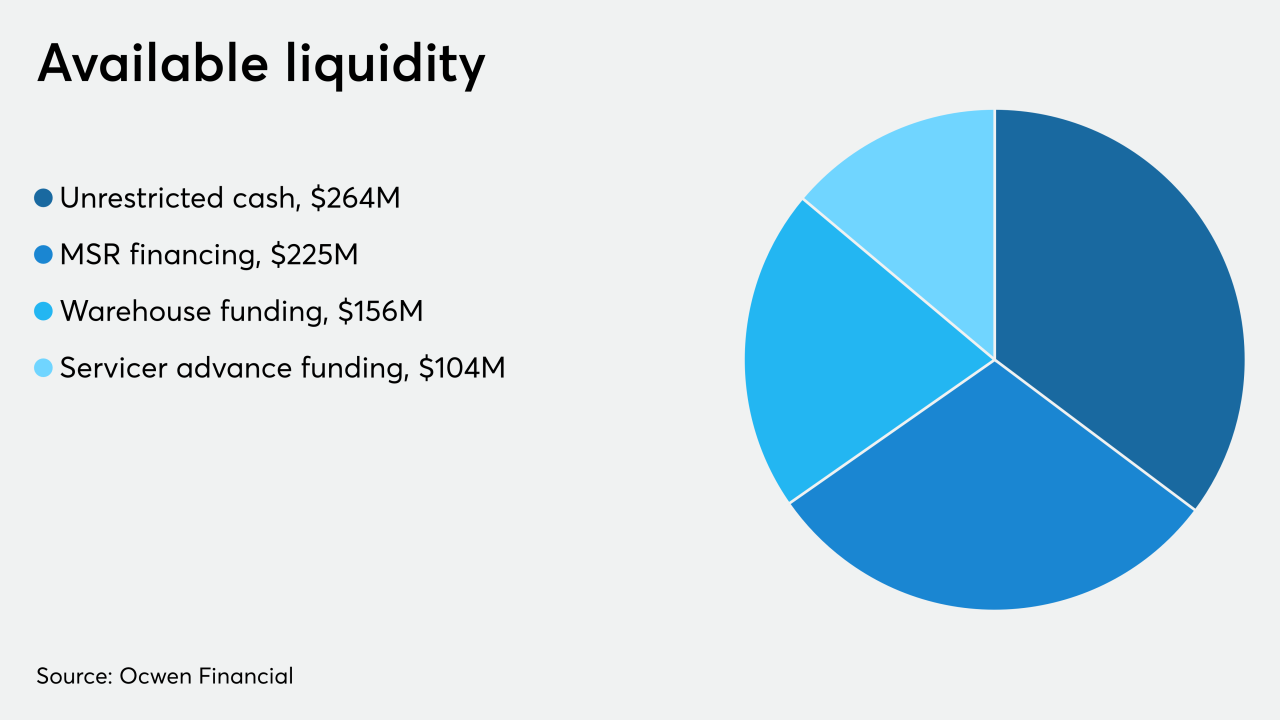

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

The review for downgrade affects three recent Aaa-rated issues totaling $3.25 billion from Nissan Motor Acceptance Corp.'s dealer inventory ABS platform.

April 3 -

ABS participants saw markets freeze and were bracing for worse when federal aid provide a short-term respite. The question now: How much trust can anyone put in the medium-term and beyond?

April 3 -

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

April 2