Pepper Residential Securities Trust No. 25 is relying on rigorous servicing to ensure the performance of its collateral of low-doc, high-loan-to-value loans made to borrowers with unfavorable credit records, according to details from an S&P Global presale report.

-

Lenders contend the proposal goes beyond policing third-party debt collectors and could expose banks to enforcement actions and lawsuits.

November 25 -

The two deals continue a late-year surge of private-label RMBS deal volume totaling $8.37 billion priced since Oct. 1.

November 25 -

Democracy Forward filed the lawsuit Monday against the consumer bureau, Director Kathy Kraninger, the U.S. Department of Education and Education Secretary Betsy DeVos.

November 25 -

AMSR 2019-SFR1 Trust is a $442.94 million transaction backed by a single-loan secured by 2,525 SFR properties in 13 states, according to presale reports from Moody’s and DBRS Morningstar.

November 25 -

The nonbank share of large mortgage servicing is growing, but smaller players tend to be depositories, the Consumer Financial Protection Bureau found in a new report aimed at examining regulatory impacts.

November 22

-

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

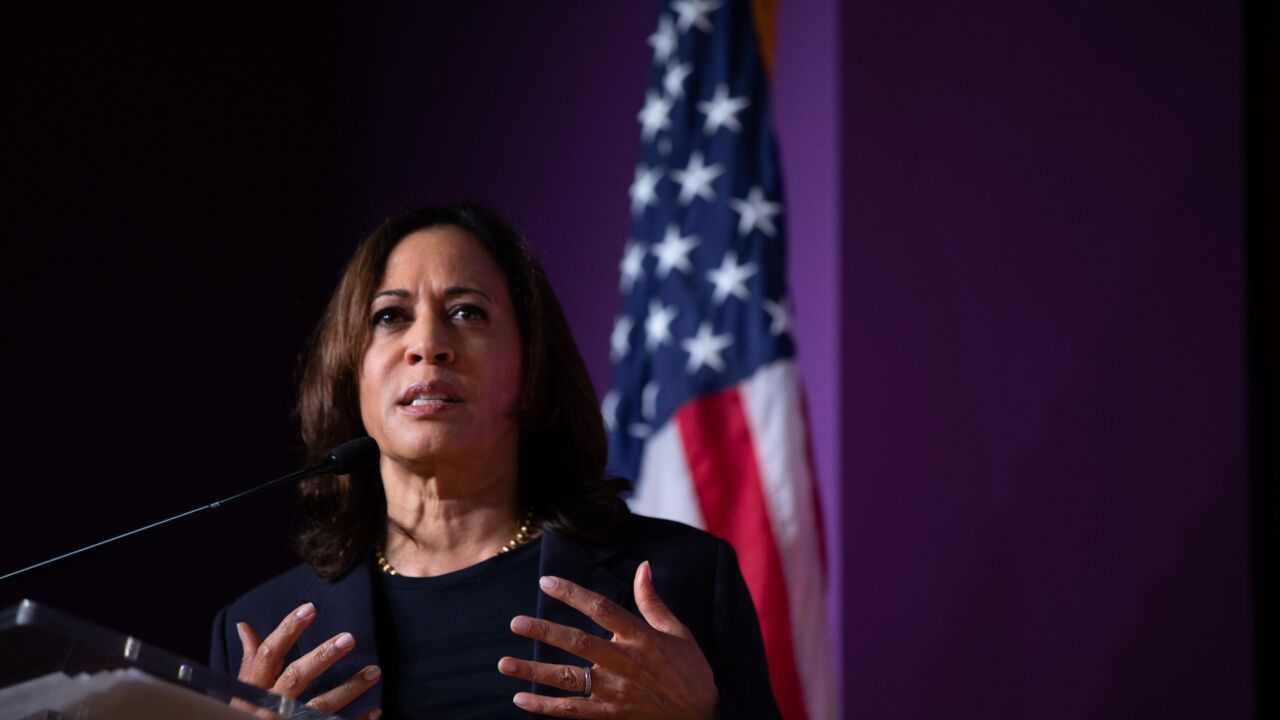

The House Financial Services chair is sponsoring a bill with one of the Democratic presidential contenders aimed at alleviating the public housing capital backlog.

November 21 -

Blackstone Real Estate Partners is securitizing a new $343 million commercial mortgage that financed the parent firm’s recent acquisition of a portfolio of Southern California apartments.

November 21 -

In an update of its rulemaking agenda, the bureau said it "expects to take final action in April 2020" on a proposal that would rescind strong underwriting requirements.

November 21 -

The online lender said it applied insights from its partnership with Fifth Third Bancorp in developing a new digital platform it’s marketing to other large financial services companies.

November 20 -

Octane Receivables Trust 2019-1 is a $210.9 million transaction involving fixed-rate loans to prime and non-prime borrowers financing the purchase of all-terrain and utility-task vehicles, as well as dirt bikes, motorcycles, mowers, tractors, snowmobiles and personal watercraft.

November 20