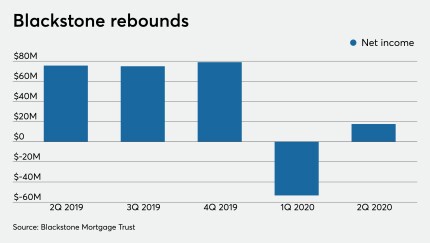

The private equity megalith's mortgage trust made a second-quarter net income of over $17.5 million and $85.2 million in core earnings.

-

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

The 30 loans secured by 146 properties in DBJPM 2020-C9 have lower-than-average loan-to-value ratios than recent bond offerings backed by commercial-mortgage securitizations of multiple properties.

August 18 -

Under the agreement, fintechs and their bank partners will have a safe legal harbor to offer loans, as long as their interest rates do not exceed 36% and they meet various other standards.

August 18 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 18 -

For the second consecutive month, the average extension rate in June for troubled loans due to pandemic-related stresses on borrowers shrank in both prime and subprime loan sectors.

August 18

-

Brookfield Property Partners, in a JV with Qatar's sovereign wealth fund, is securitizing a commercial mortgage for the newly constructed, 70-story tower near New York's revitalized Hudson Yards district.

August 17 -

The number of loans going into coronavirus-related forbearance decreased for the ninth consecutive week, according to the Mortgage Bankers Association.

August 17 -

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

August 17 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14 -

A pioneer in the commercial mortgage-backed securities market argues the HOPE Act would bail out savvy investors who don't deserve it. Barclays predicts that kind of attitude will make passage difficult.

August 14 -

With the moratorium still in place, mortgage foreclosure activity fell 83% in July compared to the year before and 4% from June, according to Attom Data Solutions.

August 13 -

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13

![“We will step up and do whatever we can to make sure that we ensure market stability,” said FHA Commissioner Dana Wade. “But we know [the pandemic will] ... pass and we're going to have a strong, vibrant economy when it does."](https://arizent.brightspotcdn.com/dims4/default/7956e80/2147483647/strip/true/crop/3462x1947+0+223/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F86%2Fa5%2F2a944fc3439c83e983c974aa82ca%2Fwade-dana-bl-081720.jpg)