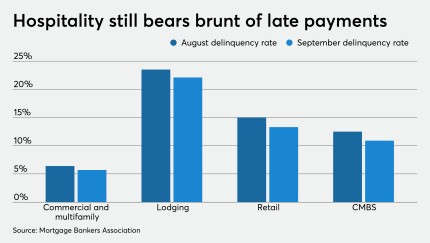

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

-

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

Pretium, by taking over Front Yard's 14,000-plus rental properties, will become the second-largest operator of cash-flowing single-family rental housing in the U.S.

October 19 -

While using the 30-day SOFR as its index, Freddie Mac structured the deal so it could shift to a one-month term if and when that rate is approved.

October 19 -

The ratings agency reports that asset-backed securities backed by small-ticket equipment leases and loans is subject to greater volatility from small-business payment deferrals.

October 19 -

The CEO of SWBC Mortgage discusses her top priorities for the Mortgage Bankers Association, the election, the CFPB's seasoned QM proposal and what to expect at this week's conference.

October 19

-

This year will top the total volume generated in the housing boom year of 2003. Meanwhile, next year's 30-year FRM is predicted to stay at 2.8%.

October 18 -

Lenders’ loan modifications have temporarily reduced the delinquency rate of loans in CMBS deals for the second month in a row, according to Moody’s Investors Service, but the temporary nature remains cause for concern.

October 16 -

Deals, trends and research in structured finance and asset-backed securities for the week of Oct. 9-15

October 16 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

NYL Investors’ $400 million Flatiron CLO 20 incorporates increasingly common provisions giving it more flexibility in today’s uncertain credit environment.

October 16 -

PPM Loan Management Company's new CLO has an expected triple-A spread of 142 basis points.

October 16 -

Barings LLC is back in the market with the $319 million Barings CLO 2020-II deal that provides higher credit enhancement on the top rated tranches than the Barings CLO 2020-I, its first CLO this year that was completed in September.

October 15