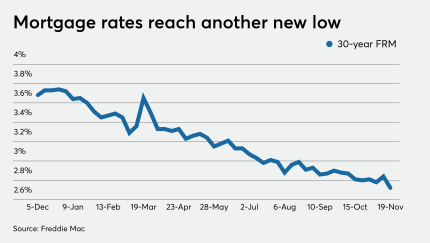

Weaker consumer spending data coming into the holiday season, as well as a resurgence of the COVID-19 spread, pushed mortgage rates to a new low, Freddie Mac said.

-

Fannie hasn't completed any credit risk transfers to private investors since the second quarter. Some experts worry the decision — likely spurred by the company’s concerns about a recent capital regulation — could put the mortgage giant on unsteady footing.

December 3 -

The transaction involving 345 high-balance mortgages is just the third sponsored by Morgan Stanley's mortgage acquisition and trading arm since the financial crisis more than a decade ago.

December 3 -

The $310.47 million GLS Auto Receivables Issuer Trust 2020-4 collateralizes 13,316 loans with an average borrower FICO of 573. That is lower subprime territory, but is slightly higher than any of GLS’ most recent securitizations, according to a report from DBRS Morningstar.

December 3 -

The head of the Federal Housing Administration said Congress should consider whether to continue allowing the loan floor and ceiling to remain tied to changes in the conforming mortgage limit.

December 2 -

Vice Chairman of Supervision Randal Quarles said the agency wants to figure out why banks are holding on to capital that could be used more aggressively to respond to the pandemic.

December 2

-

Even government-sponsored enterprise loans, which have seen forbearance rates drop for 24 weeks in a row, saw a slight uptick.

December 1 -

The third offering of bonds secured by non-guaranteed private student loans has a senior-note weighted average life of just 3.44 years, compared to over five years each for two prior Navient SLABS deals this year.

December 1 -

The agency finalized a policy allowing companies to submit formal requests for clarification on a regulatory issue. The bureau said it will publish the advisory rulings in the Federal Register.

November 30 -

Other portions of the casino-property loan have been previously assigned to nine other commercial-mortgage securitizations.

November 30 -

The extension of the FHA’s willingness to conditionally endorse loans with suspended payments came amid a renewed push by public and private entities to spread awareness of the CARES Act option.

November 30 -

The WA FICO of 710 contrasts with the range of 554 to 635 in recent Carvana securitizations centered on subprime borrowers.

November 30 - LIBOR

The move would alleviate near-term risks and potential disruption with legacy securitization and structured-finance portfolios should all key Libor rates cease publication after 2021, as originally planned.

November 30