The $1.15 billion CarMax Auto Owner Trust 2021-2 could potentially be upsized to $1.56 billion, according to presale reports from Fitch Ratings and S&P Global Ratings. CarMax upsized its first deal of the year that priced in January.

-

Also, even with bans in place, the total number of filings keeps inching up due to actions taken on vacant properties.

April 15 -

The Michigan lender agreed in 2012 to pay $133 million to resolve civil fraud charges tied to government-backed mortgages. But the deal with the Justice Department came with a catch that eventually allowed Flagstar to pay far less.

April 15 -

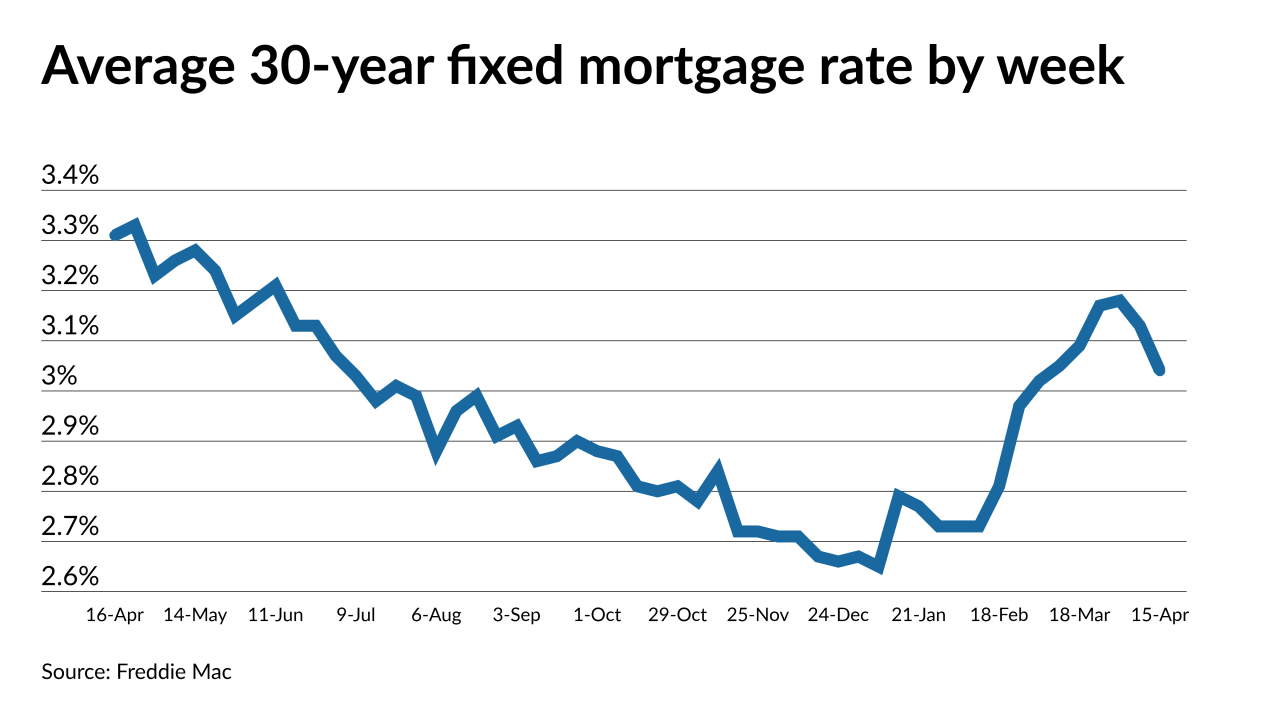

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

The $1.28 billion securitization includes a collateral pool with a higher WA FICO, lower LTV and shorter original terms that its previous loan ABS deal issued last October.

April 15 -

Oaktree Re VI 2021-1 will market $531 million in CRT notes that will provide NMI with partial reinsurance on a $45B pool of GSE-eligible loans.

April 14

-

Fewer obligors with troubled loans improved default exposure for managers of broadly syndicated CLOs, and provided deeper cushions for overcollateralization tests.

April 14 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

The conduit transaction will carry a $120 million portion of a $750 million debt financing package for Facebook's newly built Oculus R&D center near San Francisco.

April 13 -

The Consumer Financial Protection Bureau's revocation of a Trump-era policy on abusive practices could mean higher fines and penalties for violators. But it still isn't clear what makes a practice abusive.

April 13 -

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

Also launching deals last week were Santander Consumer USA and DriveTime Automotive Group, according to ratings agency presale reports.

April 12 -

The inaugural securitization includes 447 30-year loans with average balances of $863,206.

April 12