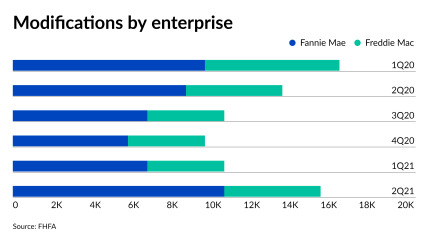

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

-

Many banks are still making loans tied to the scandal-plagued benchmark despite years of preparation for its demise. The end of 2021 could prove hectic as bankers scramble to implement changes and explain them to commercial borrowers.

September 28 -

It’s in the modeling and the long-term benefits, a cross-section of executive tells virtual crowd at Moody’s ‘Road to COP26’ event.

September 28 -

Conforming single-family homes, 65.3%, comprise most of the portfolio, and none of the borrowers in the portfolio had availed themselves of COVID-19 related forbearance.

September 28 -

Using data aggregation subsidiary Finicity, the card network will allow its bank and credit union partners to offer installment loans directly to consumers, who can repay from checking and savings accounts.

September 28 -

The proposal calls for a 20-year mortgage with Ginnie Mae and Treasury participation, but critics suggest that other measures would be more effective in bridging the gap in home equity.

September 28

-

The transaction is also the first securitization for ACREC. The entity is also taking on multiple roles, acting as sponsor, issuer and collateral manager.

September 27 -

Office imaging equipment and other business-related loan and lease contracts collateralize the highly diversified pool of obligors.

September 27 -

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

September 24 -

The filing by Tamara Richards also accused the founder and other execs of encouraging a "frat house" environment that mistreated women.

September 24 -

The July 21‘Risk Alert’ brings practices most common to hedge fund managers under scrutiny, but CLO managers who replicate those practices should also take heed.

September 24 -

To help determine certain forms of credit enhancement and loss triggers, LendingPoint 2021-B is tightening its definition of what a charged-off account is.

September 24 -

The need to size up the impact of hurricanes and pollution is increasing and current measures aren’t as precise as credit or rate models, according to the Research Institute for Housing America.

September 23