The potential amendments could expand coverage but also add new record-keeping and systems requirements for large banks handling custodial accounts.

-

Borrowers in the deal have a weighted average (WA) credit score of 722, have a DSCR of 1.39x and a weighted average loan-to-value (LTV) 71.7%.

July 29 -

The digital lender, which bought Radius Bancorp in February, still expects to record a full-year loss partly because of merger-related costs. But its stock price soared Thursday after it reported second-quarter net income of $9.37 million.

July 29 -

Democratic proposals to offer free accounts, restrict overdraft fees and cap interest rates have zero chance of passage. But analysts say lawmakers’ push for products that help consumers is influencing some banks’ decisions to institute reforms on their own.

July 28 -

Starting out as a consumer lender in 2012, Plenti began to make auto loans through its proprietary platform in 2017 and also offers peer-to-peer lending access.

July 28 -

Such applications have declined on an annual basis for the past three months, but overall weekly numbers increased due to a jump in refinances amid plummeting rates.

July 28

-

Combined with its pending acquisition of HSBC's East Coast branches, the deal would give the Rhode Island-based Citizens a top-10 deposit market share in metropolitan New York.

July 28 -

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

The potential amendments could expand coverage but also add new record-keeping and systems requirements for large banks handling custodial accounts.

July 27 -

The trust scales back on its office concentration, and increases multifamily and retail exposure. The latter's concentration is higher than all YTD averages since 2019.

July 27 -

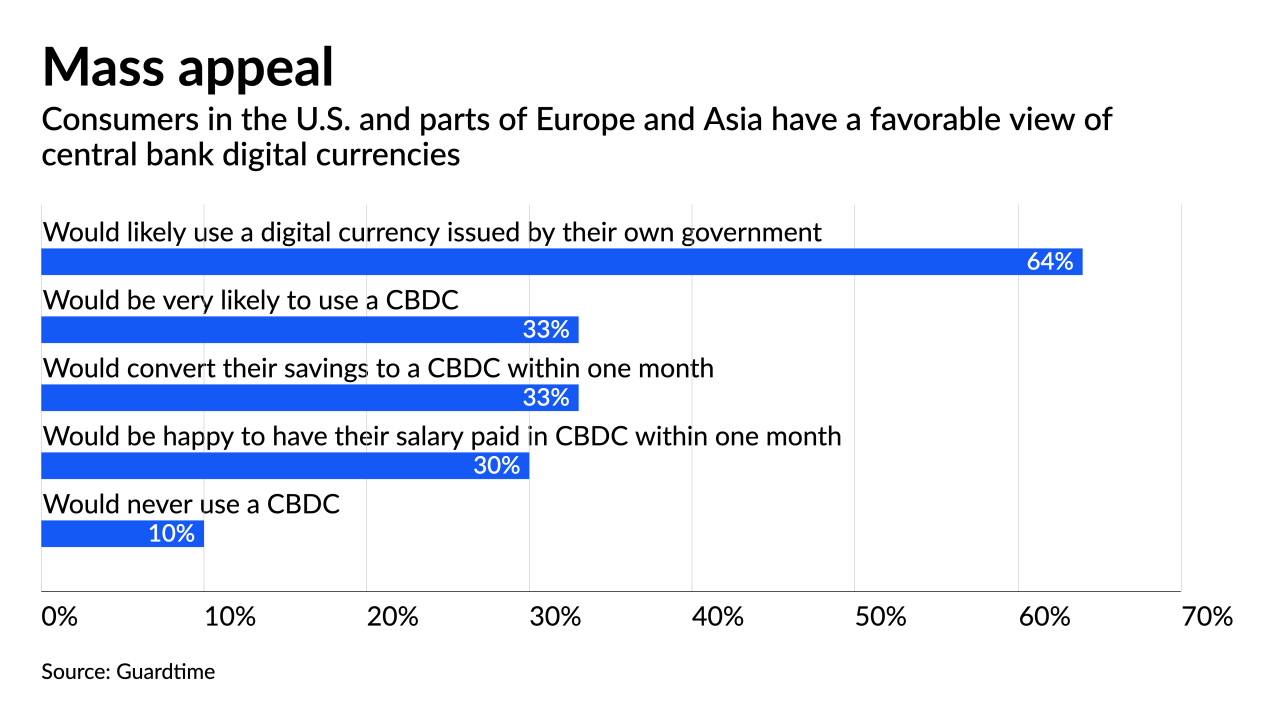

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

Expanded prime and non-prime mortgages underpin the pool in the deal, issuing $459.8 million in notes.

July 26 -

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26