In the past week, five new-issue collateralized loan obligations have been launched and/or priced by U.S. managers, after just one deal was arranged in the first two weeks of the year. The latest deals were placed by THL Credit Advisors, Sound Point Capital Partners, CIFC Management, Apex Credit Partners and Octagon Credit Investors.

-

As part of its plans to grow its business in the Netherlands, risk and due diligence expert Clayton Euro Risk has announced a strategic alliance with The Dutch Mortgage Consultants.

March 7 -

Barings U.K. is serving as manager for a new collateralized loan obligation warehouse funding structure that will have a target notional value of between 320-400 million (US$338-$422.8 million), according to a report from bond rating agency DBRS.

March 7 -

Freddie Mac is preparing a transaction that transfers credit risk on $639.9 million of super conforming residential mortgages.

March 7 -

Tennessee bankers are opposed to the introduction of the green-bond financing program in the state because of the first-lien priority of PACE assessments over mortgages. PACE programs are already in place in 32 states and the District of Columbia.

March 7 -

Orico, a Japanese finance company, is pursuing its sixth multi-currency prime auto loan securitization in a $336.5 million deal that includes several tranches of U.S.-dollar denominated bonds.

March 6

-

Rising interest rates have slowed a recent run of unexpectedly high prepayments of government-insured mortgages, making servicing rights for loans held in Ginnie Mae securities more attractive to investors.

March 6 -

U.S. CLO new issue bounced back in February with 15 deals coming to market for a combined total of $8.1 billion, according to Thomson Reuters LPC.

March 6 -

Subprime auto lender Westlake Financial Services is hoping asset-backed investors can stomach a bigger dose of regulatory risk.

March 6 -

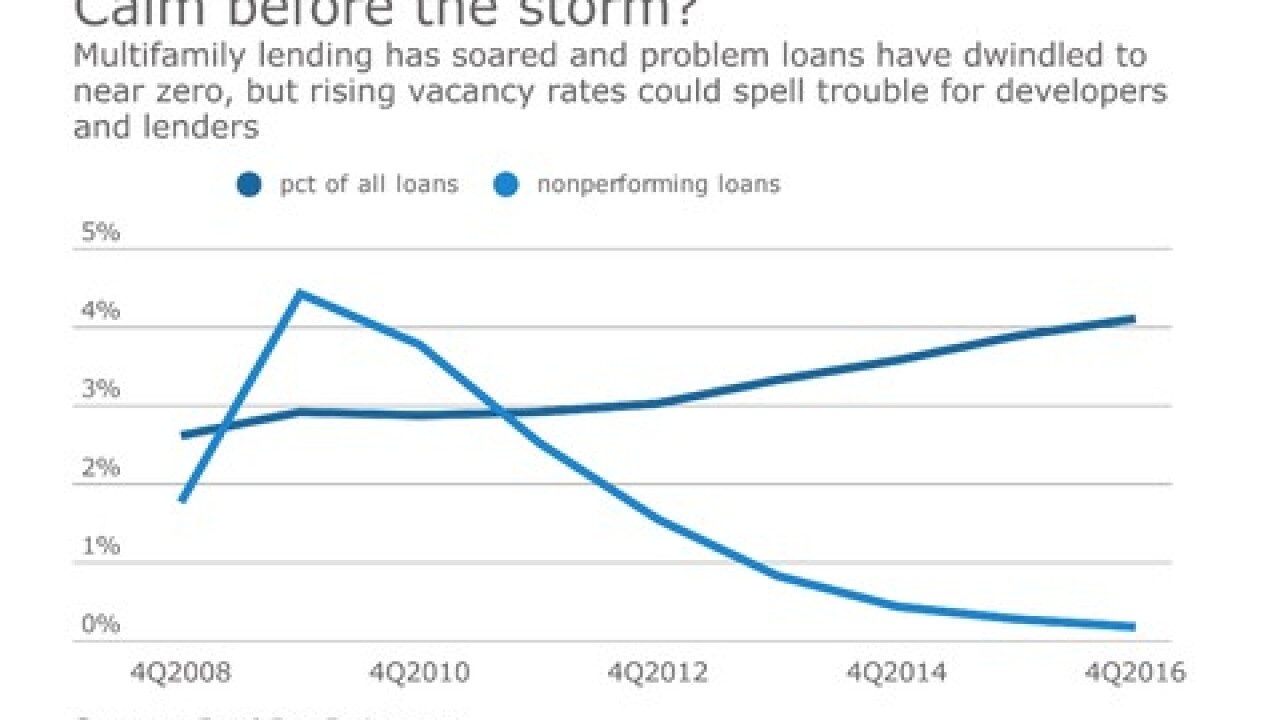

Multifamily is one of four lending subcategories that regulators consider when assessing a banks exposure to commercial real estate. Dozens of banks remain above regulators preferred capital ratio for measuring CRE risk.

March 6 -

Avis Budget Car Rental is piecing together the markets second rental-car fleet transaction of the year in a $500 million transaction.

March 5 -

ECMC Group is marketing another $409 million of notes backed by federally guaranteed student loans that were once delinquent but are now making timely payments.

March 5