Technology

Technology

-

JPMorgan Chase is sending signals that its homegrown blockchain, Quorum, is alive and well despite a recent shake-up.

April 23 -

The Wall Street giant's acquisition of the app maker Clarity Money is only one part of a long-term strategy to build a digital retail bank from the ground up.

April 17 -

As upstart companies mature, they face pressure to develop deeper relationships with their customers. That is leading some to offer to a wider range of products, including deposit accounts.

April 12 -

Upgrade's new product, unveiled Tuesday, is aimed at consumers who are expecting a big expense but may not need to borrow all the money at once. Unlike a home equity line of credit, the loan can be approved in minutes because there is no need for collateral or an appraisal process.

April 10 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

Even as many venture capitalists retreat from the online lending industry, Upstart Network is hoping to find investors still willing to bet on the business.

March 27 -

Fifth Third and First Republic are among the investors in the company’s $50 million equity round.

March 21 -

As the agency pulls back its enforcement efforts, it opens the door for state authorities to pursue more cases against financial startups for their data collection and privacy practices.

March 19 -

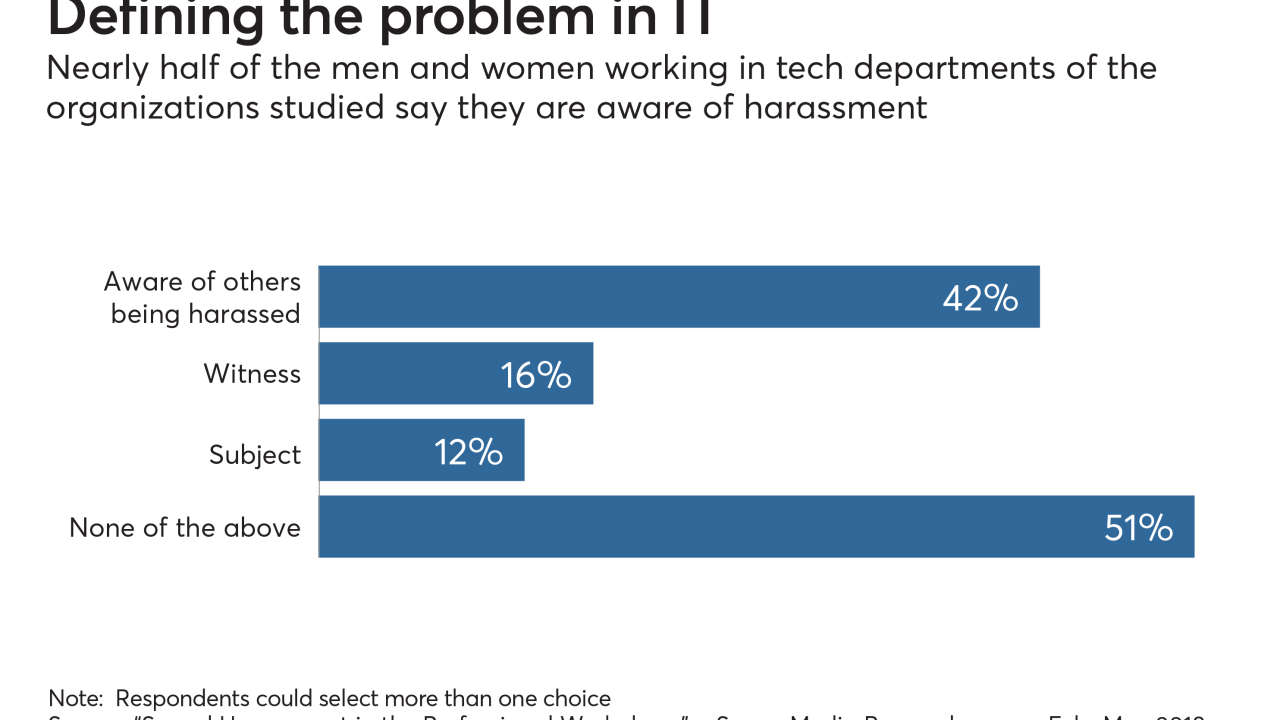

Many workers in the technology departments across a range of industries describe behavior that may fall short of a legal definition of sexual harassment, but is still disturbing and could contribute to low employee morale and high turnover.

March 12 -

The online lender is taking a stand against businesses that sell assault weapons or that sell any type of firearms to people under 21.

March 5 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

February 13 -

Fintech firms and industry watchers hope the pilot program will help fix a balkanized chartering system, but getting enough states on board to expand the plan's reach could be a challenge.

February 9 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

Stepping in after co-founder Mike Cagney's resignation, Twitter's Anthony Noto needs to overhaul the firm's corporate culture, lay the groundwork for an IPO and determine whether to renew SoFi's pursuit of a bank charter.

January 23 -

The agreement marks the latest example of the banking giant teaming with a fintech to speed up delivery of services to its customers.

January 11 -

The two senators are set to introduce a bill that would force such firms to pay $100 per customer whose personal information was compromised.

January 10 -

Intrust Bank has agreed to purchase $20 million worth of Funding Circle's small-business loans in what could just be the beginning of a long-term relationship.

January 4 -

Startups that have developed the technology for real estate finance are starting to conduct a broader array of transactions, including property sales.

January 2 -

Some were sold at discounted prices, while others were shut down by their acquirers or quietly ceased doing business.

December 25