-

Wednesday brings the next pivotal data point, with the release of the latest consumer-price figures, which are forecast to show inflation remains sticky.

January 14 -

Tuesday's declines lifted yields by one to four basis points across maturities after Trump said he'd impose additional 10% tariffs on goods from China and 25% tariffs on all products from Mexico and Canada.

November 26 -

When the Trump tax cuts expire next year, the White House will ask for higher corporate taxes and a buyback tax as Congress enters one of its biggest economic fights of the decade, which will have major implications for bankers.

May 10 -

The case involves a house seized for a tax debt — but the state pocketed the profits.

May 16 -

Infrastructure will command most of lawmakers’ attention, but expect banks to keep pushing for bills that would ease the transition away from a key benchmark rate and help them serve legal cannabis businesses.

August 24 -

Raising the capital gains tax and code changes could have more of an impact on the public debt market than rising interest rates, according to a panelist at the Urban Land Institute's Spring event.

May 13 -

Now that Democrats have won control of the Senate following the Georgia runoffs, experts say tax increases, progressive regulators and stricter congressional oversight await. Still, there could be some positives for banks, too.

January 7 -

The global pandemic and stalled trade negotiations have discouraged farmers and ranchers from taking on more debt and made banks uneasy about extending more credit.

August 4 -

The COVID-19 pandemic’s longer-term impact on residential mortgage-backed securities remains uncertain, but for now DBRS Morningstar’s outlook for the residential property assessed clean energy asset-backed securities sector remains stable.

June 25 -

The 2008 package proved some banks were too big to fail. But the rushed $2.2 billion stimulus shows now any company can be bailed out.

March 31 Polyient Labs

Polyient Labs -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

The backloaded maturity schedule of the debt brings comparisons to the city's supposedly abandoned "scoop-and-toss" practices.

October 29 -

Financial services groups are calling for more funding for the Internal Revenue Service that could fix flaws in the agency's system for verifying the income of mortgage applicants.

February 22 -

The Senate approved the final tax reform plan 51-48 early Wednesday, the second-to-last obstacle before sending it to President Trump for his signature.

December 20 -

Top officials at the Internal Revenue Service met with mortgage industry groups this week to discuss possible fixes to the agency’s verification system, which lenders rely on to process mortgage loans.

December 19 -

Mortgage lenders are bracing for big delays in the processing of mortgage applications, citing a problem with the income verification system at the Internal Revenue Service.

December 17 -

Regulatory changes that would put an end to state and local tax deductions could prompt many homeowners in high-tax states to consider relocating, a Redfin survey shows.

December 11 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

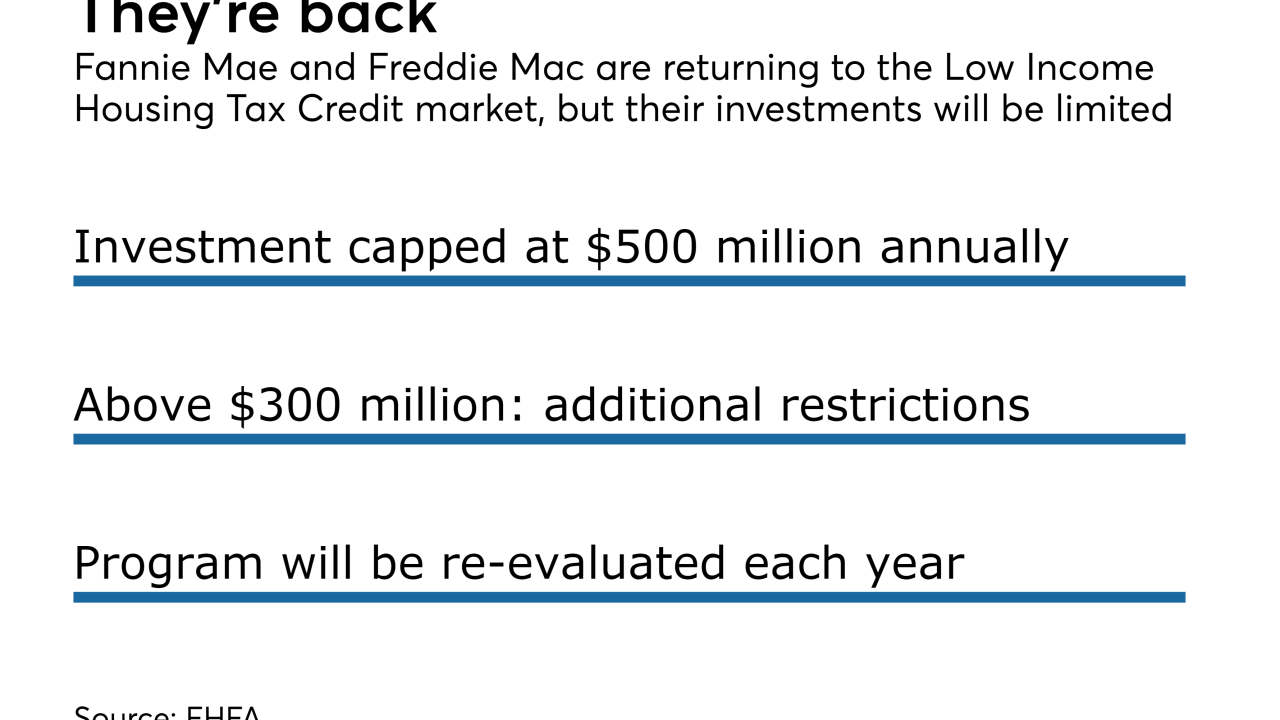

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16