-

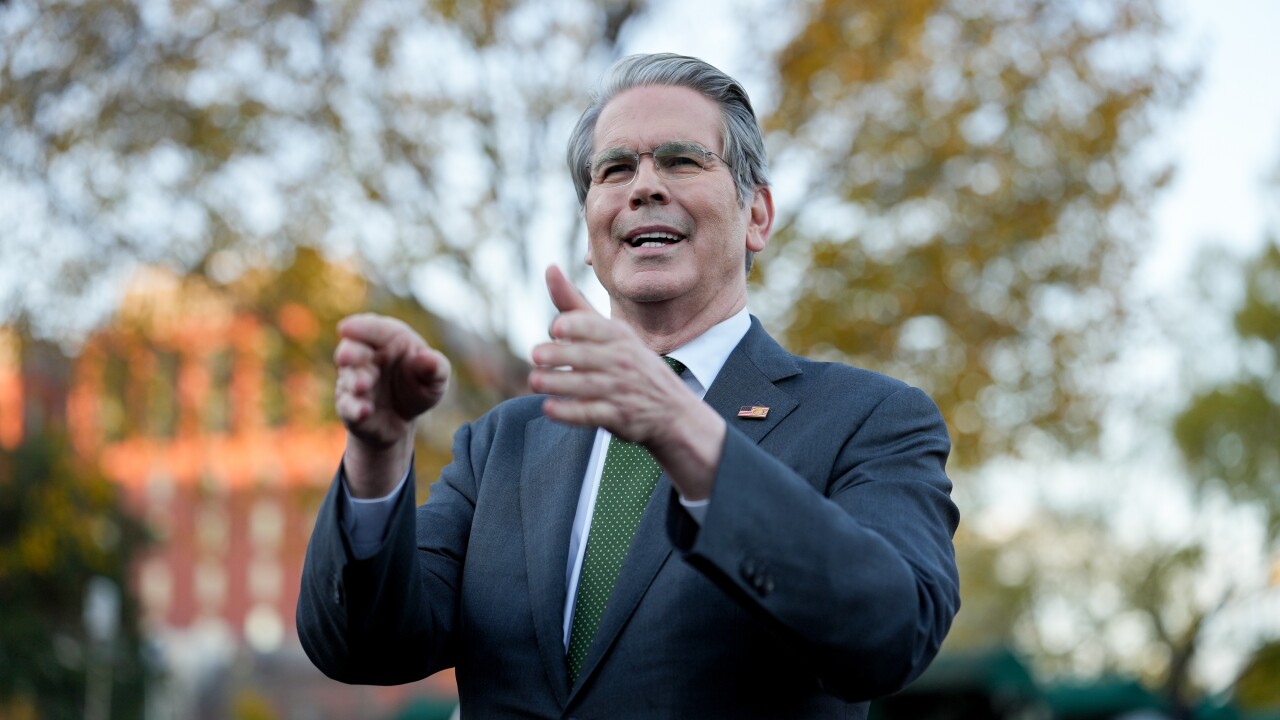

John Velis, Americas macro strategist at BNY, said the US can lean on T-bills to plug that "substantial" gap, helping to explain why the reaction in US Treasuries to Friday's ruling has so far been muted.

February 24 -

The top court's verdict eliminates import taxes that have acted as a restraint on the government's $1.8 trillion budget deficit and the swelling national debt.

February 20 -

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

February 4 -

The Federal Open Market Committee voted 10-2 Wednesday to hold the benchmark federal funds rate in a range of 3.5%-3.75%.

January 28 -

Under the framework deal that persuaded Trump to defuse the Greenland crisis, the president would agree to stand by his promise to hold off on fresh tariffs on European products.

January 22 -

The $13 billion auction was awarded at 4.846%, about a basis point lower than its yield in trading just before 1 p.m.

January 21 -

In the U.S. Treasuries market, longer-dated bonds were hit hardest, as 30-year yields climbed 8 basis points to 4.92%.

January 20 -

The twists and turns of the U.S. economy and the artificial-intelligence boom both played a role. But much of it could be traced to the White House.

December 30 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

The two privately discussed what a move could look like, with the Trump administration "receptive" to welcoming Switzerland's largest bank, the newspaper said.

November 17 -

Trump, who has touted the billions raised in US tariff revenue this year, has talked about the checks as public frustration mounts over the cost of living.

November 16 -

Bessent spoke a week after Democrats won several key elections by zeroing in concerns over the cost of living, including housing, groceries, utilities and health care. Trump himself has rebuffed such concerns.

November 11 -

Yields on 10-year benchmark US government bonds rose as much as four basis points to 4.04%, the highest in more than a week, after negotiators from the world's two biggest economies said they'd struck a series of agreements on issues.

October 27 -

Dollar bonds, meanwhile, reversed an earlier jump. Notes maturing in 2035 were down by almost 0.1 cent on the dollar, trading at 57 cents.

October 17 -

After an apparent truce, the US and China are back to making tit-for-tat trade swipes. Market participants are fretting more about the potential impact on growth than how the protectionist measures will affect inflation.

October 14 -

Federal Reserve Governor Stephan Miran floated the idea of conducting monetary policy with an eye toward the neutral rate and suggested that the president's immigration and fiscal policies will exert downward pressure on inflation.

September 22 -

He is expected to take part in the closely-watched Federal Open Market Committee meetings scheduled for Tuesday and Wednesday.

September 16 -

While Trump's trade war has roiled markets, unnerved foreign governments and provoked criticism from leading economists, S&P affirmed its AA+ rating for the US — a score it's given since 2011.

August 19 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said she foresees three interest rate cuts for this year, a view bolstered by the latest employment data.

August 11 -

Deal's trucking exposure could raise credit challenges as tariffs increase.

August 1