-

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

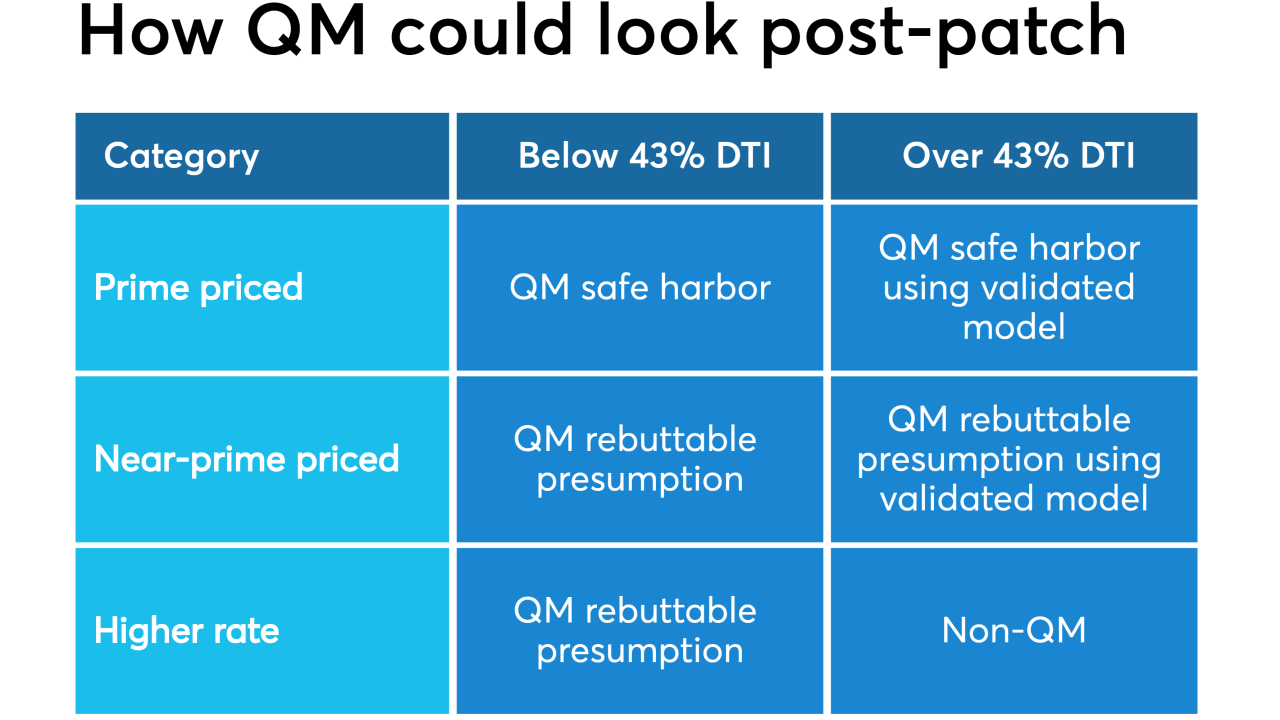

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

June 19 -

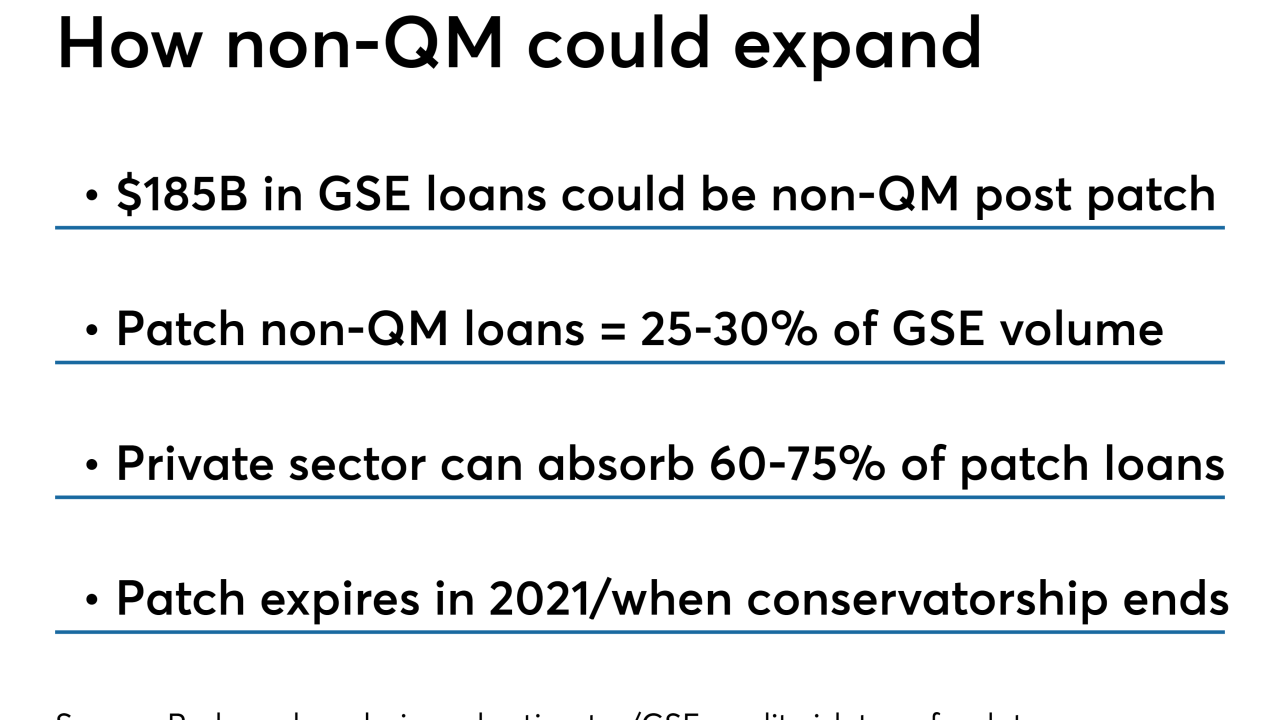

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

With prospects for government-sponsored enterprise reform improving, players in the private residential mortgage-backed securities market are starting to think about how they could better compete against the GSEs while awaiting change.

May 20 -

Investors can now exchange certain existing Freddie Mac bonds for to-be-announced uniform mortgage-backed securities in preparation for the full launch of UMBS next month.

May 8 -

Freddie Mac exchanged existing bonds from its portfolio for mirror certificates for the first time, completing a key test that is central to the creation of a uniform mortgage-backed security.

March 28 -

The Federal Housing Finance Agency, by allowing Fannie Mae and Freddie Mac to split the CEO and president positions, let the companies dodge a congressionally mandated cap on executive salaries, the regulator's inspector general said.

March 27 -

The Securities Industry and Financial Markets Association approved changes to its good delivery guidelines that ease the path to the government-sponsored enterprises issuing uniform mortgage-backed securities starting on June 3.

March 12 -

Ginnie Mae could limit how much servicing income mortgage lenders can sell off through a transaction if they don't establish a minimum 25-basis-point spread at the portfolio level by next year.

March 8 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

Falling mortgage rates have reached the point where they are spurring speculation about a possible resurgence in refinancing.

January 2 -

Nonbank lenders are gearing up for new secondary market requirements and must make some difficult choices about whether to buy, sell or hold mortgage servicing rights, says Ruth Lee, the executive vice president of MorVest Capital.

December 28 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2