-

However, leadership noted that 2021 was the second record year for new single-family mortgages and also discussed how the government sponsored-enterprise plans to further rebuild its capital.

February 10 -

In addition to hinting at a March rate hike, the central bank this week announced an intention to have Treasury securities make up a greater share of its holdings, which has implications for securitized home loans.

January 27 -

The change aims to streamline the processing of certain pandemic-related loan options that accommodate lower monthly payment amounts for borrowers with long-term economic hardships.

January 24 -

The researchers found that the disparities that emerged from the analysis of 1.8 million appraisals from 2019 and 2020 were statistically significant.

January 21 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The Duty-to-Serve goals currently under review drew some objections from a coalition of affordable housing groups last year.

January 6 -

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

Under the Federal Housing Finance Agency rule, the GSEs would need to lay out how levels will change under a variety of stress tests, including required ratios separately proposed for amendment.

December 16 -

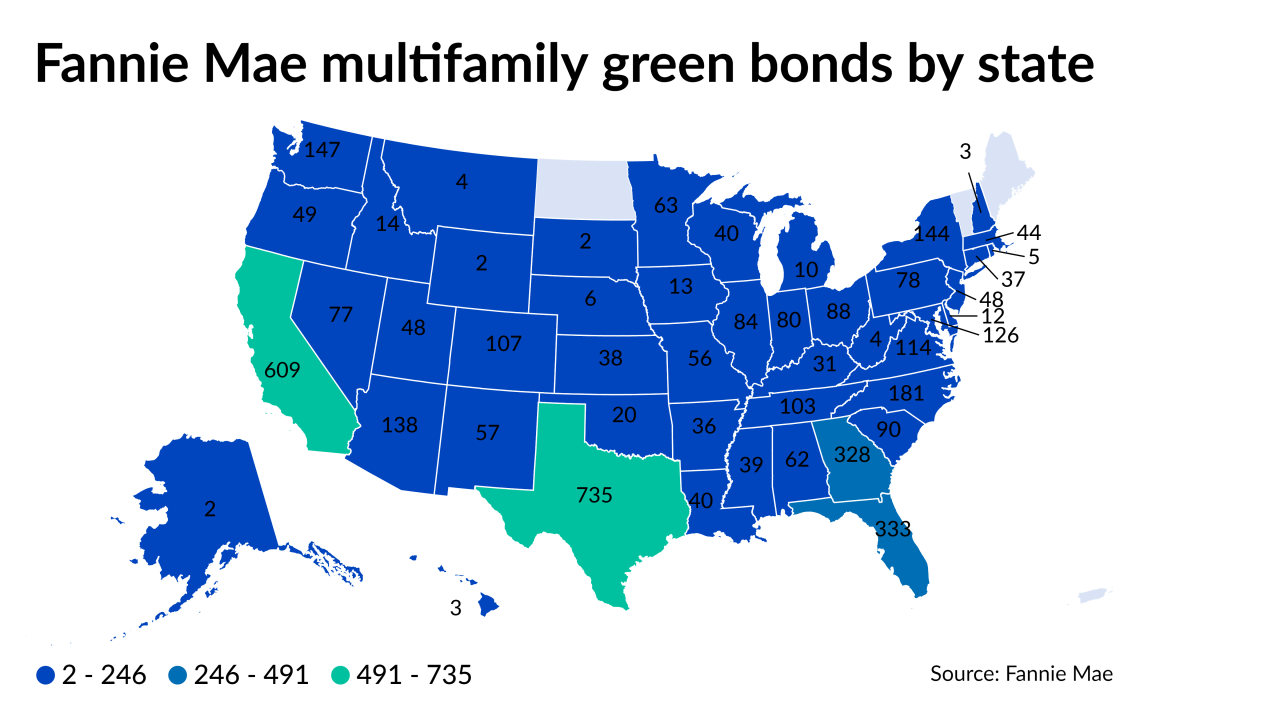

New securitizations of mortgages on energy-efficient rental housing totalled $12.7 billion during the first 11 months of this year, suggesting 2021’s total will come close to matching 2020’s $13 billion.

December 8 -

Acting Federal Housing Finance Agency Director Sandra Thompson and the Housing Policy Council say the new amounts are not good for affordable housing.

November 30 -

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

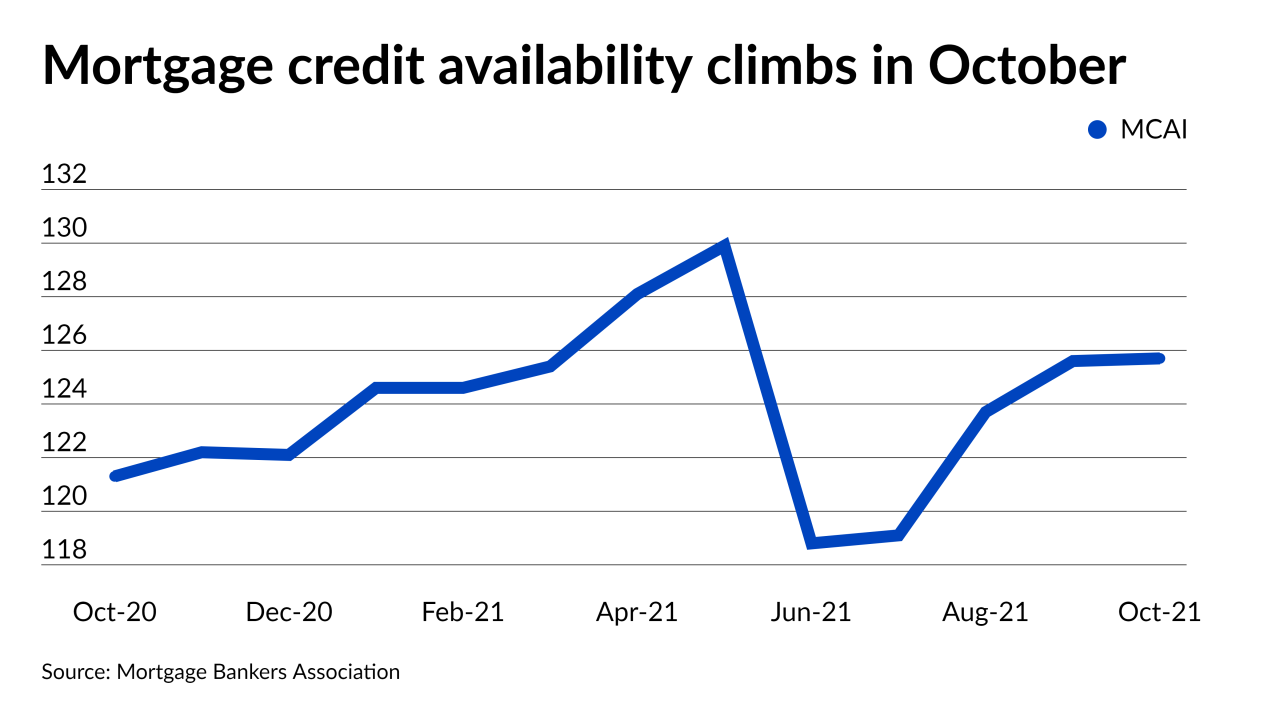

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

The reception in the market to structured single-family CRTs' return at the government-sponsored enterprise was strong enough for it to plan to follow up this transaction with another one next month.

October 20 -

The problem loans mature right around when tenants in the offices are due to renew — or end — their leases. That may unsettle investors in commercial mortgage-backed securities, analysts at Moody’s Analytics warned this week.

October 14 -

Two Wall Street firms and a single-family rental investor have purchased portions of the government-sponsored enterprise's latest nonperforming loan package.

October 12 -

The $146 million deal could indicate that volume in the asset class has gotten large enough to support programmatic activity in the pricey housing market.

October 12 -

Common Securitization Solutions has disbanded a group of independent board members originally brought on in early 2020 to look into using the government-sponsored enterprises’ platform to serve a broader market.

October 6 -

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1