-

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

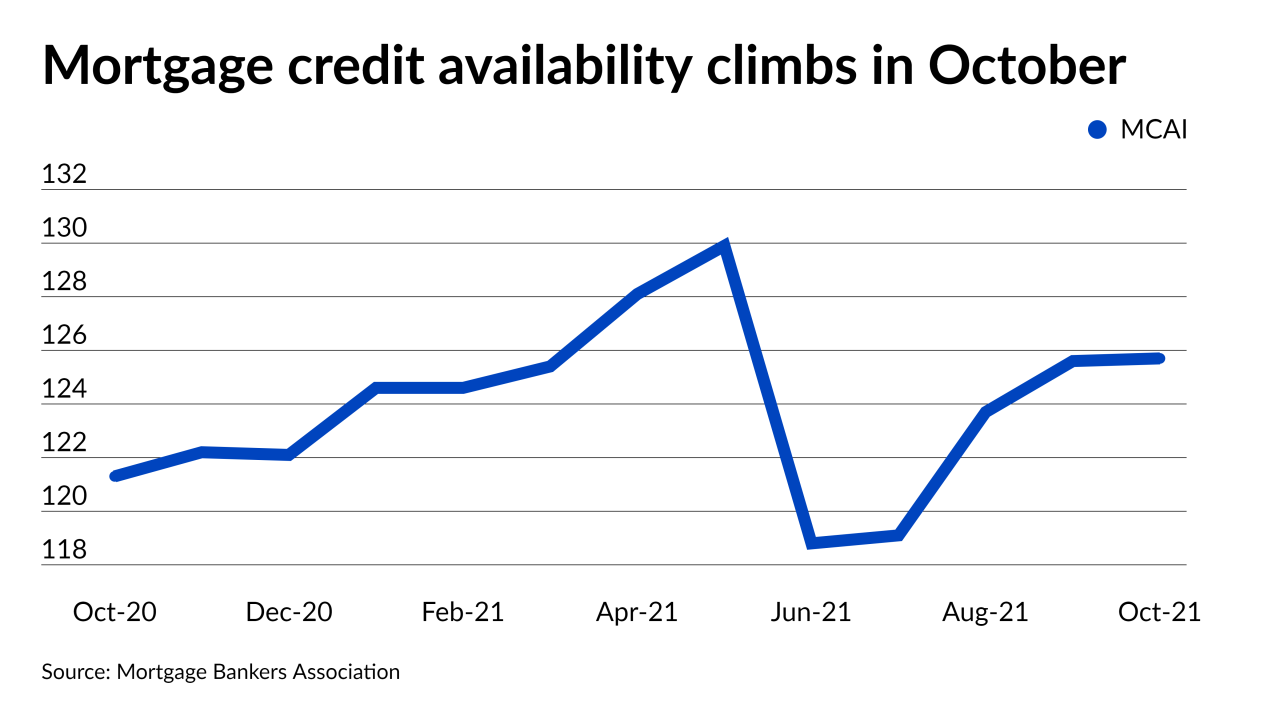

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

The reception in the market to structured single-family CRTs' return at the government-sponsored enterprise was strong enough for it to plan to follow up this transaction with another one next month.

October 20 -

The problem loans mature right around when tenants in the offices are due to renew — or end — their leases. That may unsettle investors in commercial mortgage-backed securities, analysts at Moody’s Analytics warned this week.

October 14 -

Two Wall Street firms and a single-family rental investor have purchased portions of the government-sponsored enterprise's latest nonperforming loan package.

October 12 -

The $146 million deal could indicate that volume in the asset class has gotten large enough to support programmatic activity in the pricey housing market.

October 12 -

Common Securitization Solutions has disbanded a group of independent board members originally brought on in early 2020 to look into using the government-sponsored enterprises’ platform to serve a broader market.

October 6 -

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1 -

While PLS loans still represent a sliver of the overall mortgage market and are nowhere near the $1 trillion level seen before the Great Recession, issuance jumped markedly this year.

September 30 -

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

September 24 -

The company will return to selling pieces of its credit exposure to private investors during the last three months of the year, but is still evaluating its strategy for 2022.

September 20 -

While overall volume was down in August, it remained historically strong, particularly in the securitized market for home equity withdrawal loans made to borrowers age 62 and up.

September 9 -

The government bond insurer allowed lenders to become “eIssuers” a little over a year ago, and the move contributed to a large surge in electronic notes this year.

September 7 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

DeVito takes over on June 1, replacing interim CEO Mark Grier, who returns to his seat on the government-sponsored agency's board.

May 26