-

This move comes at a time when the largest HECM producer sold its operations to a rival and another filed for bankruptcy.

January 30 -

The Lansing, Michigan-based firm was awarded the contract this spring and takes over from Novad Management Consulting, which had previously serviced government-held HECMs since 2014.

December 13 -

The deal will close for $10 million in cash, plus the right to purchase nearly 33.9 million shares of common stock.

December 7 -

In the face of a growing number in home-equity products, HECM endorsements dropped nationwide by over 43% on a monthly basis to its lowest point in more than two years.

October 4 - LIBOR

The deadline for inclusion in Ginnie mortgage-backed securities has been extended and an exception will be made for some participations.

December 16 -

HomeEquity will sell an as-yet undetermined volume of notes to finance forthcoming originations by the bank sponsored by Birch Hill Equity Partners Management.

December 8 - LIBOR

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021, and earlier for reverse-mortgage securitizations.

September 21 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Ginnie Mae helped to fund more than $70 billion in loans aimed at helping low- and moderate-income borrowers in July.

August 10 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Dana Wade would succeed Brian Montgomery, the acting deputy secretary of the Department of Housing and Urban Development.

February 20 -

A trade group is looking into why New York Gov. Andrew Cuomo felt foreclosure risks were too high to sign a bill that would have approved reverse mortgages for cooperative properties.

December 26 -

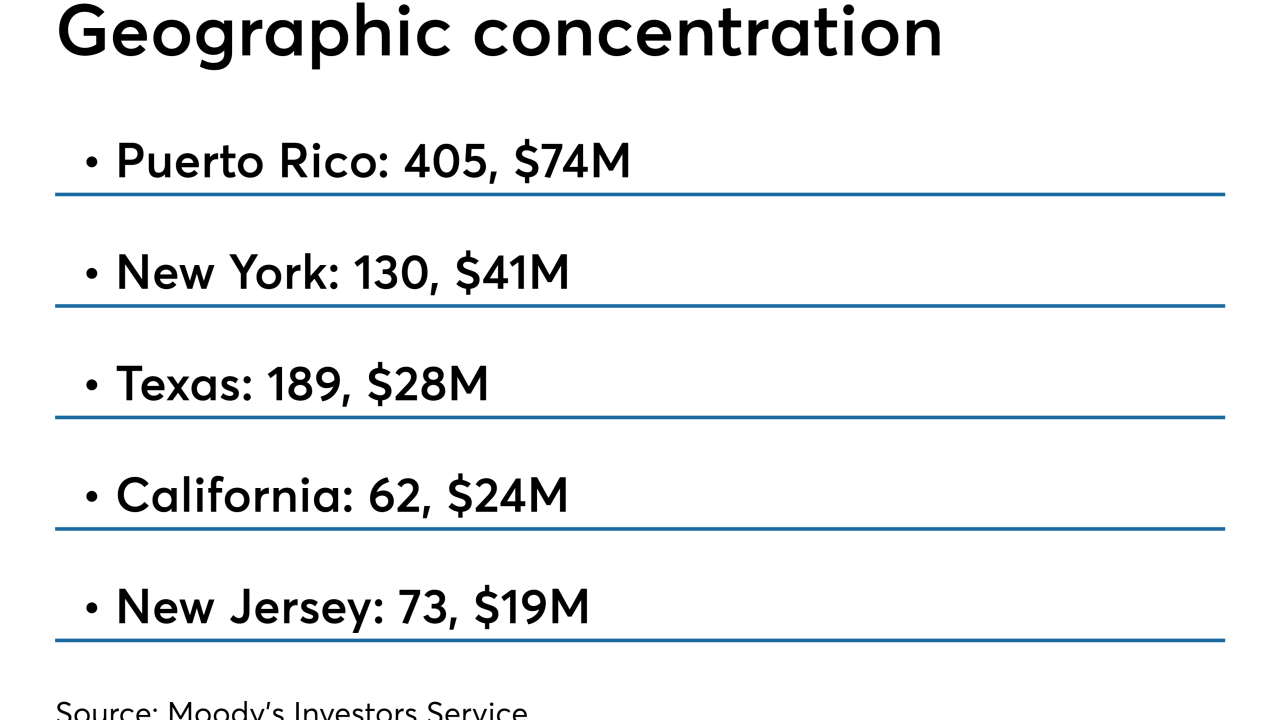

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

August 6 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

Nearly 67% of the loans in the $309 million loans and repossessed properties backing FASST 2019-HB1 were obtained from a 2017 deal that was recently collapsed.

April 18 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

The $571 million transaction is backed by 915 loans originated from 2002 and 2008 that Waterfall Asset Management acquired over eight years.

November 1