-

Dana Wade would succeed Brian Montgomery, the acting deputy secretary of the Department of Housing and Urban Development.

February 20 -

A trade group is looking into why New York Gov. Andrew Cuomo felt foreclosure risks were too high to sign a bill that would have approved reverse mortgages for cooperative properties.

December 26 -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

August 6 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

Nearly 67% of the loans in the $309 million loans and repossessed properties backing FASST 2019-HB1 were obtained from a 2017 deal that was recently collapsed.

April 18 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

The $571 million transaction is backed by 915 loans originated from 2002 and 2008 that Waterfall Asset Management acquired over eight years.

November 1 -

New securitizations backed by reverse mortgages are now at a low not seen in two years, signaling that higher volumes seen in recent months may be tapering off.

June 18 -

Issuance of Ginnie Mae securities backed by reverse mortgages rose above $1 billion for the second time in two years, according to the government agency's latest monthly report.

March 20 -

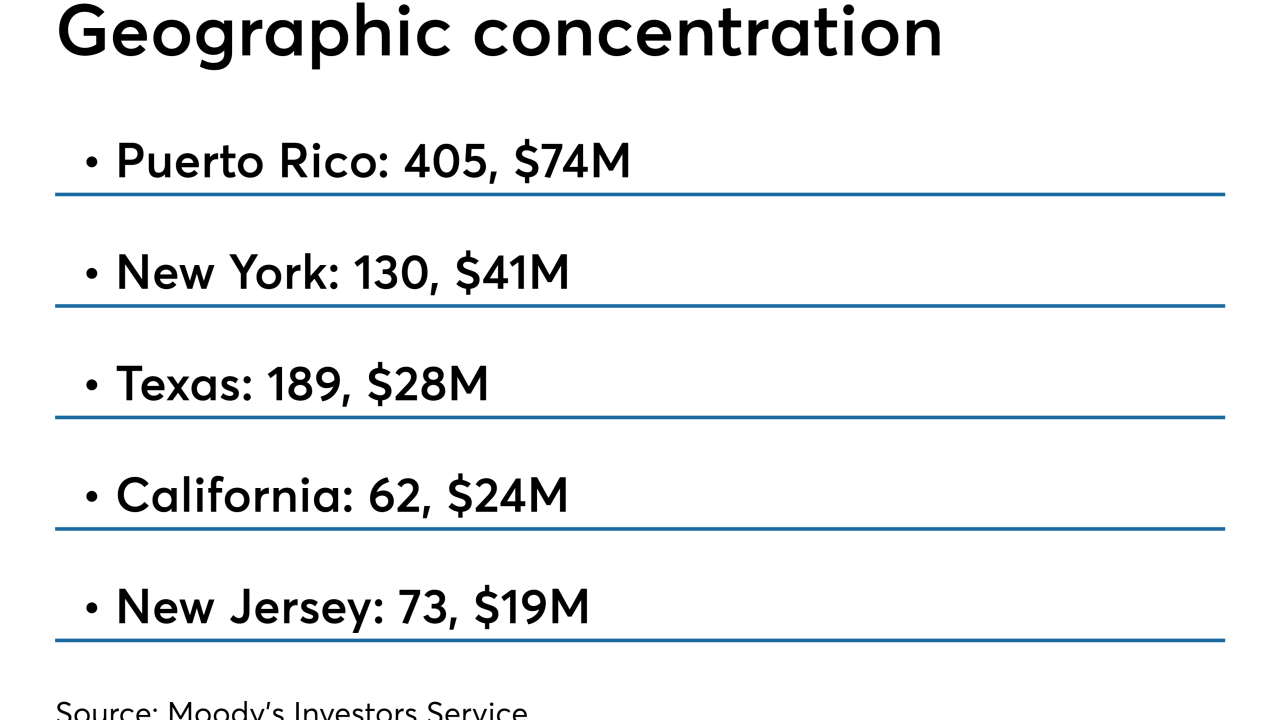

Over 40% of the collateral is from two 2016-vintage transactions that were recently "collapsed" because proceeds from liquidations had slowed. Then there's the exposure to Puerto Rico.

March 9 -

Securitization of nonperforming home equity conversion loans was pioneered by Nationstar; FAC's inaugural deal may be outstanding longer.

December 7 -

The sale of the struggling Financial Freedom unit to an undisclosed buyer would continue CIT's strategy of shedding noncore business lines.

October 6 -

Nearly half of the properties are in New York (30.3%), New Jersey (10.4%) or Florida (8.7%), states that require a court to sign off on a foreclosure, a lengthy process that could affect the timing of payments.

September 26 -

The Department of Housing and Urban Development is implementing reforms to its reverse mortgage program and providing more counseling resources for seniors who are considering the product, Secretary Ben Carson said Monday.

July 17