Regulation and compliance

Regulation and compliance

-

The latest violations come as the bank expects to face more than $3 billion in regulatory fines for anti-money-laundering failures.

September 11 -

Federal Reserve Vice Chair for Supervision Michael Barr outlined the changes he and other regulators would like to see to the capital reform plan, including largely excluding banks with less than $250 billion of assets.

September 10 -

Prophecies about a wave of bank failures caused by sickly CRE loans haven't yet come true. But there are still plenty of caution signs in a saga that will take years to play out.

September 6 -

Patrick Harker, the longest serving regional reserve bank president, will leave office in June 2025. Directors at the Fed bank have started the search for his replacement.

September 4 -

Home Loan bank executives said Congress would have to pass a law for the system to increase its affordable housing contribution above 10% of earnings.

August 30 -

The Federal Reserve finalized its capital requirements for large banks Wednesday based on June's stress test outcomes.

August 28 -

The interagency Property Appraisal and Valuation Equity initiative, which was tasked by the Biden administration with rooting out bias in home valuations, appears to have run its course. But experts say it could be years before the group's efforts bear fruit.

August 26 -

Four companies are fighting CFPB enforcement actions by claiming the agency cannot be funded by the Federal Reserve, which has not been profitable since 2022. The consumer bureau calls the new legal theory "meritless."

August 19 -

A bipartisan group of ex-inspectors general is pushing Senate leaders to quickly confirm Christy Goldsmith Romero to chair the Federal Deposit Insurance Corp. despite scheduling delays and the upcoming election.

August 13 -

The change in medical debt reporting initiated by the three credit bureaus did not go far enough as 15 million Americans are still impacted, the groups led by the National Consumer Law Center said.

August 12 -

The Treasury, CFPB and Federal Trade Commission are joining forces to warn consumers about predatory practices in financing solar energy panels.

August 7 -

Sen. Jack Reed, D-R.I., asked the Federal Reserve to require public reporting of synthetic risk transfers — also known as credit risk transfers, or CRTs — through bank call reports and systemic risk reports.

August 5 -

Federal Deposit Insurance Corp. Vice Chair Travis Hill has called for a full reproposal of the Basel III endgame capital standards, emphasizing the need for joint advancement by all three major federal banking agencies and an additional comment period for industry feedback.

July 24 -

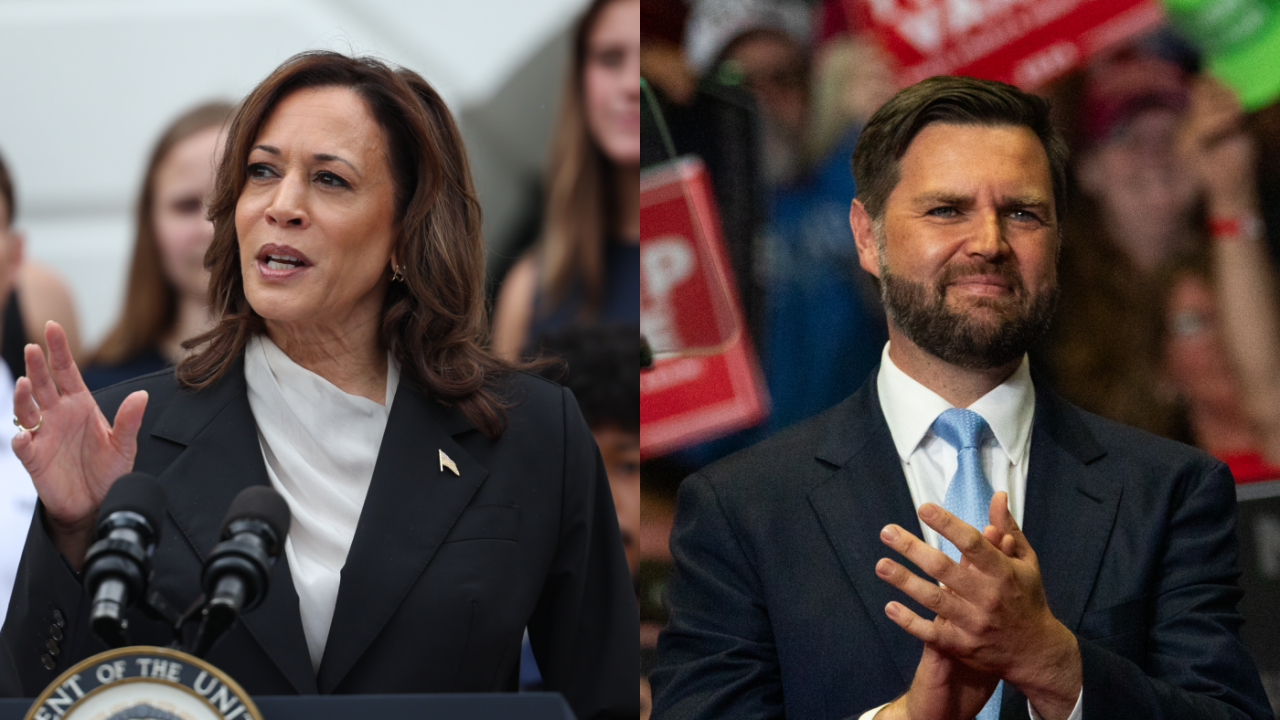

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

The final rule governing the use of automated valuation models for home assessments is substantially similar to the initial proposal made last June.

July 17 -

The investment banking giant said that it will "moderate" its pace of share repurchases as it continues to talk to the Federal Reserve, which recently increased its stress capital buffer from 5.5% to 6.4%.

July 15 -

During his second day of congressional testimony this week, the Federal Reserve chair said the central bank does not have supremacy over other agencies on their joint rulemaking.

July 10 -

At the CFTC Sterling oversaw the 3,300-plus banks, intermediaries and asset managers registered with the agency, and the examination, rulemaking and enforcement referral programs.

July 10 -

The Federal Reserve chair said there is a consensus within the central bank's board of governors for reproposing its capital rules, but notes that other agencies have not yet signed off on this approach.

July 9