-

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

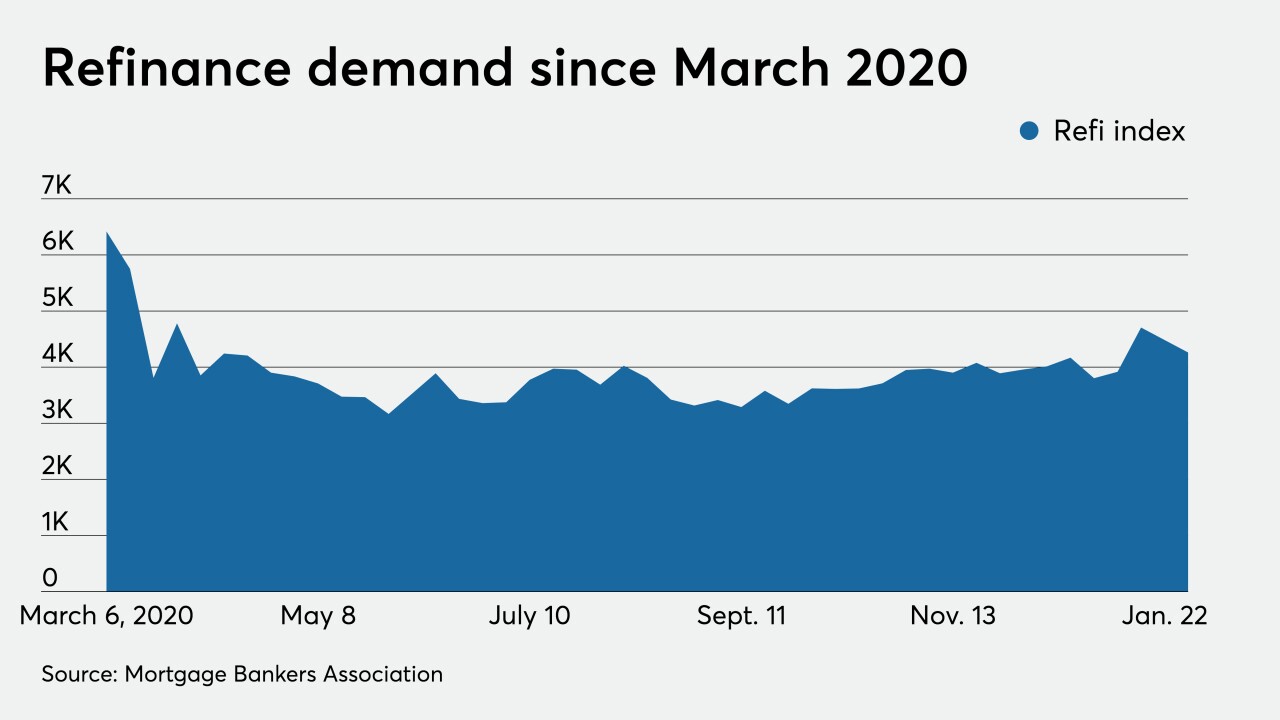

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

Upcoming changes to underwriting regulations, as well as the end of the QM patch, in addition to growing home values, all add up for this market to have a good year.

January 19 -

Falling interest rates more than canceled out median home listing prices, reaching an all-time time high during the month, Redfin said.

December 24 -

The head of the Federal Housing Administration said Congress should consider whether to continue allowing the loan floor and ceiling to remain tied to changes in the conforming mortgage limit.

December 2 -

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

November 18 -

Mortgage applications increased 3.8% from one week earlier as a drop in most loan interest rates brought on an increase in refinance activity, according to the Mortgage Bankers Association.

November 4 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Mortgage application fraud risk dropped drastically from 2019 with the spike in refinances, but the fallout from the coronavirus means next year could come with more risk, according to CoreLogic.

October 28 -

Mortgage rates fell this week to another record low, and are now over a full percentage point below where they were five years ago, according to Freddie Mac.

October 22 -

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

October 21 -

Mortgage applications decreased 0.6% from one week earlier, although a slight drop in purchase volume belied the fact that consumers are taking advantage of the current rate environment, according to the Mortgage Bankers Association.

October 21 -

Just a week after commenting that the bottom on mortgage rates was possibly reached, Freddie Mac reported that they fell 6 basis points to another record low.

October 15 -

Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

October 14 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6