-

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

The Consumer Financial Protection Bureau received over a quarter-million complaints in 2018, according to analysis by an advocacy group that urged the agency to maintain public access to its database.

May 12 -

The long-awaited proposal includes safe harbors to protect collectors from getting sued, but would restrict phone collection attempts and allow borrowers to opt out of receiving other communications.

May 7 -

Susan Ehrlich, the fintech lender's new chief, discusses what she learned working at Amazon and Simple and how her firm is approaching consumer loans differently.

March 22 -

As the consumer lender announced its seventh consecutive profitable quarter, its CEO bragged that his company is better positioned than the likes of Goldman Sachs and LendingClub.

February 1 -

Lenders are glad the agency worked swiftly through a backlog of paperwork, but they're worried funds will get cut off if the government closes again.

February 1 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

Live Oak Bancshares became an SBA juggernaut by making loans, selling them and making more. With economic conditions changing, it is retaining more credits.

December 14 -

New Penn Financial will change its name to NewRez at the start of 2019, reflecting its acquisition earlier this year by New Residential Investment Corp.

December 7 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

November 6 -

The Federal Trade Commission, which issued a formal complaint against SoFi, is urging other lenders to review their advertisements for false claims about the benefits of refinancing.

October 29 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

Four lenders, led by Sallie Mae, have long dominated the market for private student loans. But they could soon face new competition from Navient and Nelnet.

September 13 -

Scott Powell, the CEO of Santander Holdings USA, has spent years contending with a host of regulatory problems. He outlined a long-range vision that includes a branch-focused retail push and possible acquisitions.

September 4 -

Zillow Group is moving from being a mortgage marketer to originating loans with its acquisition of Mortgage Lenders of America, in an effort to support its home-flipping business.

August 6 -

Toyota Financial Services has promoted a company insider to replace Mike Groff, who is retiring at the end of this month.

August 6 -

The deal is designed to improve capital ratios and reduce risk at the Seattle company.

July 3 -

No reason was given for his exit by the Silicon Valley lender, which named another prominent economist, Susan Athey of Stanford, to its board of directors.

March 28 -

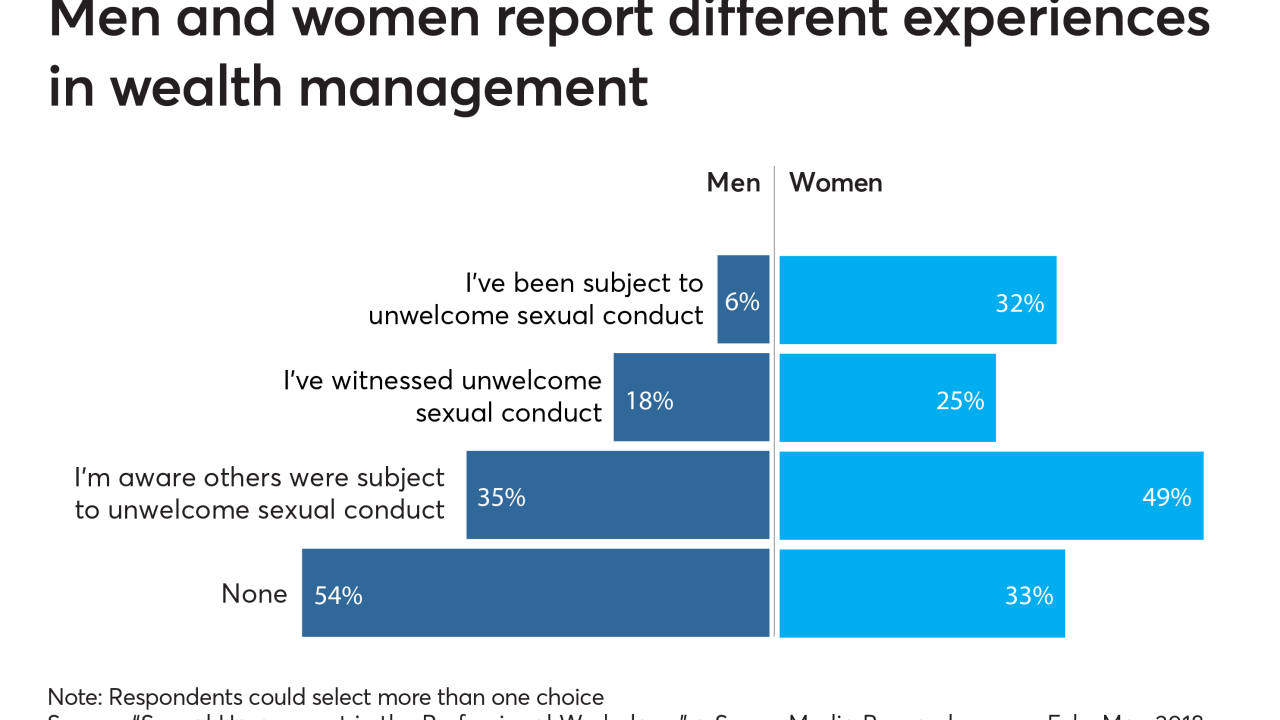

Which industries have the highest prevalence of unwanted sexual conduct in the workplace? Will the #MeToo movement have a lasting impact? Key findings from a SourceMedia survey.

March 28 -

It’s tough enough to grapple with sexual harassment in the workplace. It’s more complex when clients are involved.

March 28