-

The Federal Trade Commission, which issued a formal complaint against SoFi, is urging other lenders to review their advertisements for false claims about the benefits of refinancing.

October 29 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

Four lenders, led by Sallie Mae, have long dominated the market for private student loans. But they could soon face new competition from Navient and Nelnet.

September 13 -

Scott Powell, the CEO of Santander Holdings USA, has spent years contending with a host of regulatory problems. He outlined a long-range vision that includes a branch-focused retail push and possible acquisitions.

September 4 -

Zillow Group is moving from being a mortgage marketer to originating loans with its acquisition of Mortgage Lenders of America, in an effort to support its home-flipping business.

August 6 -

Toyota Financial Services has promoted a company insider to replace Mike Groff, who is retiring at the end of this month.

August 6 -

The deal is designed to improve capital ratios and reduce risk at the Seattle company.

July 3 -

No reason was given for his exit by the Silicon Valley lender, which named another prominent economist, Susan Athey of Stanford, to its board of directors.

March 28 -

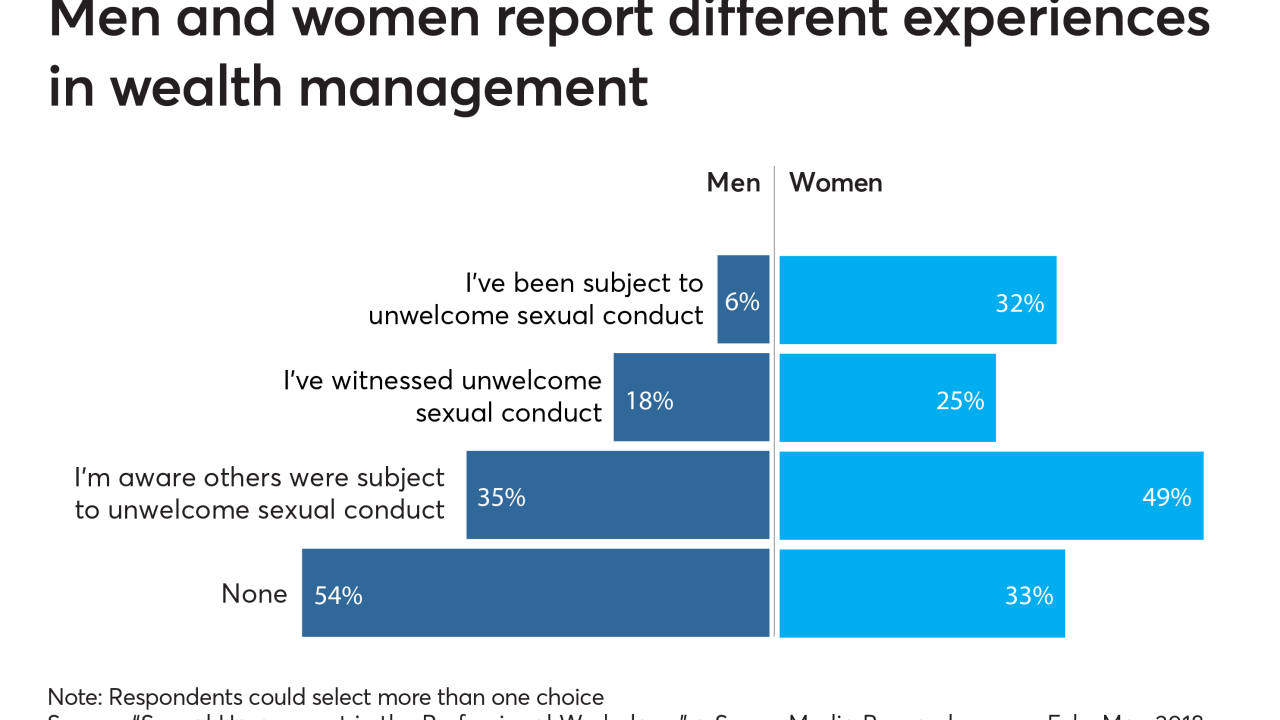

Which industries have the highest prevalence of unwanted sexual conduct in the workplace? Will the #MeToo movement have a lasting impact? Key findings from a SourceMedia survey.

March 28 -

It’s tough enough to grapple with sexual harassment in the workplace. It’s more complex when clients are involved.

March 28 -

An unprecedented, industrywide survey of sexual harassment in the professional workplace reveals industries with the highest prevalence of unwanted sexual behavior, the differences between large and small companies, and blind spots that may be preventing corrections. Fortunately, the data also lights a path forward.

March 12 -

Men and women who work in accounting say there’s a low prevalence of sexual harassment in the profession; the numbers suggest otherwise.

March 12 -

Human resources professionals are looking to fight bad behavior driven by upper management.

March 12 -

If the Fed order is lifted quickly — a big if — then the impact on Wells should be minimal. But if it lingers past 2018, then the bank could find itself on the losing end of the battle for customers and top talent.

February 5 -

The percentage of flood damage to residential properties from Hurricane Harvey that is uninsured is turning out to be a little higher than earlier estimates.

January 25 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Banks that have flocked to the business because of higher yields and loan diversity stand to benefit if clients use tax savings to upgrade equipment.

January 10 -

Rather than jump right away into lending to car buyers, Access National will start by offering CRE and M&A financing to dealerships.

January 5 -

Former top commercial mortgage-backed securities strategist Trevor Murray accused the Swiss lender of illegally firing him in 2012 for blowing the whistle on attempts by traders to influence his research reports.

December 22 -

The House approved a five-year extension of the National Flood Insurance Program on Tuesday, but it remains unclear whether the Senate will seek to pursue its own bill. The program is due to expire Dec. 8.

November 14