Politics and policy

Politics and policy

-

Vice President Kamala Harris' pledge to deliver 3 million homes has drawn applause from homebuilders, lenders and affordability advocates, but experts are uncertain how her administration would pull it off.

August 23 -

In his speech at the Federal Reserve's Jackson Hole Economic Symposium, the Fed chair said employment losses are now a bigger risk than elevated inflation.

August 23 -

Mortgage professionals interviewed say there should be more focus on increasing housing supply.

August 21 -

Vice President Kamala Harris outlined a raft of populist economic proposals in her first major economic speech since securing the Democratic presidential nomination, including some aimed at lowering housing costs and boosting supply.

August 16 -

The change in medical debt reporting initiated by the three credit bureaus did not go far enough as 15 million Americans are still impacted, the groups led by the National Consumer Law Center said.

August 12 -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

The Federal Housing Finance Agency wants to update the dual mission of the Federal Home Loan Banks. Members of the private bank cooperative say their regulator has no authority to redefine the mission.

August 8 -

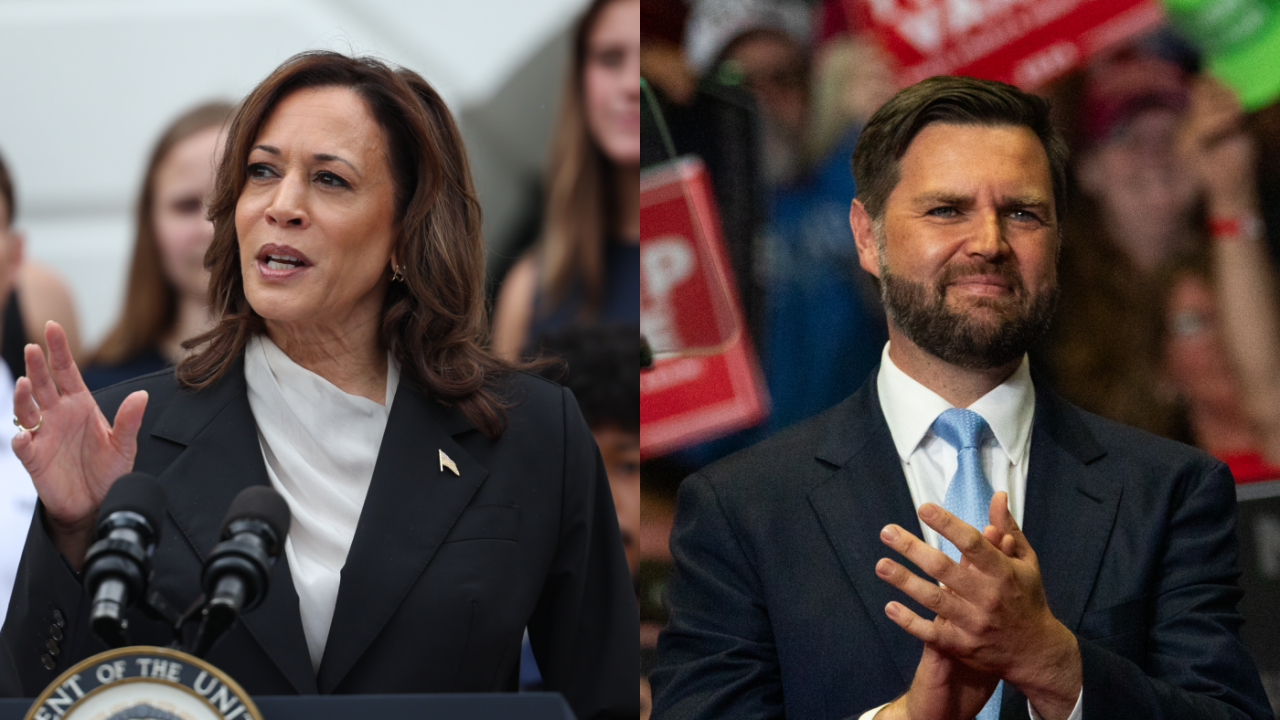

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21 -

Hugh Frater was one of four appointed to the Bipartisan Policy Center board, along with former Philadelphia Mayor Michael Nutter, a co-chair of its Housing Council.

July 19 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

A federal appeals court ruled that the Equal Credit Opportunity Act prohibits not just outright discrimination but also the discouragement of prospective applicants for credit.

July 11 -

During his second day of congressional testimony this week, the Federal Reserve chair said the central bank does not have supremacy over other agencies on their joint rulemaking.

July 10 -

The Consumer Financial Protection Bureau has proposed requiring that mortgage servicers exhaust all efforts at assisting struggling borrowers before moving ahead with a foreclosure.

July 10 -

The Federal Reserve chair said there is a consensus within the central bank's board of governors for reproposing its capital rules, but notes that other agencies have not yet signed off on this approach.

July 9 -

The central bank also noted that the banking system is sound but faces several challenges. The report precedes Federal Reserve Chair Jerome Powell's upcoming appearances on Capitol Hill.

July 5 -

The Federal Reserve's struggle in bringing inflation down from its current level to its 2% target may come down to how the government measures shelter costs in the U.S., leading some experts to question whether the problem is in the economy or in how it is measured.

July 4 -

Federal Reserve Chair Jerome Powell brushed away concerns that a second Trump presidency could imperil the central bank's independence.

July 2 -

Banking experts are divided on how regulators will reshape the capital overhaul and if reported revisions being floated by regulators will meet the banking industry's demands.

June 30 -

The plan from the Heritage Foundation, a group the first Trump administration was largely in line with, would shutter CFPB, break up HUD and raise FHA premiums.

June 27