-

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

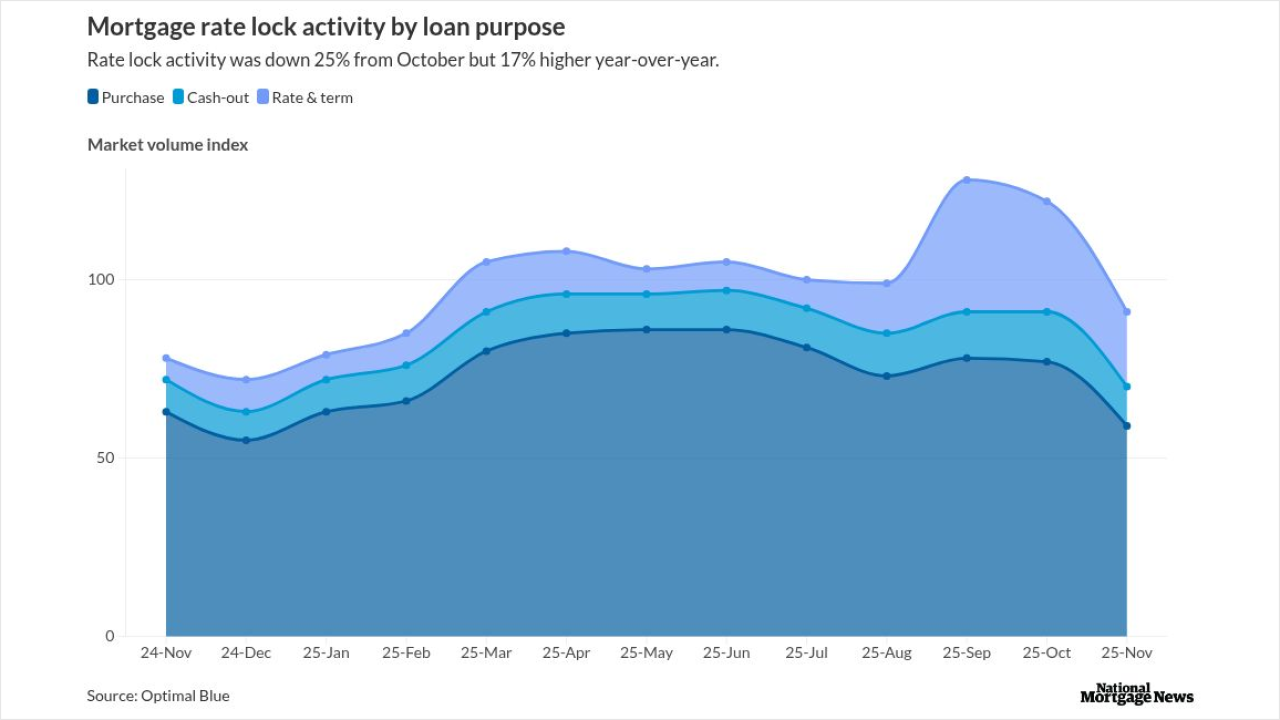

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

The home equity investment provider first approached the securitization market in July 2024 to raise $217 million.

December 9 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

Delinquency trends split in Q3, with securitized and agency loans showing more strain while banks and life companies saw small improvements amid uneven vacancy and rent conditions.

December 4 -

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

December 3 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

Fortress has been one of the most active home equity investment firms in November, investing $1 billion in Cornerstone.

December 1 -

If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

November 26 -

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

November 26 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

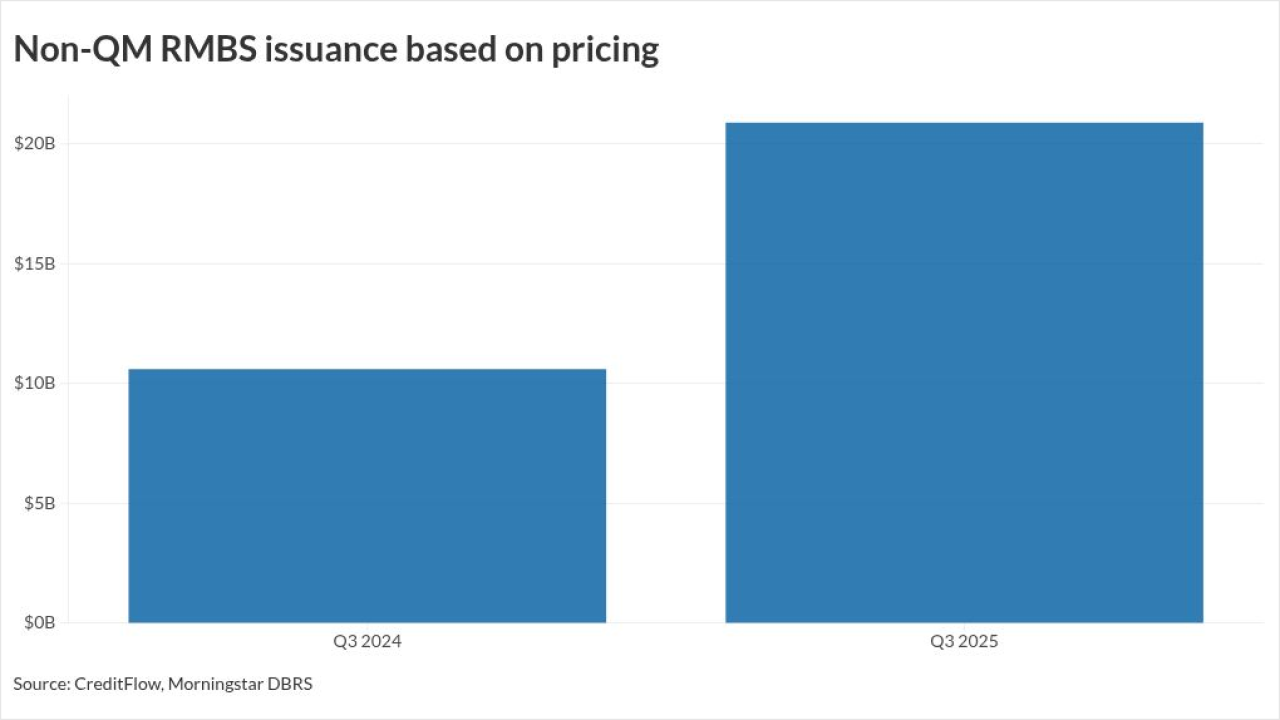

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

A large majority of the pool assets, 86.2%, are second-lien home equity investment contracts that have a weighted average (WA) multiple share rate of 2.00x.

November 19 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

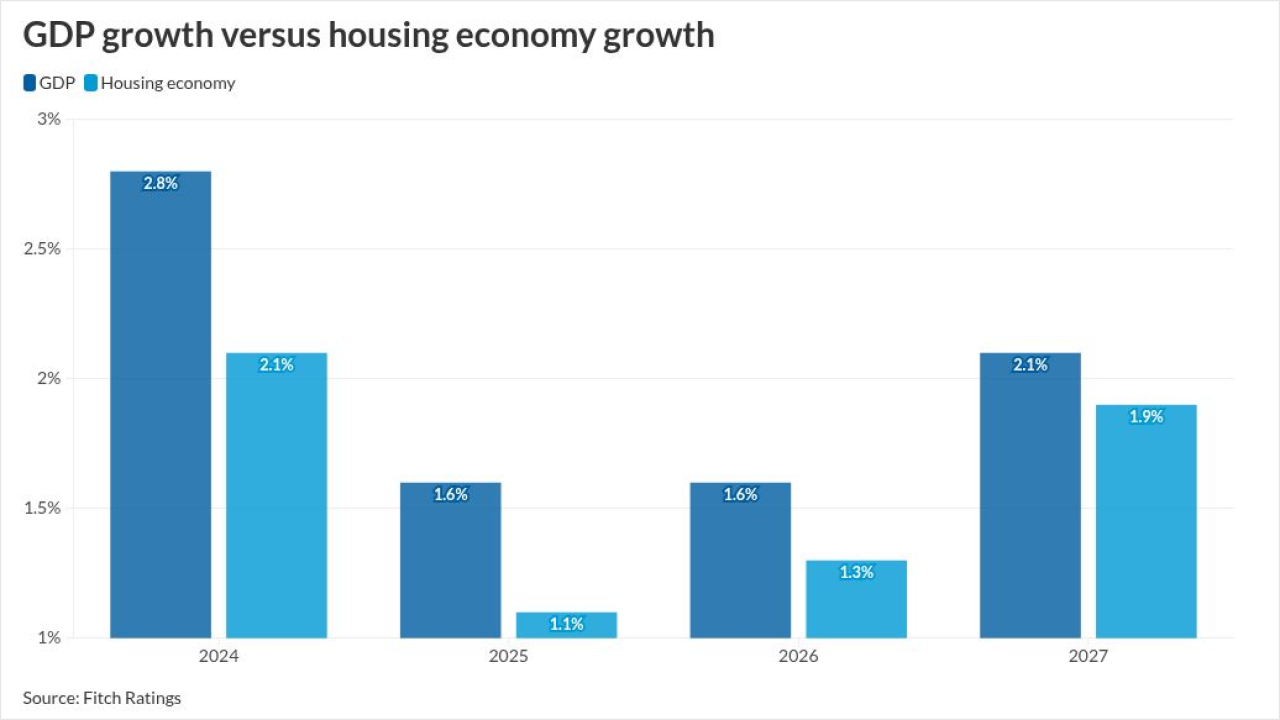

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

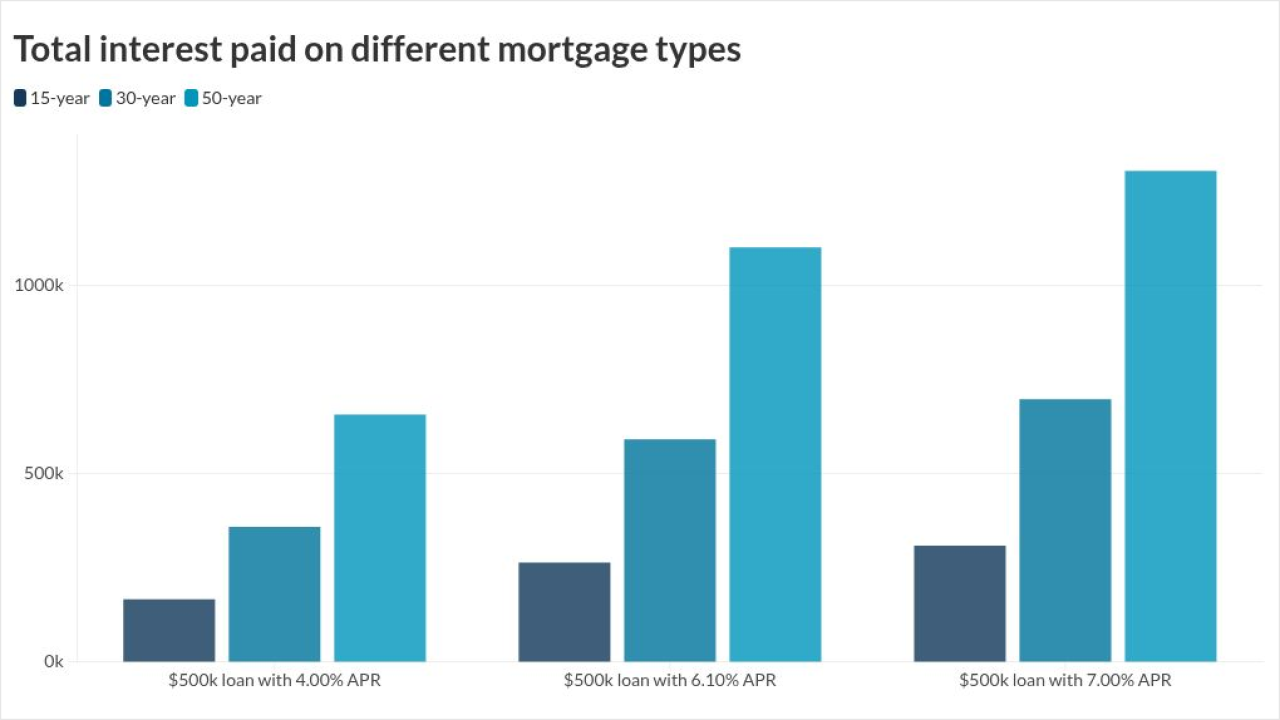

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13