-

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

With the qualified mortgage patch expiring and a recession likely, wealth inequities that have hurt black and millennial homeownership could worsen, according to the National Association of Real Estate Brokers.

September 16 -

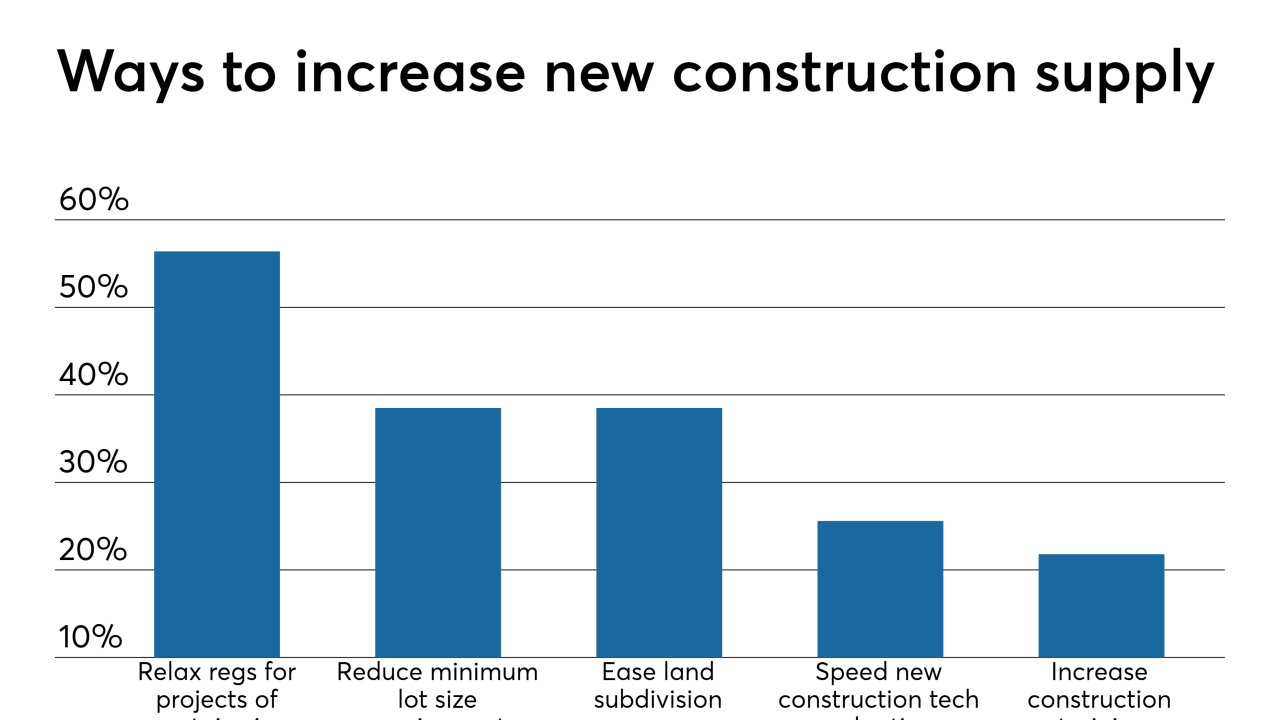

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

June 19 -

Although higher corporate debt could hurt the economy, Federal Reserve Chair Jerome Powell argued changes made since the last crisis will guard against a meltdown.

May 20 -

The JFSA published a final rule outlining the hoops U.S. CLO managers will have to jump through if Japanese banks are to avoid a higher risk weighting on their holdings; it remains to be seen how much of a burden this will be.

March 19 -

A top official at the Office of the Superintendent of Financial Institutions defended tougher underwriting rules blamed recently for a slump in the nation’s housing market, but left open the possibility that regulations could ease if conditions change.

February 5 -

The company has filed a request with a federal judge in Pennsylvania for a summary judgment in two counts against it, accusing the bureau of failing to provide evidence.

January 18