-

The two latest transactions follow in the wake of the government-sponsored enterprise’s first deal of the year and the release of a finalized capital rule aimed at facilitating broader risk-sharing.

March 22 -

The moves come after Powell struck a hawkish tone on Monday, prompting traders to rapidly ratchet up estimates for how aggressively the Fed will tighten monetary policy this year.

March 22 -

The U.S. economy is relatively insulated from the events unfolding in Eastern Europe. Western Europe may be affected indirectly by higher energy prices.

March 14 -

The transaction, expected to close on March 2, has a non-call period end date of two years from the expected closing, a reinvestment period end date of April 15, 2026.

February 28 -

The repricing comes as Federal Reserve Governor Michelle Bowman suggested a hike of that magnitude could be on the table if inflation readings come in too high.

February 23 -

Treasuries led losses in global bond markets as inflation concerns, stoked by soaring oil prices, overshadowed any haven bids on the back of Russia-related tensions.

February 22 -

The best-performing countries on human and labor rights have significantly lower bond market spreads compared to the worst, even when taking into account factors such as level of income.

February 17 -

About 3.3% of loans in the deal fall into the 600-649 FICO bucket on the current Sunnova Helios VIII, 2022-A, compared with a 1.2% level in the 2021-C deal.

February 10 -

With minimal coupon protection, exceedingly long duration and super-tight credit spreads, the powder keg was fully loaded. Now we have sizzling inflation and hawkish central bankers providing us with the spark.

February 9 -

Government bonds worldwide are extending declines after the worst six months in five years, a Bloomberg index showed. Meanwhile, the pool of negative-yielding debt shrank to a six-year low.

February 8 -

The debt facility from Barings is likely the largest to a Black-owned investor in the market.

January 24 -

Pension funding versus liabilities was close to 100% at the end of 2021, for the first time since the financial crisis, according to investment advisory firm Milliman.

January 20 -

A broader investor base, rising inflation and higher interest rates are likely to result in significant demand for CLO bonds, which have experienced few defaults.

January 19 -

U.S. Treasuries gained, bouncing back from an initial wave of selling after consumer-price inflation accelerated at the fastest annual pace in four decades in December.

January 12 -

The bond selloff that pushed 10-year Treasury yields to their highest in two years may not lead to a full-on taper tantrum, according to one of the biggest Treasury options market makers.

January 10 -

The rapid wage growth underscored the case for a more aggressive tightening by the Fed and capped a punishing week in the bond market.

January 7 -

The municipal market has a history of outperforming during periods when the Fed hikes rates, because as yields rise, the tax-free interest that munis pay makes them more attractive.

January 6 -

The selloff worsened after minutes from the Federal Reserve’s latest meeting showed officials considering earlier and faster interest-rate increases than expected.

January 5 -

Treasury yields rose a second day amid increasing conviction that the Federal Reserve will raise rates at least three times beginning in May.

January 4 -

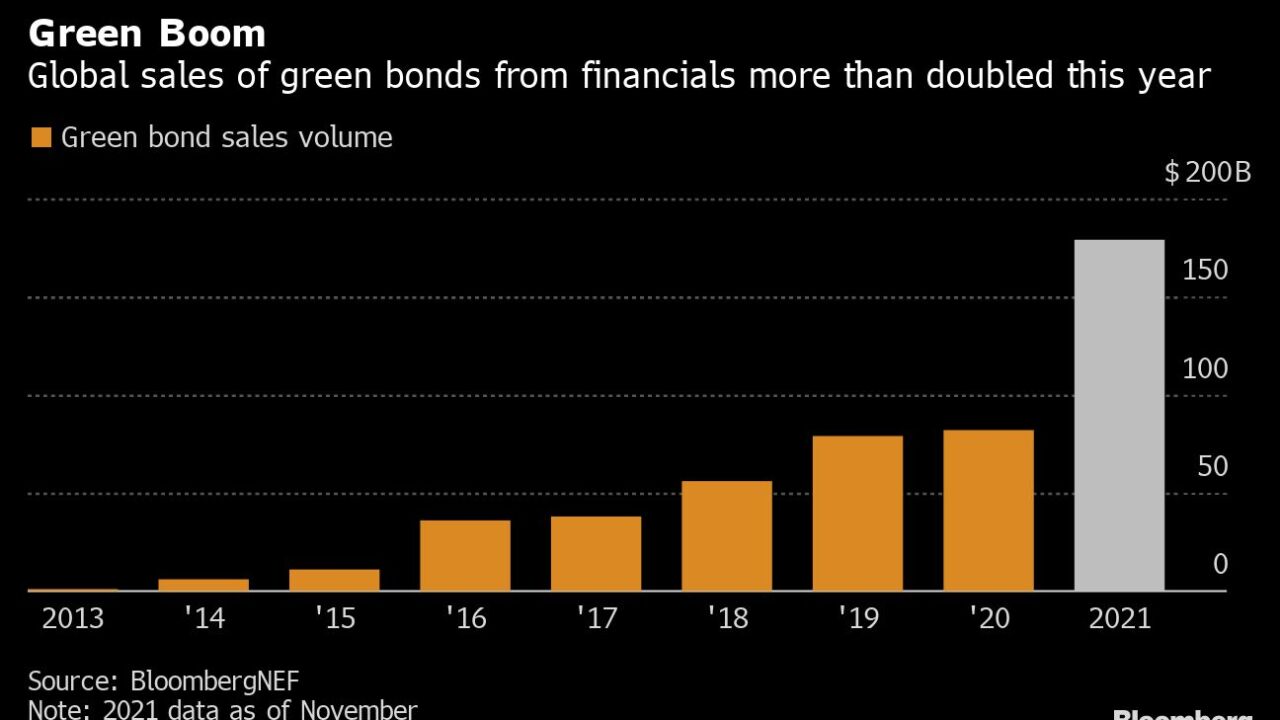

A growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

December 22