-

A broader investor base, rising inflation and higher interest rates are likely to result in significant demand for CLO bonds, which have experienced few defaults.

January 19 -

U.S. Treasuries gained, bouncing back from an initial wave of selling after consumer-price inflation accelerated at the fastest annual pace in four decades in December.

January 12 -

The bond selloff that pushed 10-year Treasury yields to their highest in two years may not lead to a full-on taper tantrum, according to one of the biggest Treasury options market makers.

January 10 -

The rapid wage growth underscored the case for a more aggressive tightening by the Fed and capped a punishing week in the bond market.

January 7 -

The municipal market has a history of outperforming during periods when the Fed hikes rates, because as yields rise, the tax-free interest that munis pay makes them more attractive.

January 6 -

The selloff worsened after minutes from the Federal Reserve’s latest meeting showed officials considering earlier and faster interest-rate increases than expected.

January 5 -

Treasury yields rose a second day amid increasing conviction that the Federal Reserve will raise rates at least three times beginning in May.

January 4 -

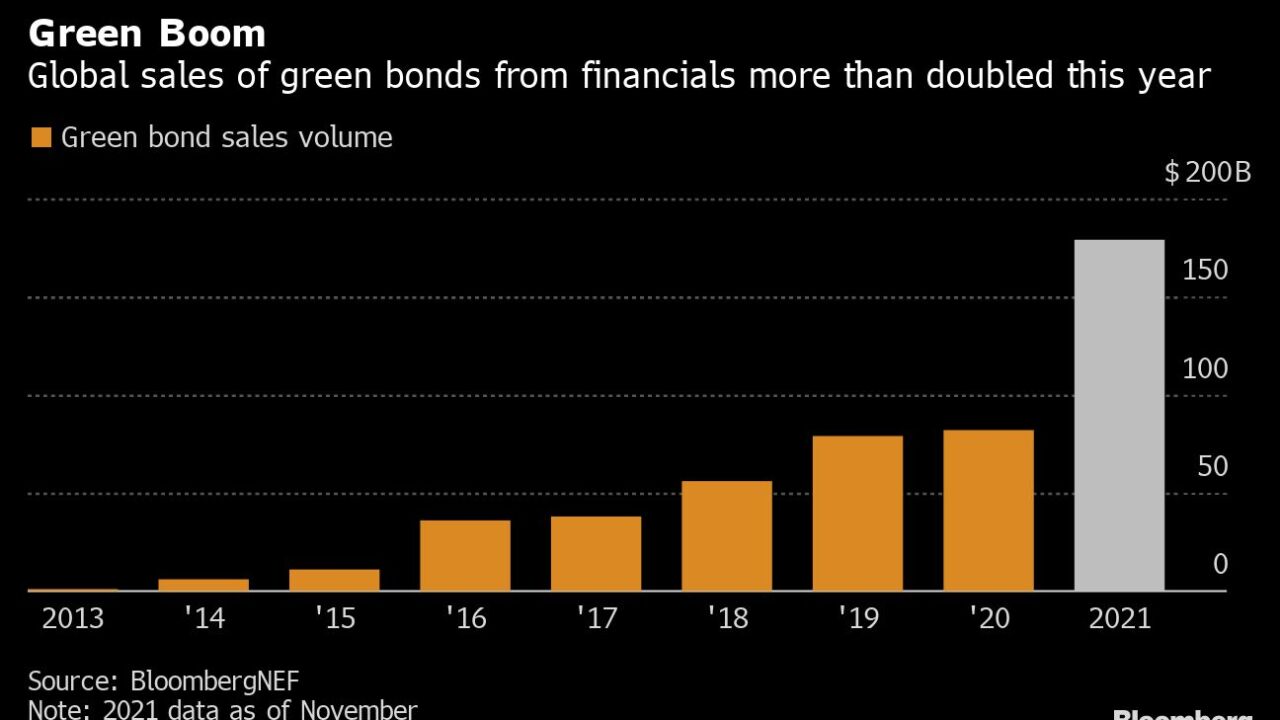

A growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

December 22 -

Deerpath’s average portfolio turnover rate of 37.8% over the past 12 months was higher than the 25.3% of all CLO 2.0 transactions.

December 20 -

More than 180 community development financial institutions and minority depository institutions will receive the federal funds under a pandemic-era program. “It’s a lifesaver,” a credit union CEO said.

December 14