-

-

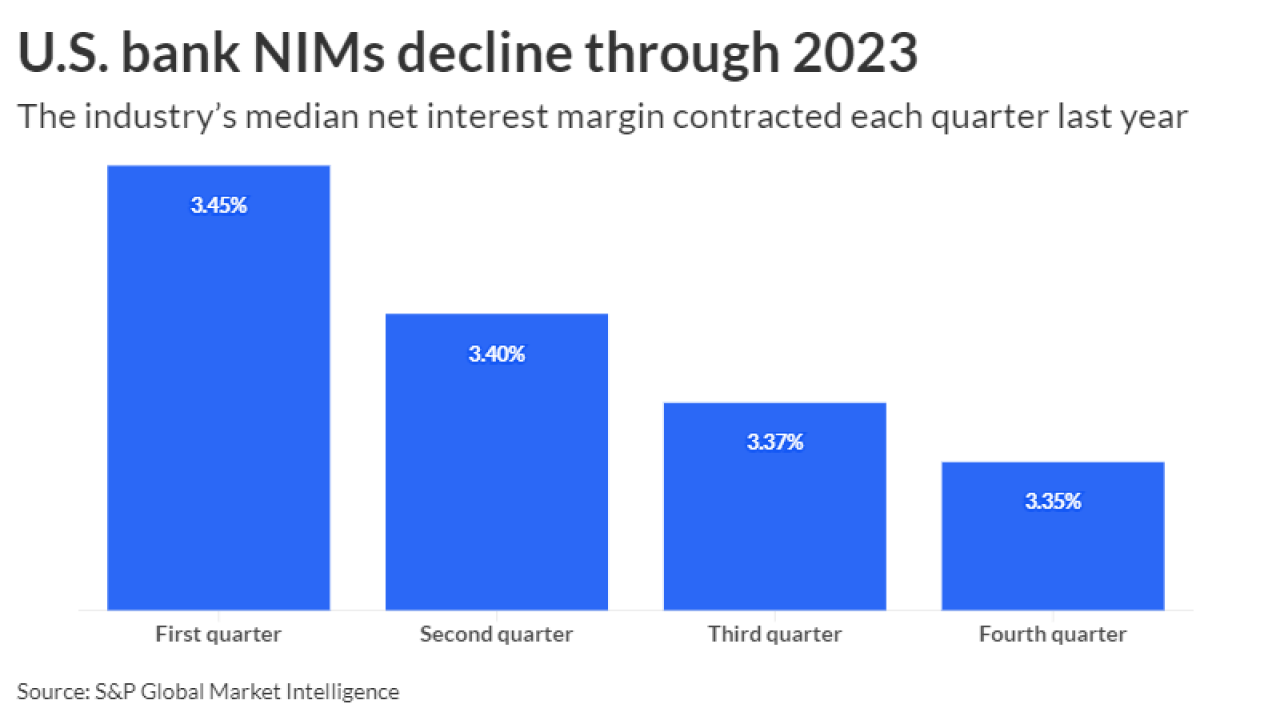

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Lenders collected an estimated $25 billion in additional interest income last year by raising the average margin on annual percentage rates, or the amount above the prime rate, according to the Consumer Financial Protection Bureau.

February 22 -

Funding pressures moderated in recent months, but loan charge-offs climbed. With festering concerns about a vulnerable economy, the potential for elevated credits costs could loom large over the upcoming bank earnings season.

December 21 -

The Federal Reserve has allowed more than $1 trillion of assets to roll off its balance sheet. Chair Jerome Powell says he doesn't believe reserves in the banking system are nearing a level that would cause the Fed to slow down or stop.

December 13 -

The North Carolina-based bank is considering the idea of selling a portion of its securities portfolio as a way to build capital, CEO Bill Rogers said Tuesday. At the end of the third quarter, Truist's securities were worth about 20% less than what the company paid for them.

December 5 -

The BSBY interest rate benchmark was originally envisioned as a successor to the once-ubiquitous Libor rate. But it failed to gain much traction, and Bloomberg now plans to shut it down next year.

November 27 -

The JPMorgan Chase CEO's comments contrast with the consensus view after 5.25 percentage points of hikes that lifted the benchmark rate to 5.5% — the highest level in 22 years. Money markets are pricing in cuts from next year.

September 26 -

Analysts look at whether the FOMC will bring the last rate hike in the cycle, whether recession is coming, and whether the Fed is making a policy mistake.

July 24 -

One asset manager recalled the prelude to the global financial crisis and the 2001 dot-com bust, when companies that loaded up on debt when costs were low got hit with a steep bill years later.

July 17 -

The bond market's reenergized bulls may want to dial down their excitement, because their fortunes hinge on whether an abstract, almost elusive number, is as low as they assume.

July 13 -

High interest rates could dampen demand for refinancing, which took a hit during the pandemic-era pause in federal student loan payments. "Curb your enthusiasm," one analyst said.

July 10 -

Bond traders have overestimated month-over-month headline inflation heading into four of the last seven Consumer Price Index releases, says strategist Raghav Datla.

June 12 -

When the once-ubiquitous interest rate goes away at the end of June, some businesses that have older loans may see a sudden jump in their payments. Banks, lawyers and business leaders are doing last-minute work to avoid that scenario.

June 1 -

Financial tightening stemming from two recent bank collapses has served as its own check on inflation, according to Federal Reserve Chair Jerome Powell. He said the relatively small rate hike announced Wednesday was not the result of financial stability concerns.

March 22 -

Ahead of this week's Federal Open Market Committee meeting, where it is expected to enact another large rate hike, 11 lawmakers sent a letter to the central bank, urging it not to go too far.

November 1 -

Almost two-thirds of banking executives believe the U.S. will see its highest interest rates this cycle in the first half of next year. And close to 60% of executives said they are concerned the Federal Reserve is hiking rates too quickly.

October 18 -

The Pittsburgh company's finance chief expects more gains in interest income, though he conceded rising deposit costs could curb the pace of advances.

October 14 -

During a visit to Buffalo on Friday, New York Federal Reserve President John Williams said the central bank may need to keep cranking up interest rates to gain greater control over high inflation.

October 7 -

Fed Chairman Jerome Powell brushed off concerns that rapidly tightening monetary policy could disrupt the financial system. Some economists and policy experts beg to differ, raising concerns about loan defaults or even the collapse of a key institution or counterparty.

July 29