-

Notably in February, Americans reduced spending on services for the first time in three years in the face of higher prices — including on dining out.

March 28 -

Sabey 2025-2 will feature a $24.8 million liquidity reserve among other credit enhancement mechanisms, including cash trap and early amortization triggers.

March 27 -

Borrowers are considered prime in this pool, but Fitch Ratings notes that delinquency rates have been increasing since 2022.

March 21 -

Total hard credit enhancement will represent 4.5% of the note balance, and initial reserves amounting to 2.0% of the pool.

March 20 -

The pass-through certificates are supported by a full pool of amortizing loans, which have no interest-only periods.

March 12 -

A set of performance-related triggers—cash trapping and expense reserve—will help maintain cash flow to the notes.

March 10 -

Over 85% of the collateralized loan obligation's total dollar value will be comprised of apartment complexes and hospitality and industrial properties.

March 10 -

The fund closes ahead of separate news that it formed the Private Real Estate Credit platform, which will originate senior and subordinated commercial real estate loans.

March 5 -

Total delinquencies as a percentage of John Deere's managed portfolio was 3.06%, an increase since 2022. That aligns with the decline in corn and soy prices in the same period.

March 3 -

Amortization will start after the deal's two-year revolving period, when the trust will deposit revenue including collections and upgrades into the acquisition account.

February 26 -

Small-balance commercial mortgages, SBA 504 and investor loans, all first-lien, make up the collateral pool.

February 24 -

The current pool has smaller exposures to the construction and turf sectors compared to the 2024-2 series, which have seen higher loss rates than the agriculture sector.

February 21 -

The rating agency covers its bases in preparation for a surge in data center debt

February 12 -

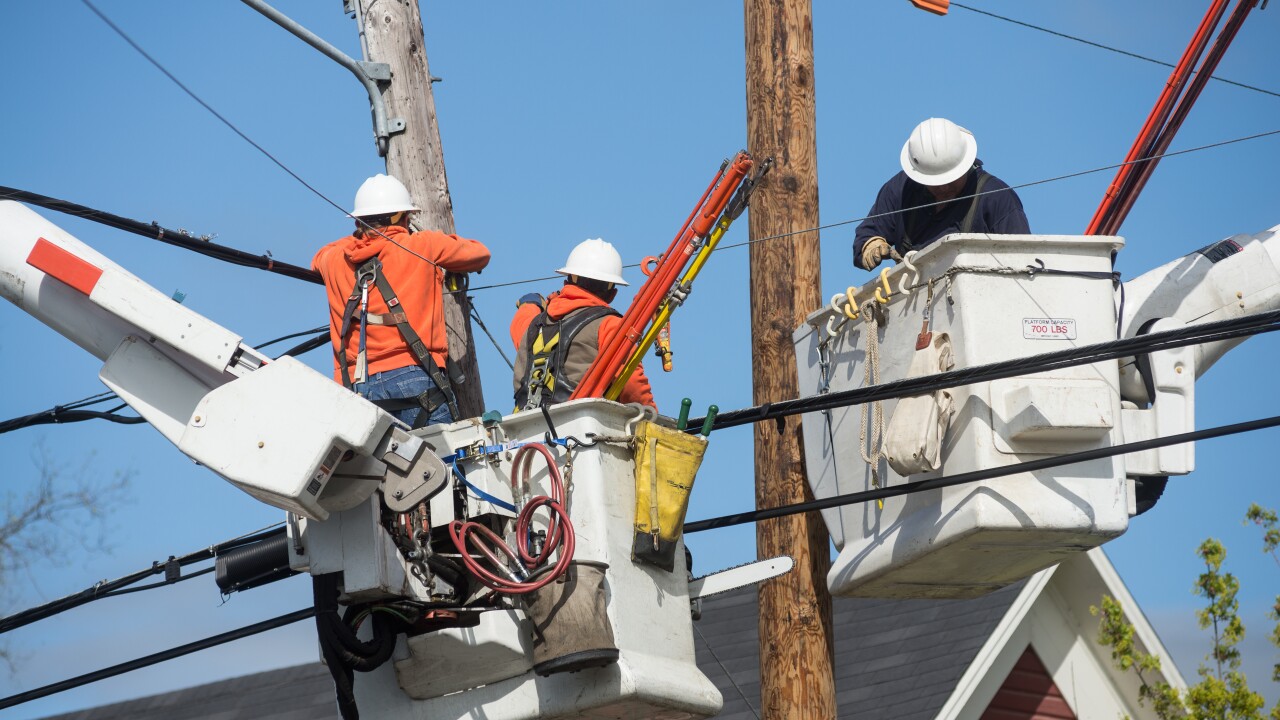

RG&E, series 2025-A, is the second utility cost recovery securitization this week, and is another first-time issuer.

February 6 -

Residential customers made up 70.1% of NYSEG's sales revenue, while commercial and industrial customers account for the other 30% of sales. The latter is a relatively high exposure for such deals.

February 4 -

Debt service coverage ratio triggers, including cash trapping and rapid amortization, will provide much of the credit enhancements to the notes.

February 3 -

Deal production has been a bright spot, but delinquencies could soon reach record highs, especially for office CMBS.

January 28 -

Valley National Bank and Dime Community Bancshares expect a better balance of deposit costs to help boost their net interest margins in 2025.

January 23 -

Obligors are slightly more concentrated but the percentage of obligors in higher credit quality grades—2 through 5—increased to 56.9%, from 41.3% from the previous deal.

January 21 -

The inaugural deal is expected to close by the end of the month. Among its structural features are cash trap and cash sweep provisions.

January 13