-

The Dallas auto lender might lose as much as one-third of its business if it severs ties with the automaker, raising fresh questions about whether its parent company will buy out shareholders and take full ownership.

June 8 -

There are almost 7 million coastal homes facing more than $1.6 trillion in potential storm-surge reconstruction expenses this year, representing a 6.6% cost increase from last year's hurricane season.

May 31 -

A continued "oversupply" of CLO deals, along with expectations for new debut or returning managers in the absence of risk-retention requirements, is expected to keep activity flowing.

May 21 -

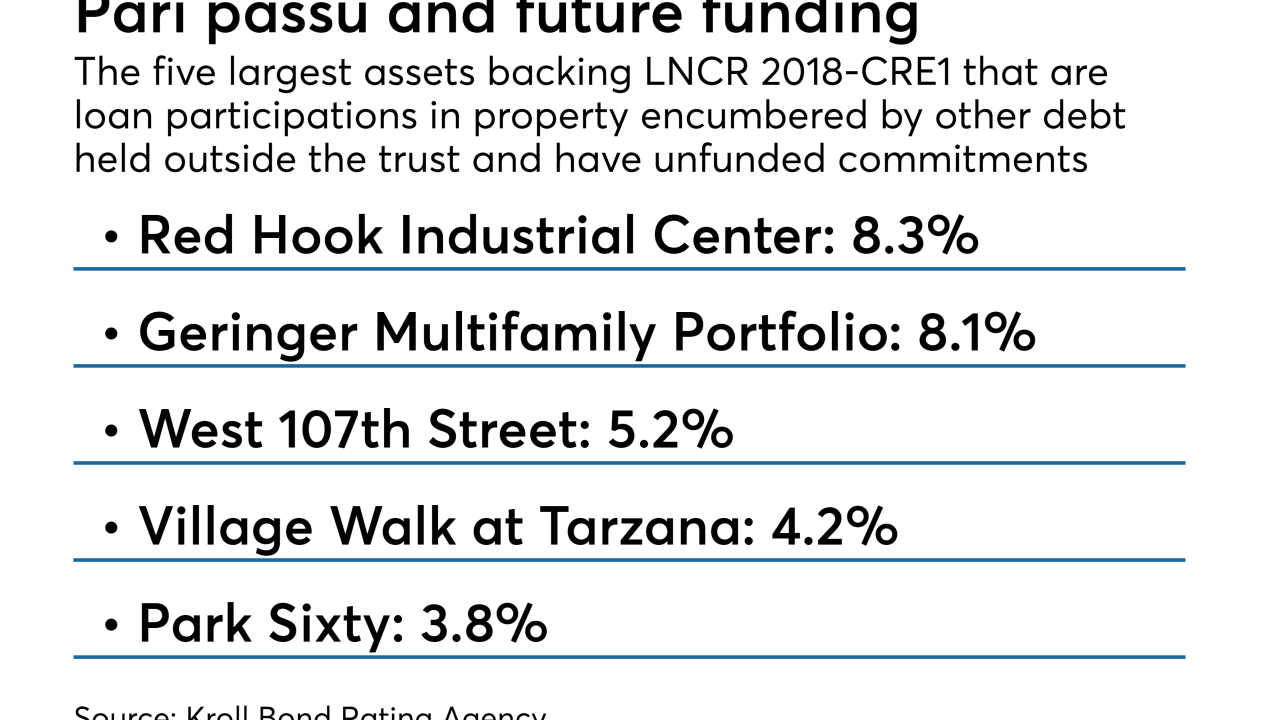

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

May 17 -

Stabilizing farm incomes are expected to help boost the performance of the sponsor's managed portfolio, which experienced a rise in 2015-2017 delinquencies, as well, according to ratings agency reports.

May 15 -

The increase in the delinquency rate for securitized CRE loans for March ended an eight-month streak of declines.

April 3 -

The transaction fills out the original available $7 billion capacity of the Sprint Spectrum trust program, which markets notes backed by the sale-leaseback receivables from Sprint's portfolio of spectrum licenses.

March 12 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

February 8 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

Moody's considers the $932.4 million TPG Real Estate Finance Trust 2018-1 to be highly leveraged, though not as highly leveraged as Blackstone's inaugural transaction.

February 5 -

The Trepp CMBS Delinquency Rate for U.S. commercial real estate loans in CMBS is now 4.83%, a decrease of six basis points from the December level.

February 2 -

Varde VMC Lender, a Minneapolis firm specializing in distressed commercial real estate, has branched out to financing offices and apartment buildings being upgraded or repurposed.

January 25 -

The Taxs Cuts and Jobs Act preserves most of existing benefits for owners, operators, and investors, and provides a few new perks as well; there are some trade-offs to be made, however.

January 19 -

Rather than jump right away into lending to car buyers, Access National will start by offering CRE and M&A financing to dealerships.

January 5 -

Some commercial buildings that are not required to obtain earthquake insurance may still be susceptible to significant structural damage that could put the borrowers at risk of default, according to Kroll Bond Rating Agency.

January 2 -

Speculators who bet on declines in commercial mortgage bond indexes as a way to profit from the expected demise of regional shopping malls may still be waiting for a big payout, according to Trepp.

December 28 -

Home values grew during 2017 at their fastest pace in four years and the same supply and demand dynamics behind that increase remain in place for 2018.

December 28 -

Consumers’ desire to shop online is creating huge demand for distribution centers and forcing property owners to think creatively about redeveloping vacant retail space. Meanwhile, hundreds of billions of dollars will be spent rebuilding areas hard hit by hurricanes and wildfires.

December 27 -

A £366.2 million mortgage on 127 industrial properties is being used as collateral for a transaction called Taurus 2017-2 UK DAC.

December 19 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19