-

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

After 10 years of conservatorship, the new year could finally usher in big steps toward housing finance reform.

December 27 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

The Office of the Comptroller of the Currency has gotten the ball rolling for financial technology firms trying to operate a national platform, but the FDIC and Federal Reserve should act to remove other policy roadblocks.

December 17

-

Live Oak Bancshares became an SBA juggernaut by making loans, selling them and making more. With economic conditions changing, it is retaining more credits.

December 14 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

Stricter energy regulations for European residential and commercial buildings, effective in 2020, will likely depress cash flow and property values, though the impact will vary by country, according to Moody's Investors Service.

December 12 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

The gap between supply and demand in the housing market is contributing to affordability constraints that are likely to limit homeownership long-term, according to Freddie Mac.

December 6 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

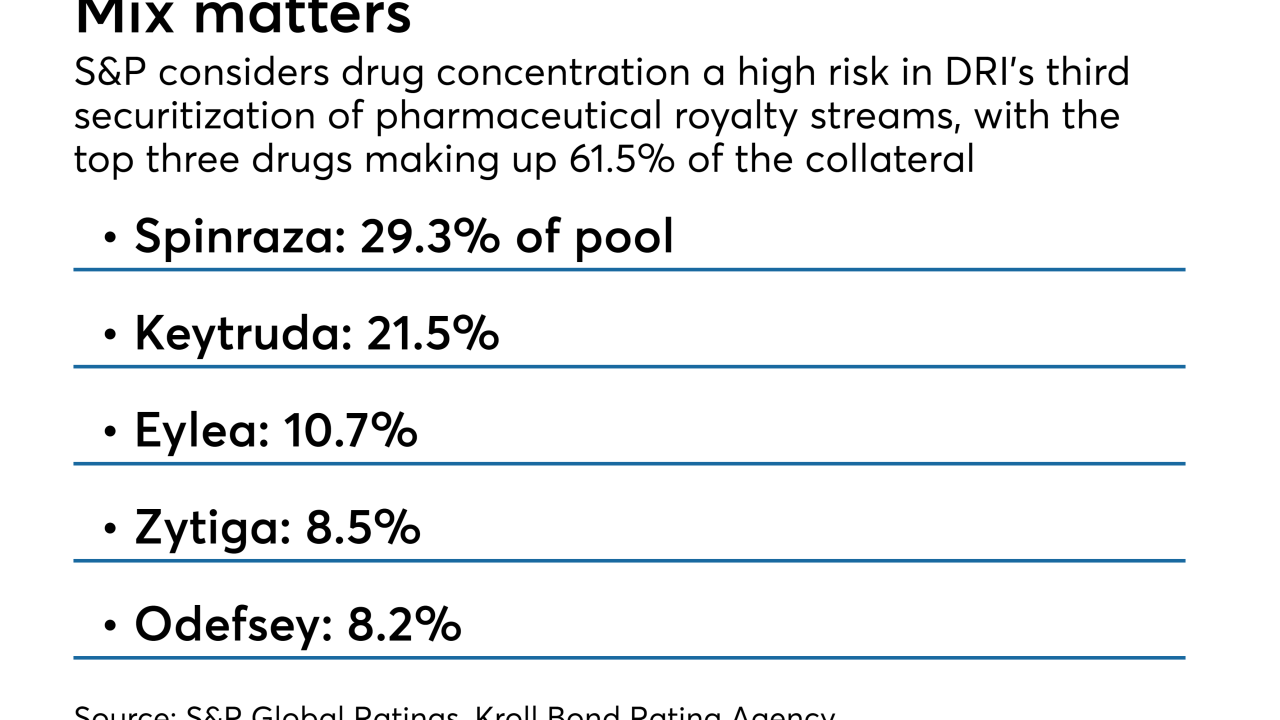

The bonds will be collateralized by payments from 15 royalty streams on 14 patent-protected drugs and technologies and will rank pari passu with securities issued from the same master trust in 2017.

November 28 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

The pool includes loans for 23 new construction, converted or acquired assets, each in a pre-stabilization phase awaiting refinancing through a permanent agency takeout loan.

November 21 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20