-

Ginnie Mae is requesting feedback on a new proposed stress test for mortgage-backed securities issuers that would take into account the government agency's increased nonbank counterparty risk.

July 24 -

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

Jefferies is housing the initial round of $300 million in loans under a repurchase agreement with four lenders, as well as with the trust established for the transaction in Jefferies’ standing as the repo seller.

July 22 -

Although the presidentially directed reports on housing finance reform are "essentially done," FHFA Director Mark Calabria doesn't expect them to be published until August or September.

July 18 -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

Treasury and HUD are close to unveiling administrative and legislative options for ending the conservatorships of Fannie Mae and Freddie Mac. Will their findings be heavy on detail or leave a lot unanswered?

July 9 -

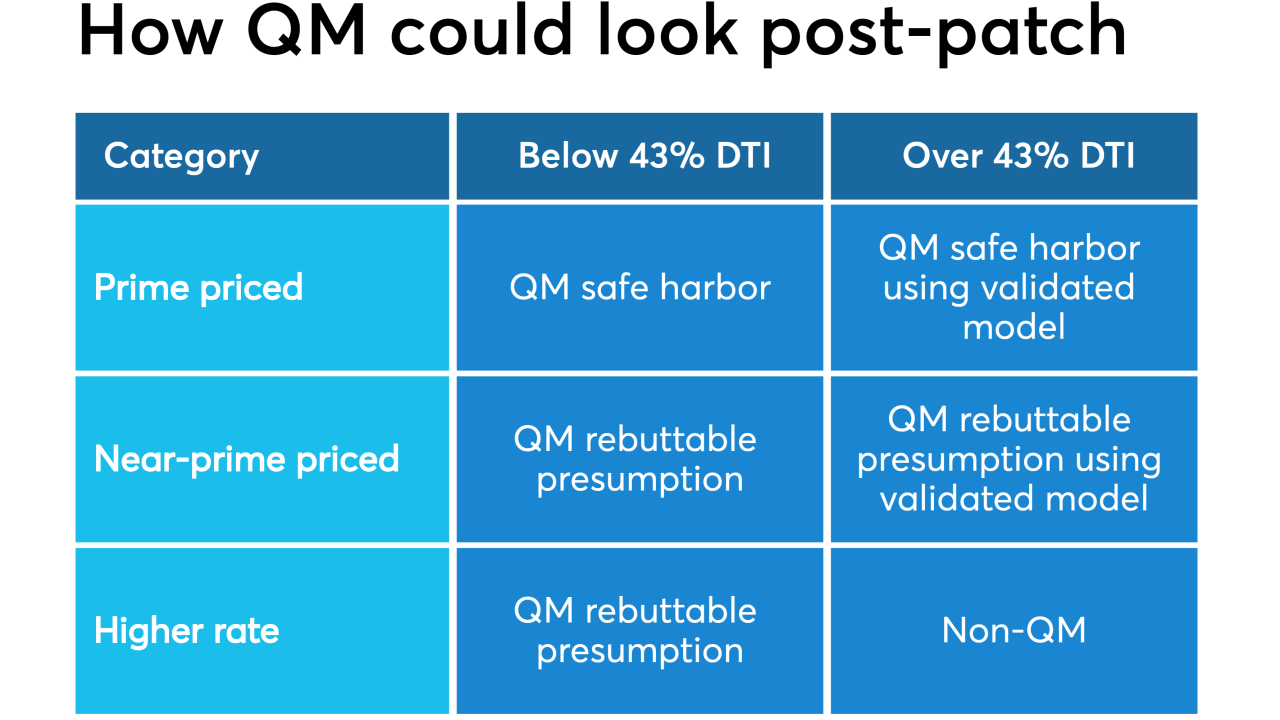

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

While mortgage rate optimism kept consumer confidence about the home purchase market high in June, affordability worries pulled overall sentiment lower, a Fannie Mae survey said.

July 8 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Mortgage lenders might be feeling a little less stressed over False Claims Act actions being brought against them following recent headlines but there is still some work to be done before they can chill out.

July 2 -

Former Freddie Mac CEO Donald Layton has joined the Harvard Joint Center for Housing Studies as a senior industry fellow focused on reform of the government-sponsored enterprises.

July 1 -

Despite rising delinquency levels, borrower performance on the underlying mortgages in GSE credit-risk transfer securitizations is strong enough to warrant ratings upgrades to more than half of nearly 1,200 outstanding note classes.

June 28 -

In a downturn, some fintechs, such as independent lenders, will be more vulnerable to economic forces than those working to service banks' regulatory needs.

June 28 -

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

There is bipartisan agreement in the Senate that Fannie Mae and Freddie Mac are "too big to fail," but some lawmakers are skeptical that a SIFI designation is appropriate.

June 25 -

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

Although the performance of the government-sponsored enterprises' single-family loans continues to improve, the deeply delinquent totals remain significant in states with court-processed foreclosures.

June 21 -

The unrated notes being issued by the FREMF 2019-KG01 Mortgage Trust are backed entirely by workforce housing loans for green-friendly upgrades of older apartment buildings that fulfill affordable housing needs in communities.

June 21 -

A DBRS report states rising concentrations of light-duty truck collateral adds risks to vehicle securitization portfolios, but risk may differ among ABS types.

June 20