-

The global pandemic and stalled trade negotiations have discouraged farmers and ranchers from taking on more debt and made banks uneasy about extending more credit.

August 4 -

Besides reauthorizing the Paycheck Protection Program, Congress should upgrade the loan forgiveness process, offer businesses the chance to take out a second loan and ensure the pricing satisfies lenders, bankers say.

August 4 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

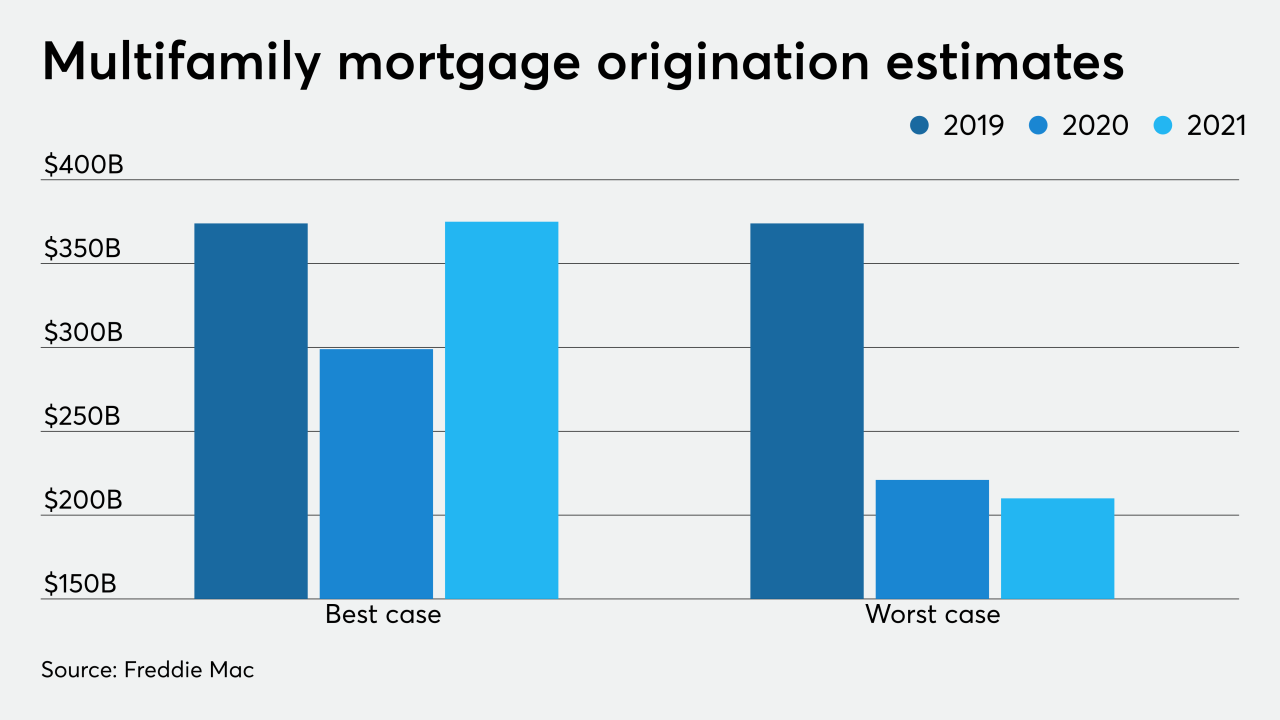

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

No two properties are alike, so lenders are tailoring their approaches for modification, forbearance and repayment of loans to a sector devastated by the pandemic.

August 2 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

The private equity megalith's mortgage trust made a second-quarter net income of over $17.5 million and $85.2 million in core earnings.

July 30 -

The complaint filed by New York, California and Illinois argues that the regulation, issued in response to the 2015 Madden decision, undermines state laws intended to protect consumers.

July 29 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

As home loans surge and lenders look to expand, they're doing a cost-benefit analysis on the possibility of opening more commercial locations.

July 24 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

Banks lending against the oil and natural gas reserves of hundreds of independent U.S. drilling companies have pulled back from the sector at an unprecedented rate this year after oil and gas prices slumped.

July 23 -

Many commercial property owners are locked out of existing coronavirus relief by financing terms that bar them from taking new loans. Under a House bill, they would receive government-backed equity investments.

July 22 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Issuers approved for the program will receive written authority to use "digital collateral" for a limited number of securitizations.

July 20 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

While rival banks reported increases in loans and deposits, thanks largely to their participation in the Paycheck Protection Program, State Street and Bank of New York Mellon saw their balance sheets shrink in the second quarter.

July 17 -

The Detroit lender disclosed that the consumer bureau had sent a civil investigative demand to Rocket Homes Real Estate for potential violations of the Real Estate Settlement Procedures Act.

July 16