-

Forecasters on an American Bankers Association panel predict continued economic growth this year, though they say President Trump's tariffs have created new inflation and recession risks.

March 7 -

The fund closes ahead of separate news that it formed the Private Real Estate Credit platform, which will originate senior and subordinated commercial real estate loans.

March 5 -

Rubin, who oversaw a shift to budget surpluses as Treasury chief under Democrat Bill Clinton in the 1990s after serving as co-chairman of Goldman Sachs Group Inc., said that while some federal spending can be cut, "as a practical matter" there's insufficient scope for that to rein in deficits.

March 4 -

Total delinquencies as a percentage of John Deere's managed portfolio was 3.06%, an increase since 2022. That aligns with the decline in corn and soy prices in the same period.

March 3 -

A March 2025 survey by the National Association for Business Economics shows growing inflation concerns — and a diminishing chance of rate cuts — in 2025, but also optimism about avoiding a recession.

March 3 -

The Federal Reserve's preferred inflation index showed little progress toward its target of 2%, increasing the likelihood of a prolonged rate pause.

February 28 -

Amortization will start after the deal's two-year revolving period, when the trust will deposit revenue including collections and upgrades into the acquisition account.

February 26 -

Small-balance commercial mortgages, SBA 504 and investor loans, all first-lien, make up the collateral pool.

February 24 -

The current pool has smaller exposures to the construction and turf sectors compared to the 2024-2 series, which have seen higher loss rates than the agriculture sector.

February 21 -

Lenders and developers are now working their contacts in Washington to try to protect Ginnie Mae.

February 21 -

The potential impacts of import tariffs cloud the outlook, though, and could lead mortgage rates to surge and fall throughout the coming year.

February 20 -

Federal Reserve Chair Jerome Powell said insurance companies and banks are already pulling out of disaster-prone areas, which could pose problems.

February 12 -

The rating agency covers its bases in preparation for a surge in data center debt

February 12 -

Most participants in a monthly Wolters Kluwer survey no longer think the next short-term rate reduction will be in March.

February 10 -

While mortgage employment is lower year-over-year, the mixed bag of data makes it more likely that borrowing rates will remain higher for longer.

February 7 -

The 30-year fixed rate mortgage continues to slip away from the 7% mark, Freddie Mac said, but experts still expect them to stay higher for longer.

February 6 -

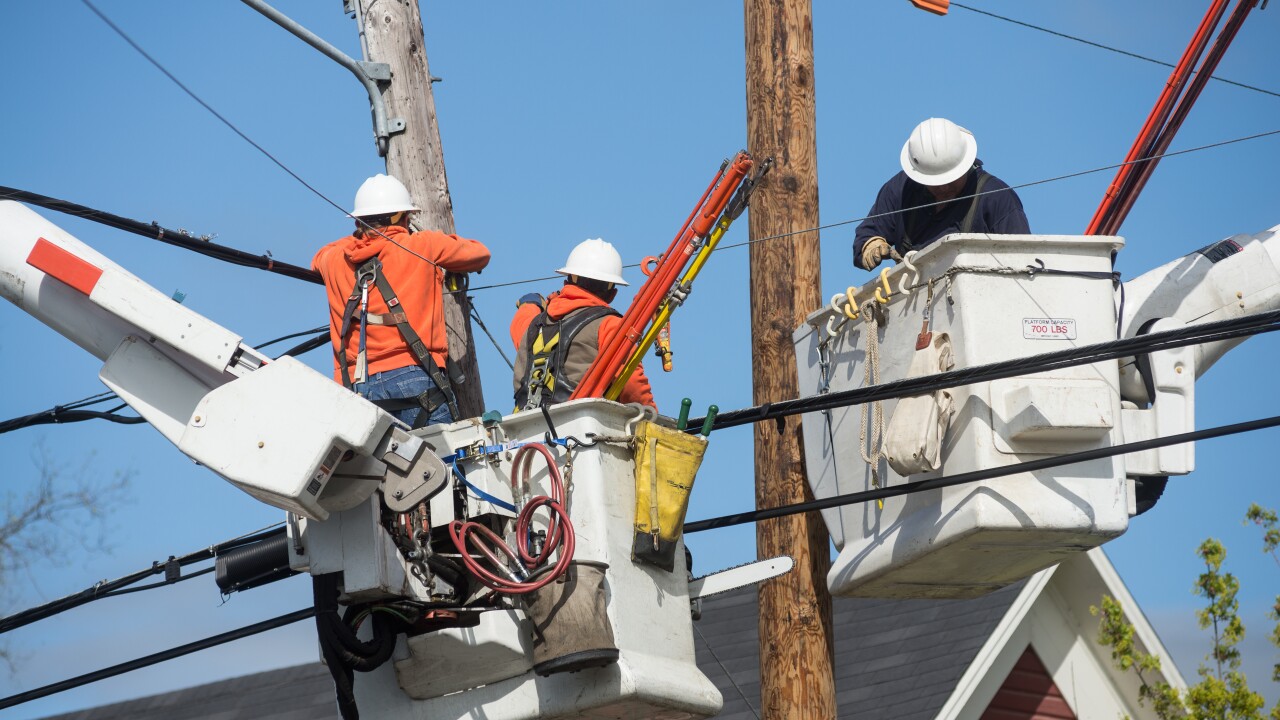

RG&E, series 2025-A, is the second utility cost recovery securitization this week, and is another first-time issuer.

February 6 -

Completed foreclosure auctions should be 8% lower this year, but if home value and unemployment expectations change, all bets are off, Auction.com said.

February 5 -

Residential customers made up 70.1% of NYSEG's sales revenue, while commercial and industrial customers account for the other 30% of sales. The latter is a relatively high exposure for such deals.

February 4 -

Debt service coverage ratio triggers, including cash trapping and rapid amortization, will provide much of the credit enhancements to the notes.

February 3