-

As apps like Uber and Lyft gain more traction, the need for new cars — and loans — is expected to diminish.

October 11 -

Kroll Bond Rating Agency has tracked rising levels of annualized net losses in marketplace-loan securitizations except for, ironically, the riskiest pools it tracks from unsecured subprime lenders: both losses and delinquencies for subprime lenders' outstanding securitizations have fallen from September 2018 levels.

October 11 -

The company has rolled out an online platform for firms considering marketplace loans as an asset class.

October 10 -

The industry had welcomed the Consumer Financial Protection Bureau plan allowing debt collectors to use electronic communication, but some worry about the effect of a court decision concerning email correspondence.

October 7 -

The transaction is the first securitization sponsored by the auto finance company since S&P Global downgraded four classes of subordinate notes in prior transactions due to higher-than-expected losses.

October 4 -

Arivo Acceptance, a two-year-old specialty-finance auto lender, is launching its debut securitization of subprime and non-prime loans for new and used cars, trucks and SUVs.

October 3 -

About 10% of the collateral pool consists of prime loans with extended term loans of 78 months excluded from World Omni's prime securitization platform.

October 2 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

A hearing on legislative proposals exposed a sharp partisan divide over a regulatory plan to restrict the frequency of collection calls.

September 26 -

Digital-first lenders more than doubled their market share in the last four years, according to a report by Experian.

September 25 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

A subsidiary of Citizens Financial Group placed first in a recent J.D. Power ranking of car dealer satisfaction with noncaptive auto lenders. However, that group — primarily banks and credit unions — lagged other types of auto lenders.

August 29 -

Asset Recovery Associates told borrowers that it could sue them, garnish their wages and place liens against their homes, according to a consent order by the consumer bureau.

August 28 -

The tech-driven asset management firm announced it had closed a $115 million asset-backed securities deal led by Cantor Fitzgerald, with unsecured consumer loans acquired from Prosper Marketplace.

August 22 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

August 20 -

Robert G. Cameron, a former official at the Pennsylvania Higher Education Assistance Agency, will succeed Seth Frotman as the bureau's point person on student lending complaints.

August 16 -

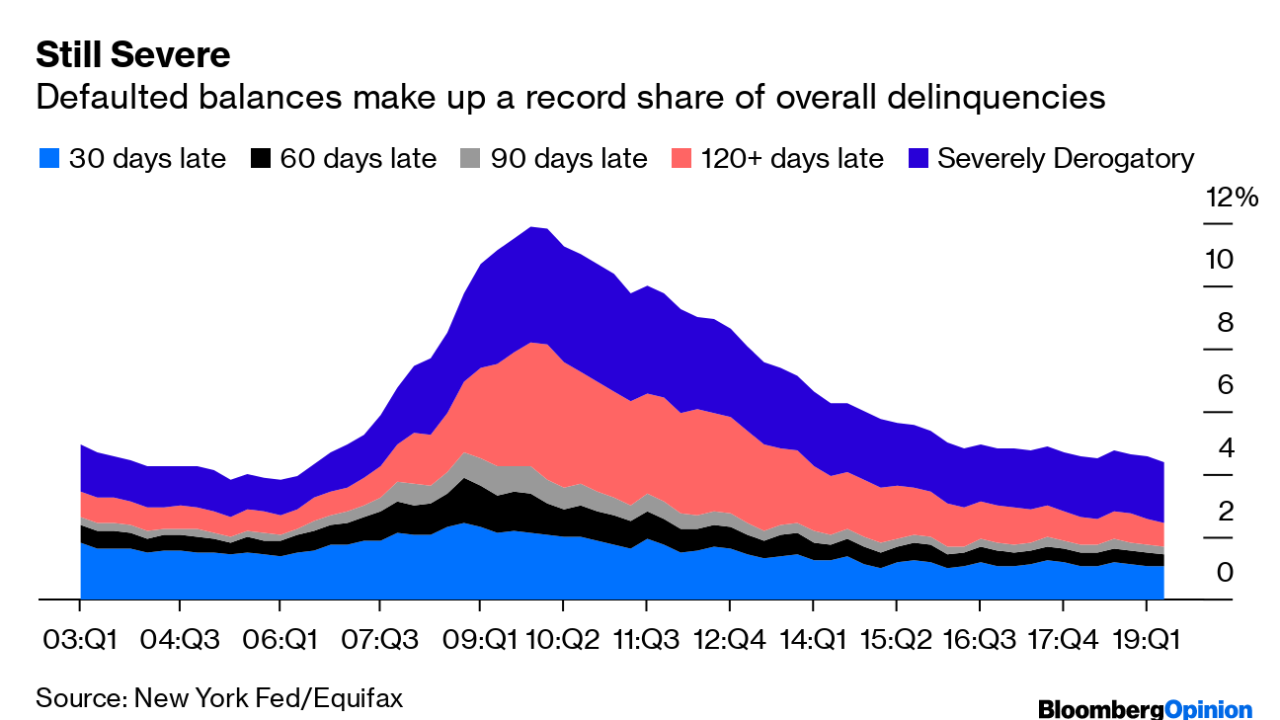

Of the roughly $250 billion severely derogatory outstanding balance, defaulted student loans make up 35%, a New York Fed report found. That’s a new phenomenon.

August 14 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

The decline in the share of "cured" delinquent loans is a potential signal for increased securitization losses in the months to come.

August 13