-

Auto-loan securitizations from AmeriCredit and Santander add to a briskly flowing 2020 subprime-deal pipeline, while Ford and JPMorgan are marketing notes backed by prime-loan receivables.

November 12 -

The overall mortgage delinquency rate improved in the third quarter as the economy got healthier while late-stage delinquencies hit a decade high, according to the Mortgage Bankers Association.

November 11 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

While the overall rate fell in October, S&P noted a sharp rise in the proportion of loans overdue 60 days as many roll out of COVID-19 forbearance.

November 9 -

Payment rates for auto lenders and credit card issuers have remained strong despite a spike in unemployment. Whether these trends continue into 2021 will depend largely on the actions of Congress and the pace of medical advances.

November 2 -

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

October 28 -

A 2019 decision by Amy Coney Barrett, then a 7th Circuit judge, cited an earlier Supreme Court ruling suggesting a high bar for plaintiffs to claim harm. But other jurists have favored a less onerous standard.

October 27 -

Wells Fargo is exploring a sale of its corporate-trust unit that could fetch more than $1 billion and is considering whether to find a buyer for its student loan portfolio, according to people familiar with the matter.

October 26 -

According to ratings agency presale reports, Flagship will sell $303 million in bonds from a $314.8 million of loan originations by Flagship as well as its CarFinance.com subsidiary.

October 22 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

Defaults have been milder than expected thanks to government relief and stricter underwriting. But with the crisis dragging on and policymakers unable to agree on a stimulus plan, loans to highly indebted companies remain at risk.

October 15 -

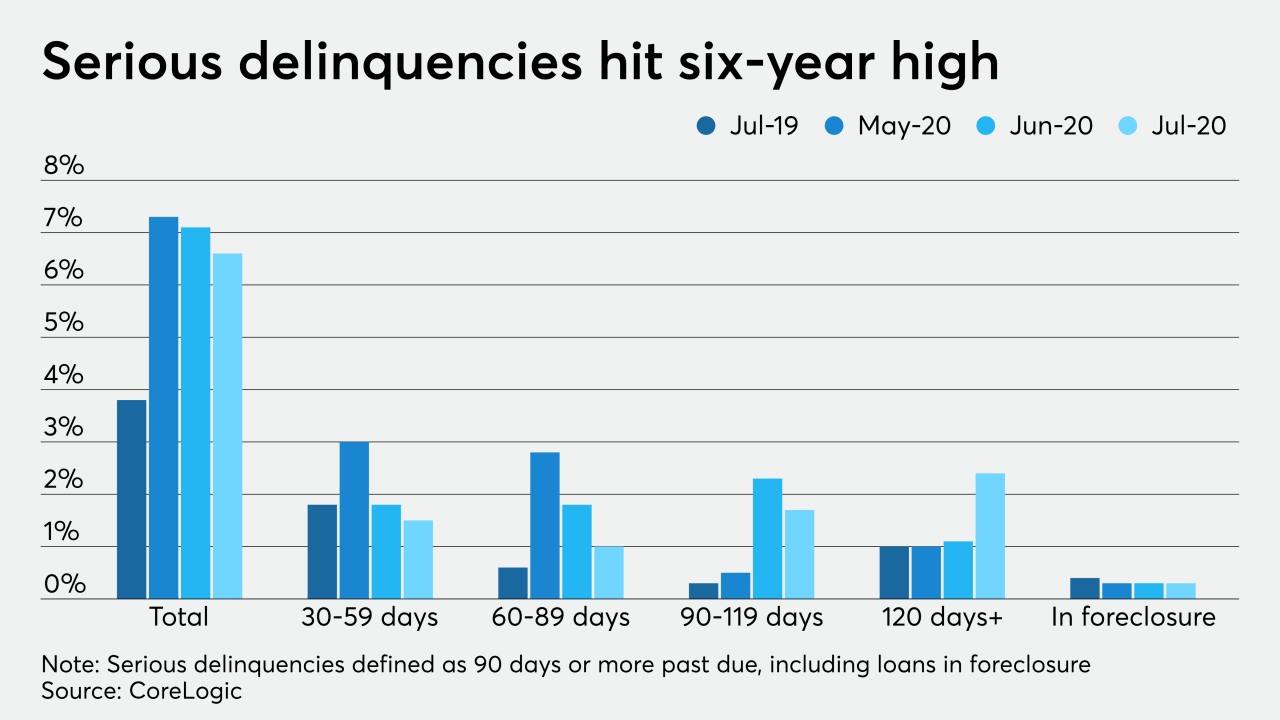

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Prestige's new $377M securitization has a collateral pool in which over 44% of the loans are from borrowers with recent Chapter 7/13 discharges.

October 9 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

Kathy Kraninger’s job status would be in question if Joe Biden wins the White House. If the president is reelected, she may continue balancing a deregulatory agenda with her unexpectedly tough stance on enforcement.

October 2 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

Deals, trends and research in structured finance and asset-backed securities for the week of Sept. 25-Oct. 1

October 1 -

Deals, trends and research in structured finance and asset-backed securities for the week of Sept. 18-24

September 24 -

“The Fed has made it clear that they don’t want a liquidity problem in the Treasury market or the higher-grade corporate market,” Fuss said. “They cannot, unfortunately, underwrite lending in the private markets.”

September 23 -

Shares of the company surged 31% in New York on Tuesday after it projected record revenue and profit margins. The stock has rallied almost 150% this year as Americans have turned to buying household essentials, entertainment and, increasingly, used cars online.

September 23