-

A three-month drought in CRE CLO issuance came to an end this week with new deals from Exantas and A10 Capital.

September 9 -

The ratings agency reports that the MPL industry might reckon with a potential spike in defaults as borrowers are rolled out of two- and three-month COVID-19 hardship programs.

September 9 -

The Senate Banking Committee met Wednesday to review central bank lending facilities such as the Main Street Lending Program, which provides bank-issued loans to middle-market firms. But some lawmakers on the panel said the focus of pandemic relief has been misplaced.

September 9 -

Bankers and fintech executives want lawmakers returning to Washington to focus on streamlined forgiveness and a second round of Paycheck Protection Program loans for small businesses.

September 8 -

Both Moody's and DBRS Morningstar project elevated credit-loss levels for the auto lender, compared to prior deals, due to COVID-19 uncertainties

September 8 -

Fintech lenders that reported a surge in missed payments at the start of the pandemic have seen credit quality rebound substantially since. But credit performance could still deteriorate if high unemployment persists and Congress fails to enact more relief measures.

September 8 -

The share of 78-month loans is at 14.9%, compared to approximately 10% in World Omni's previous issuance from its subprime/nonprime shelf.

September 2 -

More than $1 billion in coronavirus relief went to small businesses that received multiple loans and a congressional subcommittee analyzing the Paycheck Protection Program says it has seen evidence of fraud in thousands more loans.

September 1 -

This year has already seen a glut of corporate failures: there were 177 U.S. bankruptcy filings year-to-date by companies with over $50 million in liabilities, according to data compiled by Bloomberg

September 1 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31 -

The legislation, which would apply to both banks and nonbanks, would give borrowers the right to sue for damages when servicing violations occur.

August 28 -

Three non-QM deal issuers in August report varying levels of progress in moving borrowers from expired forbearance programs.

August 26 -

Citigroup’s $900 million payment blunder in a normally low-profile part of the financial market dominated by a handful of banks has experts wondering if regulators will uncover a deeper problem.

August 25 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

There’s been a flurry of interest in so-called fallen angels recently as investors seek alternatives to the ultra-low yields on high-grade debt.

August 25 -

The bank — which said it has been upgrading its loan operations platform after a review it undertook last year — said it mistakenly transmitted the payments after an employee didn't manually select the correct system options in its loan operation software.

August 25 -

While cutting losers to buy winners is an age-old investment proposition, the Covid-19 pandemic may create even more openings than the past crises that became bonanzas for real estate investors.

August 24 -

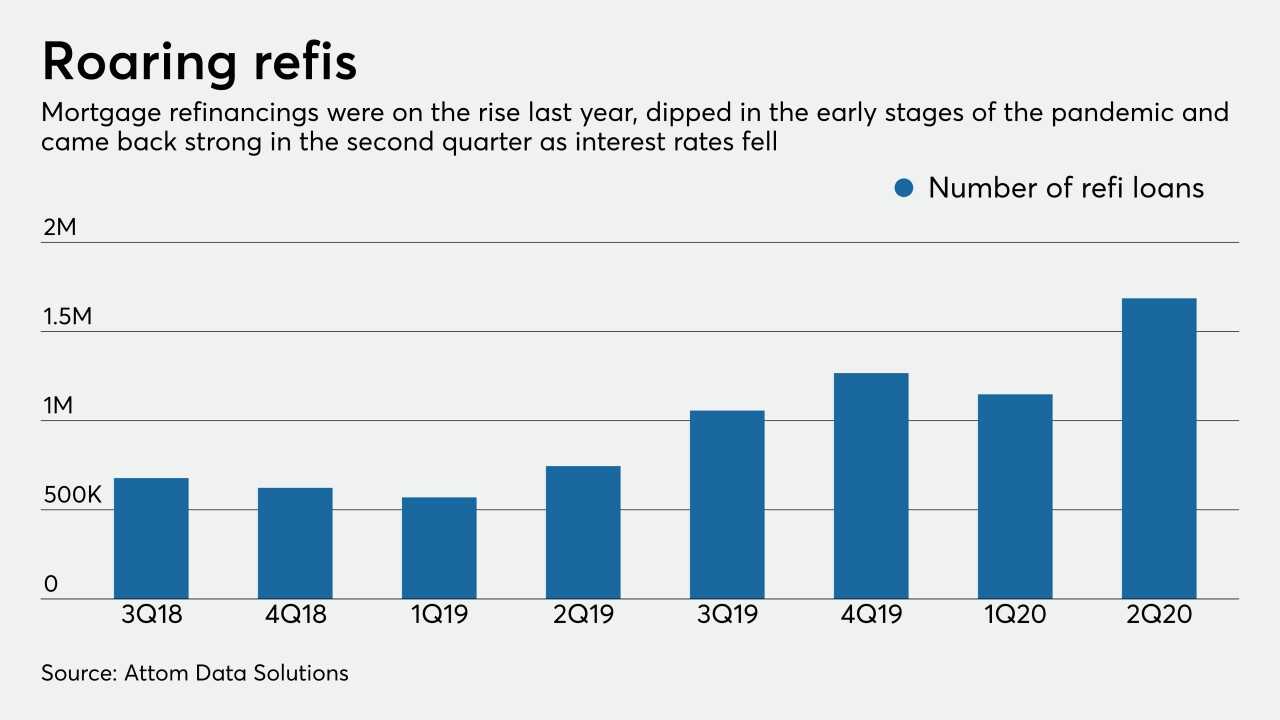

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Positive payment behaviors in conjunction with CARES Act measures kept mortgage delinquencies from rising, but the number of borrowers facing hardship grew exponentially from last year, according to TransUnion.

August 20 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20