-

The legislation, which would apply to both banks and nonbanks, would give borrowers the right to sue for damages when servicing violations occur.

August 28 -

Three non-QM deal issuers in August report varying levels of progress in moving borrowers from expired forbearance programs.

August 26 -

Citigroup’s $900 million payment blunder in a normally low-profile part of the financial market dominated by a handful of banks has experts wondering if regulators will uncover a deeper problem.

August 25 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

There’s been a flurry of interest in so-called fallen angels recently as investors seek alternatives to the ultra-low yields on high-grade debt.

August 25 -

The bank — which said it has been upgrading its loan operations platform after a review it undertook last year — said it mistakenly transmitted the payments after an employee didn't manually select the correct system options in its loan operation software.

August 25 -

While cutting losers to buy winners is an age-old investment proposition, the Covid-19 pandemic may create even more openings than the past crises that became bonanzas for real estate investors.

August 24 -

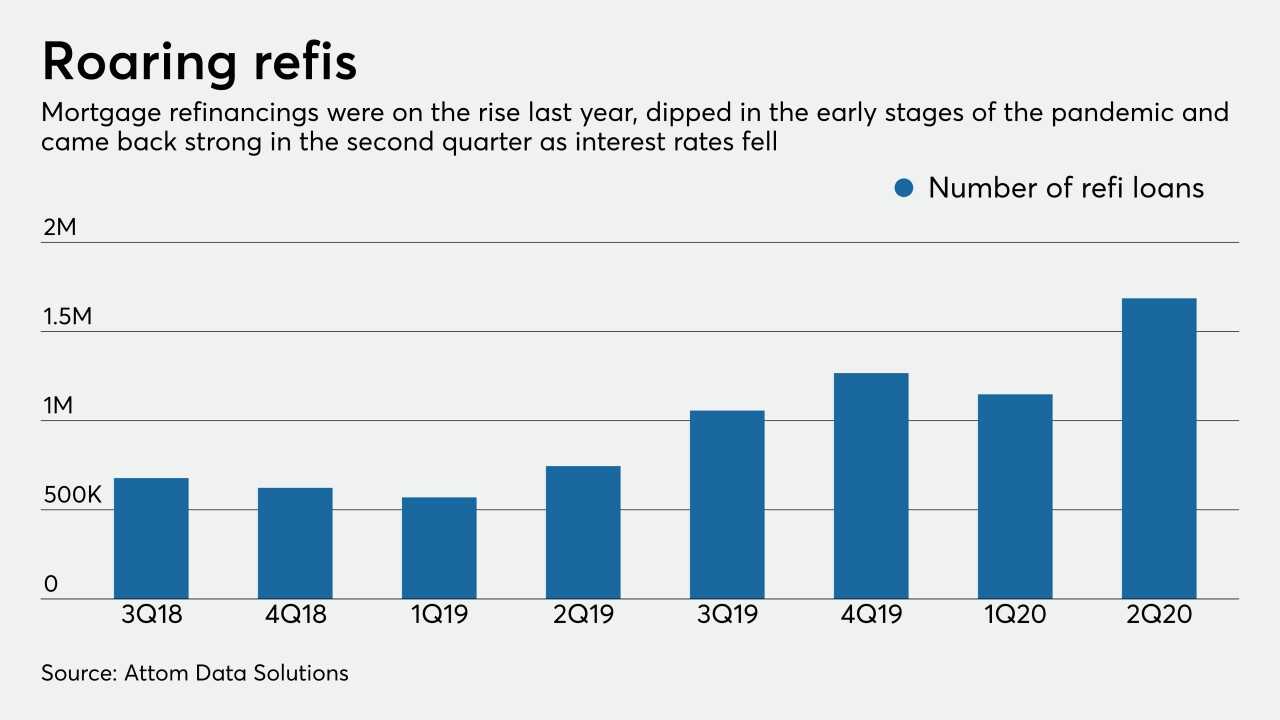

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Positive payment behaviors in conjunction with CARES Act measures kept mortgage delinquencies from rising, but the number of borrowers facing hardship grew exponentially from last year, according to TransUnion.

August 20 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20 -

The industry’s turmoil, including 'strategic options' being pursued by corporate debt obligors like Transocean and Seadrill, has sparked the biggest wave of restructurings since 2017, when the effects of the last oil price downturn reverberated through the industry.

August 19 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

Under the agreement, fintechs and their bank partners will have a safe legal harbor to offer loans, as long as their interest rates do not exceed 36% and they meet various other standards.

August 18 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 18 -

For the second consecutive month, the average extension rate in June for troubled loans due to pandemic-related stresses on borrowers shrank in both prime and subprime loan sectors.

August 18 -

The bank has begun briefing regulators about how it mistakenly sent payments to creditors of Revlon, the financially strapped cosmetics company. Citi has also filed a lawsuit against Brigade Capital Management seeking to recoup $175 million it sent to Brigade on Revlon's behalf.

August 17 -

The bank has recouped part of the payment, which it blamed on a clerical error, but some of the lenders say they were owed the money in connection with an ongoing dispute.

August 14 -

As the discredited Libor interest rate benchmark enters its last months, some banks are turning away from the repo-based alternative that regulators prefer. What could go wrong?

August 12 -

The card giant could pay $850 million in cash for the online small-business lender, according to a person familiar with the talks.

August 11 -

San Francisco-based Theorem is marketing its first-ever securitization of online, unsecured consumer loans culled from the LendingClub origination platform using machine-learning technology.

August 10