-

The Dallas-based lender's third foray into the deep subprime ABS market in 2018 arrives as recent Santander DRIVE securitizations are performing well with recently lowered loss expectations from S&P Global Ratings.

July 12 -

Loans originally securitized in three 2013 transactions account for some 11.4% of the initial collateral for the $230 million CPS Auto Receivables Trust 2018-C, according to S&P Global Ratings.

July 6 -

The notes, which are rated by DBRS, are backed by a mix of products to borrowers with weak credit; the pool of collateral will revolve over the first two years of the transaction.

June 29 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

In Santander Consumer USA's third subprime shelf offering of 2018, new cars represent 55.8% of the collateral. In previous deals dating to 2013 new-car concentrations did not exceed 40.9%.

June 15 -

Global Lending Services returns to double-A status in its new $299.4M transaction, while American Credit Acceptance issued another AAA-rated deal with a substantial prefunding account feature.

June 7 -

Despite a steep drop in average FICO and increase in extended-term loans, DriveTime is shaving overcollateralization levels thanks in part to improved performance from its outstanding securitization portfolios.

June 1 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

It’s not just weaker underwriting and higher household debt levels that are driving past-due rates to their highest levels in seven years.

May 23 -

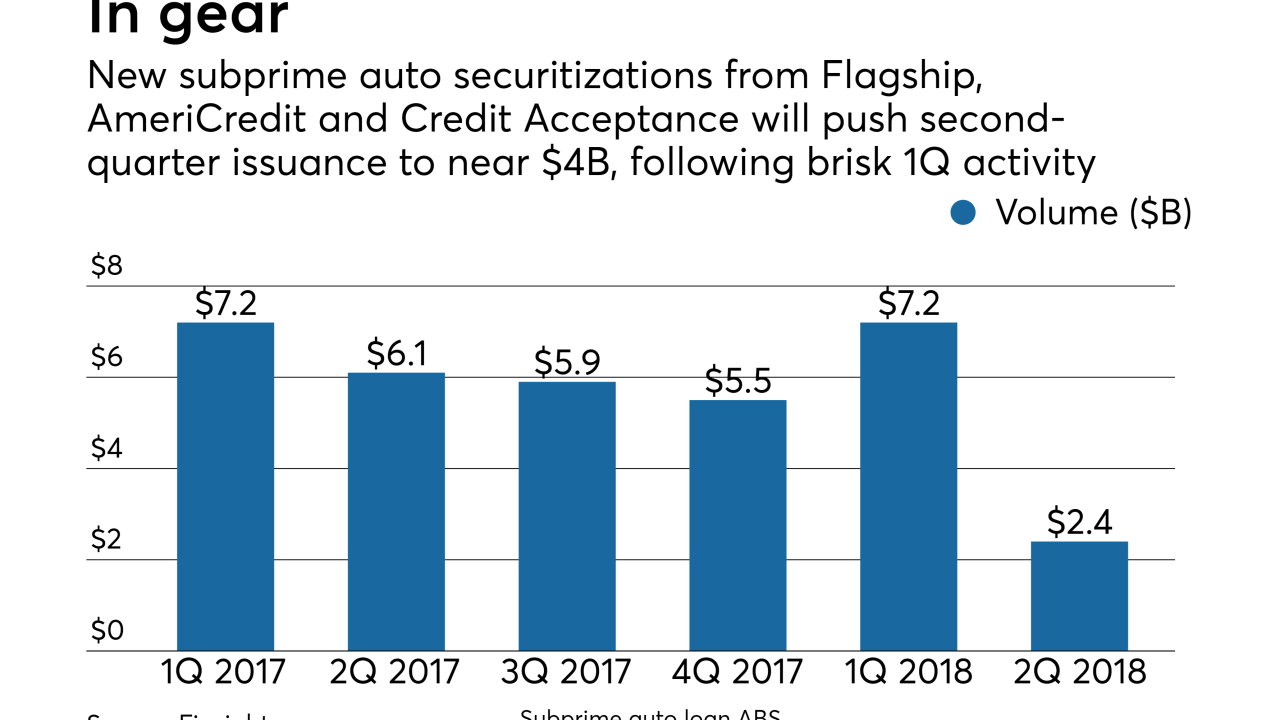

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

The Dallas-based lender, a unit of the global banking giant Banco Santander, was able to lower credit enhancement on the senior notes to 63.55% from 65.25% on the previous deal in February.

May 10 -

AmeriCredit returns to securitization for the first time since November with a $1.1 billion deal, while Flagship's $223 million deal, its second of 2018, takes a step back in collateral quality.

May 9 -

The senior tranche of Credit Acceptance Auto Loan Trust 2018-2 benefits from initial credit enhancement of 51.61%, up from 49.93% in a February deal; it comes from additional subordination.

May 9 -

Auto lenders would be well advised to keep up their guard as states — particularly blue ones — take steps of their own to crack down on what they see as abusive practices.

May 7 -

While DBRS maintained a rating of AA for the Lendmark Financial's first ABS of 2018, S&P issued an A rating after estimating higher net losses on the underlying subprime accounts.

May 4 -

RAC King (d/b/a American Car Center) has expanded rapidly since being acquired in a 2016 leveraged buyout; now it's bundling most of its portfolio into collateral for bonds.

April 25 -

The $185 million transaction features a higher exposure to borrowers entering bankruptcy than the sponsor's 2016 deal; it's also more seasoned, since it recycles 2014 collateral.

April 19 -

Higher LTVs and fewer low-risk, new-car loans trumped the recent decline in managed-portfolio delinquencies and improved ABS performance since 2015.

April 16 -

The subprime auto lender failed to disclose that it received fees for referring borrowers to CarMax, the used-car dealer, according to California's financial regulator.

April 6 -

But GMF's deeper dive into long-term loans for a pool increasingly dominated by pricier trucks and SUVs caused a slight bump in expected ABS credit losses.

April 5