-

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

The largest bank in the country bulked up its reserves by $2.2 billion for potential credit hits from the Apple card portfolio, which JPMorgan is taking over from Goldman Sachs.

January 13 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

American Banker research highlights growing concerns about an economic downturn, regulatory volatility and open-banking risks.

January 6 -

The twists and turns of the U.S. economy and the artificial-intelligence boom both played a role. But much of it could be traced to the White House.

December 30 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

A Consumer Financial Protection Bureau report on Pay in 4 buy now/pay later loans offered validation for an industry that has faced criticism for expanding into everyday spending, such as food delivery.

December 11 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

December 8 -

As federal watchdogs step back from regulating "Buy Now, Pay Later" loans, state authorities are stepping in. This week, the attorneys general from California and several other blue states joined the fight.

December 2 -

The Consumer Financial Protection Bureau plans to transfer its entire enforcement and legal divisions to the Department of Justice and is likely to staff in those units, according to sources briefed by agency leadership.

November 20 -

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

President Trump has nominated Stuart Levenbach, associate director of the Office of Management and Budget, to be the director of the Consumer Financial Protection Bureau. His selection allows acting CFPB Director Russell Vought to remain in place for at least another 210 days.

November 19 -

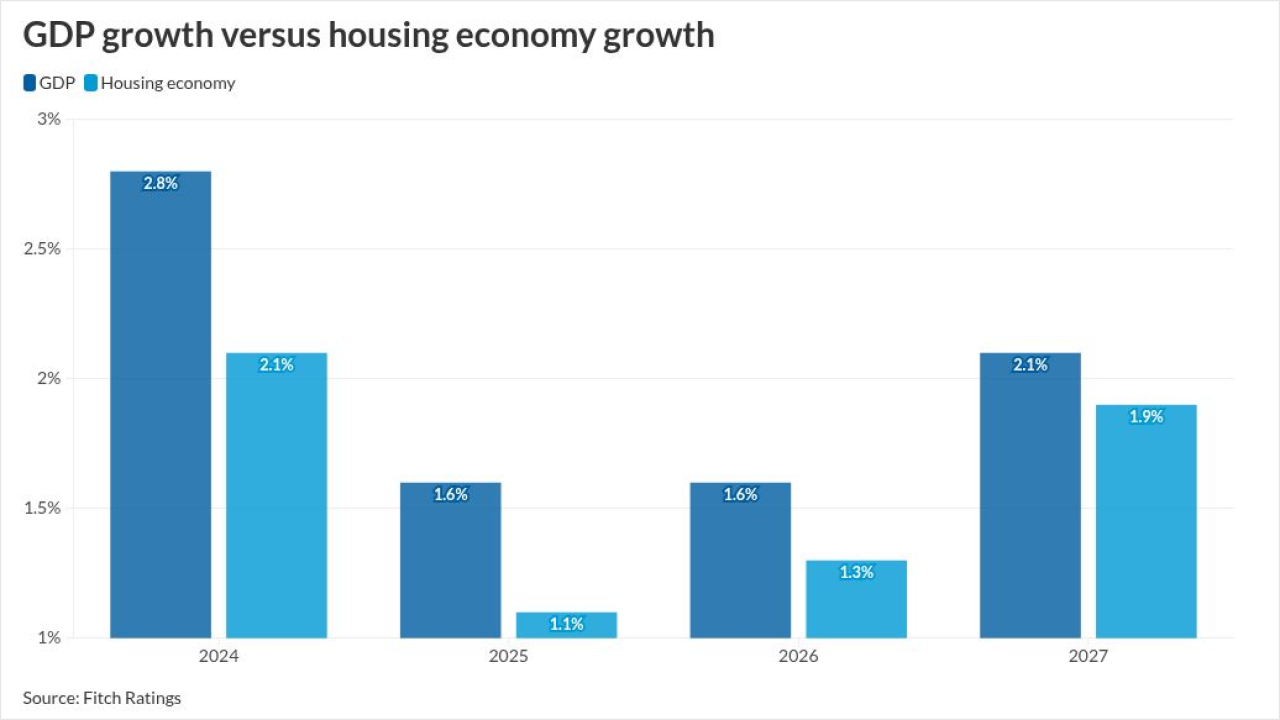

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11