-

Progress Residential's lastest pooling of 2,080 rental homes - all secured by a single-borrower mortgage - includes 719 homes rolled over from paid-off SFR securitizations.

July 12 -

The £310.3 million (US$401.26 million transaction, Twin Bridges 2017-1, is backed by 965 prime mortgages underwritten to UK landlords by Paratus AMC Ltd., formerly known as GMAC-RFC.

July 6 -

Towd Point Mortgage Trust 2017-3 is smaller the the sponsor's two previous deals of the year, but the credit quality of the collateral is remarkably similar.

July 4 -

The liquidation of Veneto Banca and Banca Popolare puts increasing pressure on other banks in the Eurozone to reduce their holdings of bad loans, according to Fitch Ratings; it remains to be seen whether securitization will play a significant role.

July 2 -

Angel Oak was able to secure triple-A credit ratings for its next offering of nonprime residential mortgage bonds, despite offering considerably less credit enhancement.

June 28 -

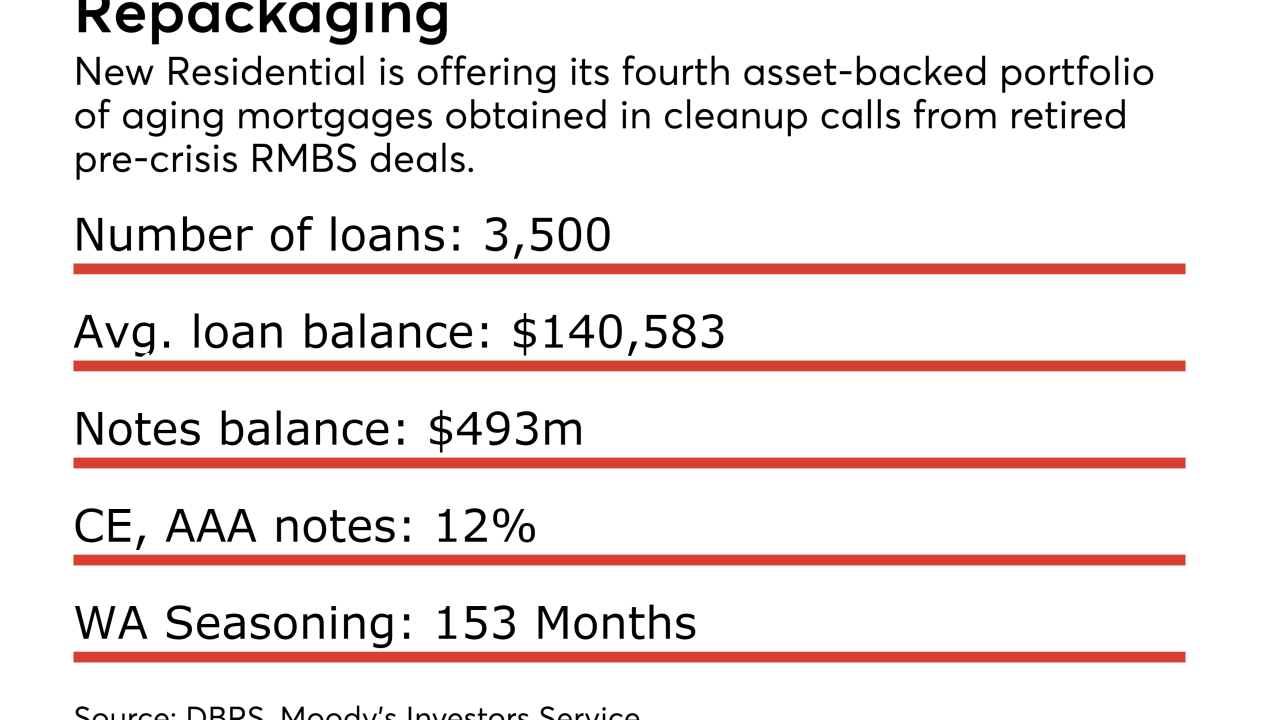

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

June 28 -

Lanark's UK RMBS and Obvion's Dutch deal are as yet unsized; Optimum's £242.3M deal is backed by UK second-lien loans

June 22 -

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21 -

Housing finance reform discussions are heating up and there's a growing sense that legislation can be enacted sooner rather than later. Here's why.

June 21 -

The properties backing the $336 million transaction average 23 years of age, with valuations averaging $303,727 per property and an average monthly rent of $2,229. Most require pre-lease rehabilitation costs that amount to an average of $8,318.

June 14