-

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

There are almost 7 million coastal homes facing more than $1.6 trillion in potential storm-surge reconstruction expenses this year, representing a 6.6% cost increase from last year's hurricane season.

May 31 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

Home Partners of America distinguishes itself from other single-family home lessors by offering right-to-purchase options. But for the majority of properties in its new asset-backed deal – a recycling of homes pooled in its first securitization – the purchase option has been bypassed or expired.

May 22 -

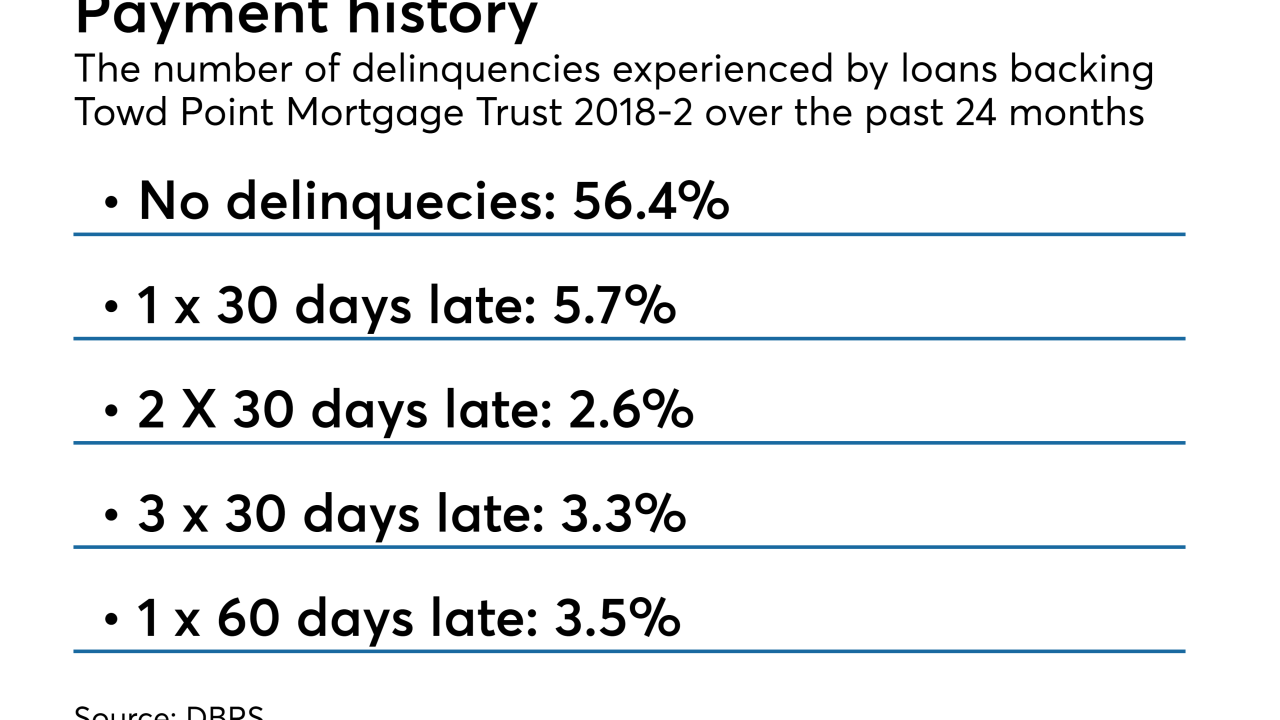

The $1.56 billion Towd Point Mortgage Trust 2018-2 also features higher exposure to loans on investment properties, in some cases loans backed by single-family homes in more than one state.

May 22 -

Test your knowledge of the secondary mortgage market with this quiz of key industry abbreviations.

May 18 -

Affinity's NREIG unit will become OwnAmeria's preferred insurance provider; landlords who list their portfolios will be able to apply for insurance directly from the trading platform.

May 18 -

After originating more than $1 billion in loans outside the ability-to-repay rule's Qualified Mortgage safe harbor last year, Angel Oak is planning to originate at least twice that in 2018.

May 14 -

The credit characteristics of borrowers are similar to those of the insurer's previous transaction in March, with a weighted average FICO of 777, income of $243,738 and liquid reserves of $236,904.

May 10 -

Despite the entrance of several large players over the past several years, financing to small-time landlords is still inefficient, executives say.

May 8