-

Strong growth in refinance volume following several weeks of so-so activity drove a 5.1% week-to-week increase in mortgage applications, according to the Mortgage Bankers Association.

July 15 -

However, those who aren't current bank customers need to have $1 million in a qualifying account.

July 10 -

Even as interest rates remained at record-low levels, mortgage application activity for both purchases and refinancings declined compared to one week earlier, according to the Mortgage Bankers Association.

June 24 -

Purchase mortgage application volume was at its most in over a decade as consumer confidence continued to improve in the aftermath of the coronavirus shutdown, according to the Mortgage Bankers Association.

June 17 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

Mortgage applications increased 2.7% from one week earlier, as purchase volume is now outpacing the prior year's activity, according to the Mortgage Bankers Association.

May 27 -

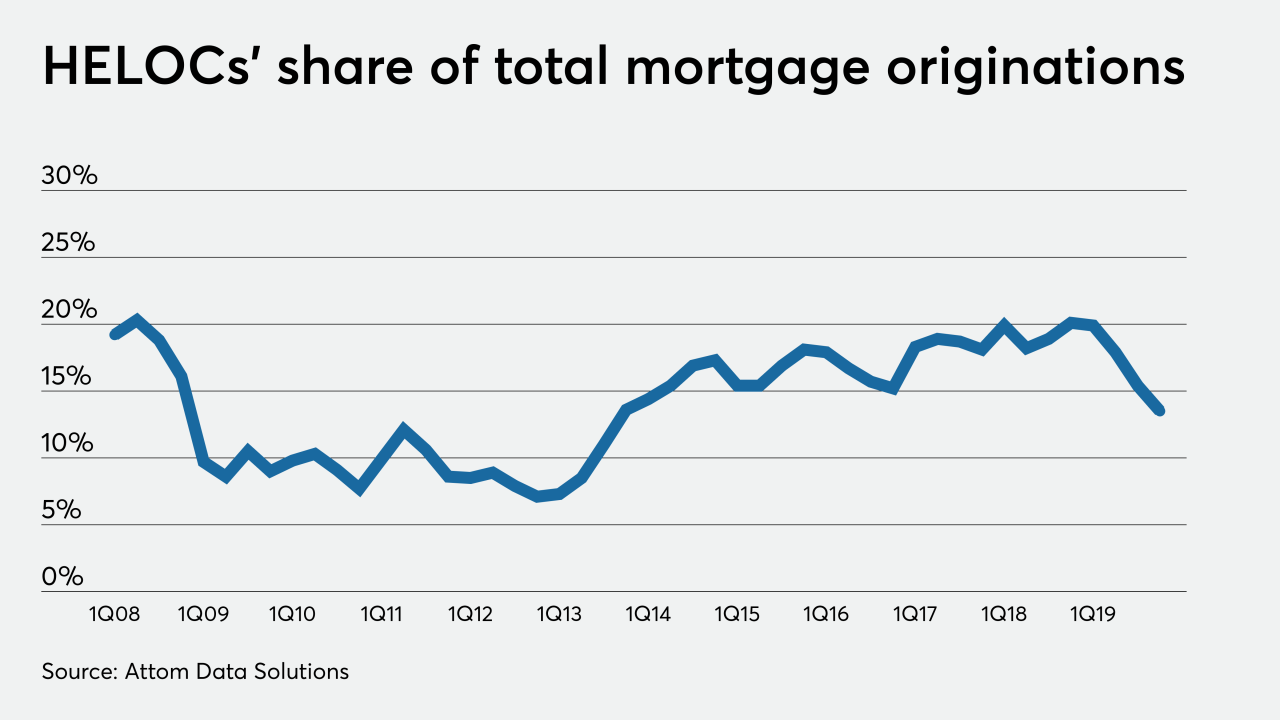

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

The Federal Housing Finance Agency clarified that borrowers with Fannie Mae- or Freddie Mac-backed mortgages who have entered into forbearance plans can be eligible for a refi or new purchase once they are considered “current” on their mortgage.

May 19 -

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8 -

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

While the mortgage market began the year healthy, lenders and borrowers need to prepare for the impacts of the coming coronavirus recession.

March 23 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

March 17 -

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

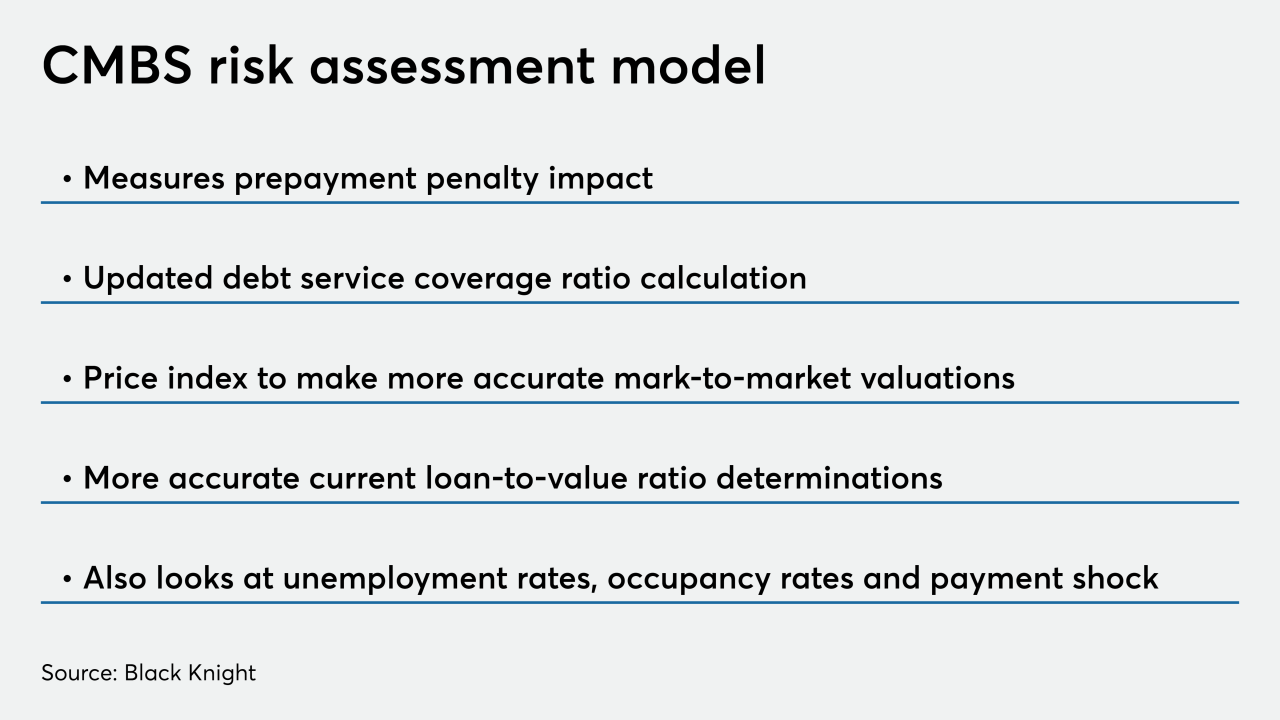

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

SoFi Professional Loan Program 2020-B Trust is a $1.06 billion asset-backed offering of bonds secured by a pool of loans made to advanced-degree graduates of medical, dental or legal universities, or MBA recipients.

February 19