-

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

Mortgage rates experienced a marginal uptick this week, rising three basis points. But they remained near record lows and possibly soon could track down again, according to Freddie Mac.

September 24 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

Mortgage rates continued their slide, with the conforming 30-year fixed at its closest point ever to breaching the 3% mark, according to Freddie Mac.

July 9 -

Mortgage rates reached their lowest level this week since Freddie Mac began its Primary Mortgage Market Survey in 1971, but they might not have yet gotten to their floor.

July 2 -

Mortgage rates increased slightly for the second consecutive week, buoyed early on by positive economic news such as the jobs report that came out last Friday, according to Freddie Mac.

June 11 -

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

May 26 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

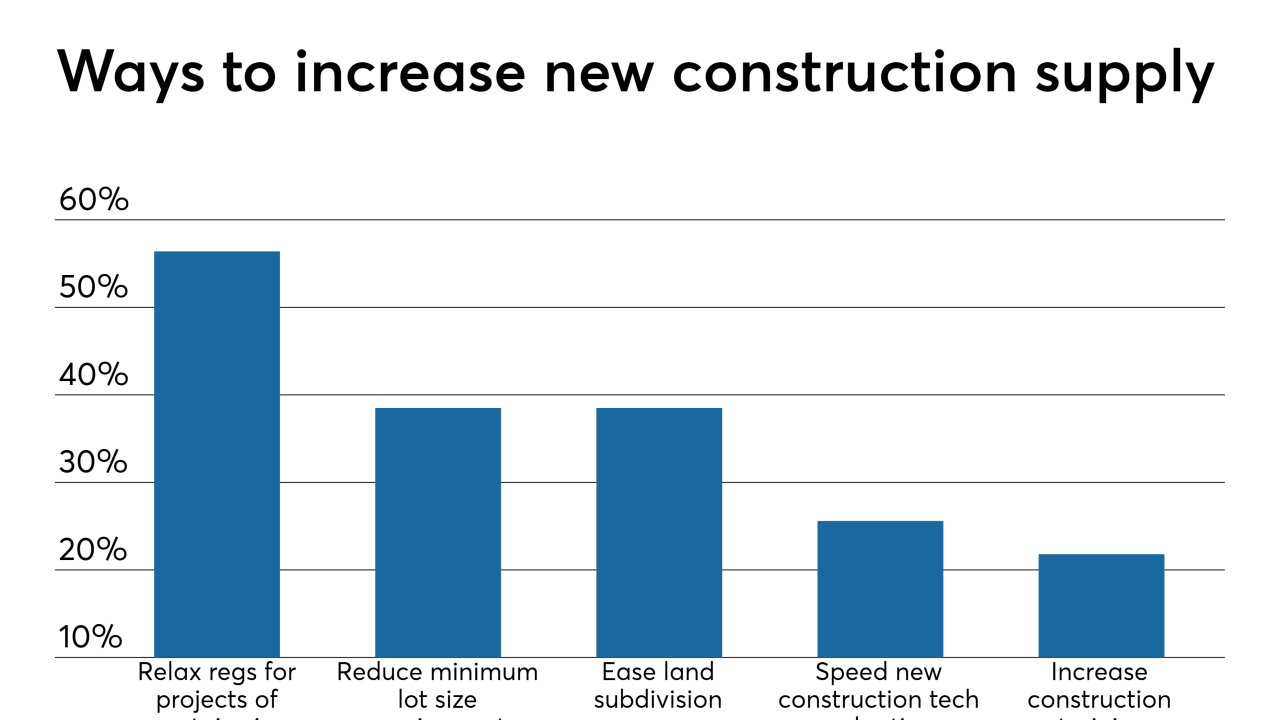

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16 -

While talks of an impending recession pick up steam, the housing market remains fairly stalwart and won't be to blame this time around, according to Zillow.

August 16 -

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

Zillow Group is moving from being a mortgage marketer to originating loans with its acquisition of Mortgage Lenders of America, in an effort to support its home-flipping business.

August 6 -

Home values grew during 2017 at their fastest pace in four years and the same supply and demand dynamics behind that increase remain in place for 2018.

December 28