-

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

April 30 -

Schwarzman says a dramatic change in tax policy under Democratic lawmakers or a rise in interest rates by the Federal Reserve could be a shock to the economy.

April 29 -

Stonyrock Partners will focus on buying stakes in asset managers focused on middle-market strategies.

April 23 -

The buyers obtained a $597 million mortgage and $53 million of mezzanine financing from Deutsche Bank and Wells Fargo to purchase the JW Marriott Grande Lakes and Ritz-Carlton Grande Lakes.

December 13 -

A $215 million commercial mortgage that was used to acquire the Ritz-Carlton Kapalua is being used as collateral for a transaction called GS Mortgage Securities 2018-LUAU

November 5 -

Invitation Homes 2018-SFR4 recycles collateral from Colony American Homes 2015-SFR1 (53.9%) and Colony Starwood Homes 2016-SFR1 (46.1%).

October 23 -

A growing number of asset managers are waking up to the opportunity to lend to small and medium-sized companies, and much of this direct lending is making its way into the securitization market.

October 2 -

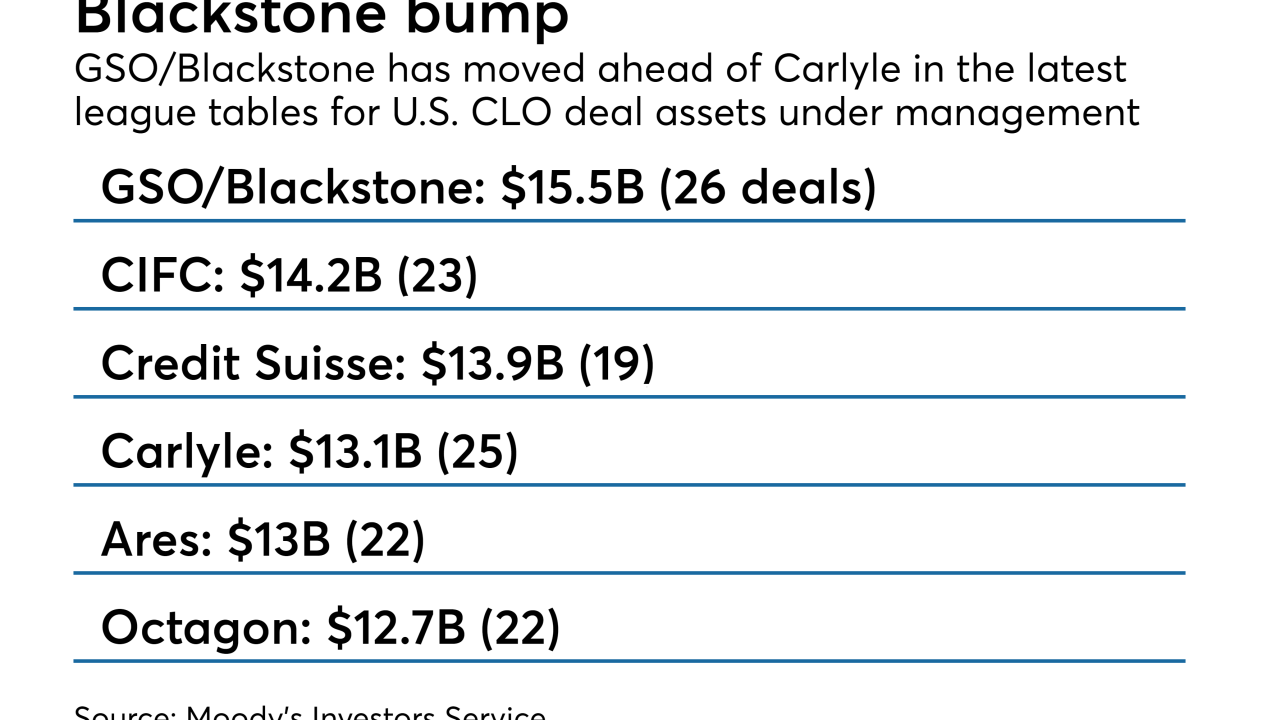

The distressed-debt manager now manages 26 U.S. CLOs totaling $15.5 billion, the most of any domestic CLO market manager.

August 13 -

La Quinta is spinning off a portfolio of 2014 hotels into a real estate investment trust called CorePoint; the REIT obtained a $1.035 billion mortgage from JPMorgan Chase that is being used as collateral for mortgage bonds.

June 25 -

Like the sponsor's February transaction, this one is backed by midsize and larger business jets, a volatile asset class; it amortizes more slowly and has looser restrictions on extending the terms of leases and loans.

June 18 -

IH 2018-SFR1 refinances three earlier transactions (one each from 2013, 2014 and 2015) and is initially sized at $1.1 billion; it may be upsized to $1.3 billion, depending on investor demand.

June 11 -

Blackstone originally included 21 of the 23 properties as collateral for a $2 billion loan issuance and securitization in 2016 to partially fund its $8.8B BioMed Realty buyout.

May 31 -

The €300 million Taurus 2018-1 also finances Italian retail assets that the Partners Group, based in Switzerland, purchased from the Blackstone Group in February.

April 30 -

The Market Center buildings in San Francisco's South Financial District includes Uber, Mindspace and TIBCO Software as tenants.

April 4 -

Nonbanks are originating more commercial mortgages on fixer-uppers in response to a sharp drop in the cost of funding in the securitization market. These deals are said to be "vastly different" than other CRE instruments that sustained big losses in the crisis — so far.

March 16 -

Just one year after it got a $1.05 billion loan from a trio of banks (Goldman, BofA and Citi), Blackstone has obtained a new, $1.3 billion loan from two more banks: Barclays and Deutsche.

March 15 -

It has obtained a $1.4 billion mortgage from four banks on a portfolio of 27 buildings that were previously securitized in a 2016 transaction, according to rating agency reports.

February 26 -

Demand for hotel rooms is running high, and mortgage bond investors are lining up to finance acquisitions and upgrades of even the largest resorts.

February 22 -

The new transaction, the $608 million Business Jet Securities, Series 2018-1, is less than half the size of the $1.48 billion deal pulled in September; it also appears to be less risky, by several measures.

February 15 -

Blackstone used the $189 million mortgage to help finance its purchase of the Turtle Bay Resort; it's planning to add rooms, but the new development will be held outside the trust.

January 17