-

IH 2018-SFR1 refinances three earlier transactions (one each from 2013, 2014 and 2015) and is initially sized at $1.1 billion; it may be upsized to $1.3 billion, depending on investor demand.

June 11 -

Blackstone originally included 21 of the 23 properties as collateral for a $2 billion loan issuance and securitization in 2016 to partially fund its $8.8B BioMed Realty buyout.

May 31 -

The €300 million Taurus 2018-1 also finances Italian retail assets that the Partners Group, based in Switzerland, purchased from the Blackstone Group in February.

April 30 -

The Market Center buildings in San Francisco's South Financial District includes Uber, Mindspace and TIBCO Software as tenants.

April 4 -

Nonbanks are originating more commercial mortgages on fixer-uppers in response to a sharp drop in the cost of funding in the securitization market. These deals are said to be "vastly different" than other CRE instruments that sustained big losses in the crisis — so far.

March 16 -

Just one year after it got a $1.05 billion loan from a trio of banks (Goldman, BofA and Citi), Blackstone has obtained a new, $1.3 billion loan from two more banks: Barclays and Deutsche.

March 15 -

It has obtained a $1.4 billion mortgage from four banks on a portfolio of 27 buildings that were previously securitized in a 2016 transaction, according to rating agency reports.

February 26 -

Demand for hotel rooms is running high, and mortgage bond investors are lining up to finance acquisitions and upgrades of even the largest resorts.

February 22 -

The new transaction, the $608 million Business Jet Securities, Series 2018-1, is less than half the size of the $1.48 billion deal pulled in September; it also appears to be less risky, by several measures.

February 15 -

Blackstone used the $189 million mortgage to help finance its purchase of the Turtle Bay Resort; it's planning to add rooms, but the new development will be held outside the trust.

January 17 -

A fund controlled by the PE group obtained a $192 million loan from Wells Fargo; proceeds, along with $127 million in subordinate financing, funded the $300 million purchase.

January 12 -

A £366.2 million mortgage on 127 industrial properties is being used as collateral for a transaction called Taurus 2017-2 UK DAC.

December 19 -

The collateral for the $59.9 million transaction from DRB Capital includes life-contingent structured settlement receivables; when the beneficiary dies, the insurer stops making payments.

December 13 -

Lee Shaiman, who oversaw $20 billion in leveraged finance and other fixed-income investments at Blackstone, will succeed Bram Smith. who announced his retirement in early 2017.

December 13 -

CHT 2017-CSMO will issue six classes of notes in the $1.38 billion transaction, which will refinance a 2016 mortgage securitization and provide funds for renovation.

November 30 -

The private equity firm obtained a $540 million loan on the JW Marriott Grande Lakes and the Ritz-Carlton Grande Lakes, which are situated on 500 acres at the headwaters of the Everglades, from Barclays and Wells Fargo.

November 15 -

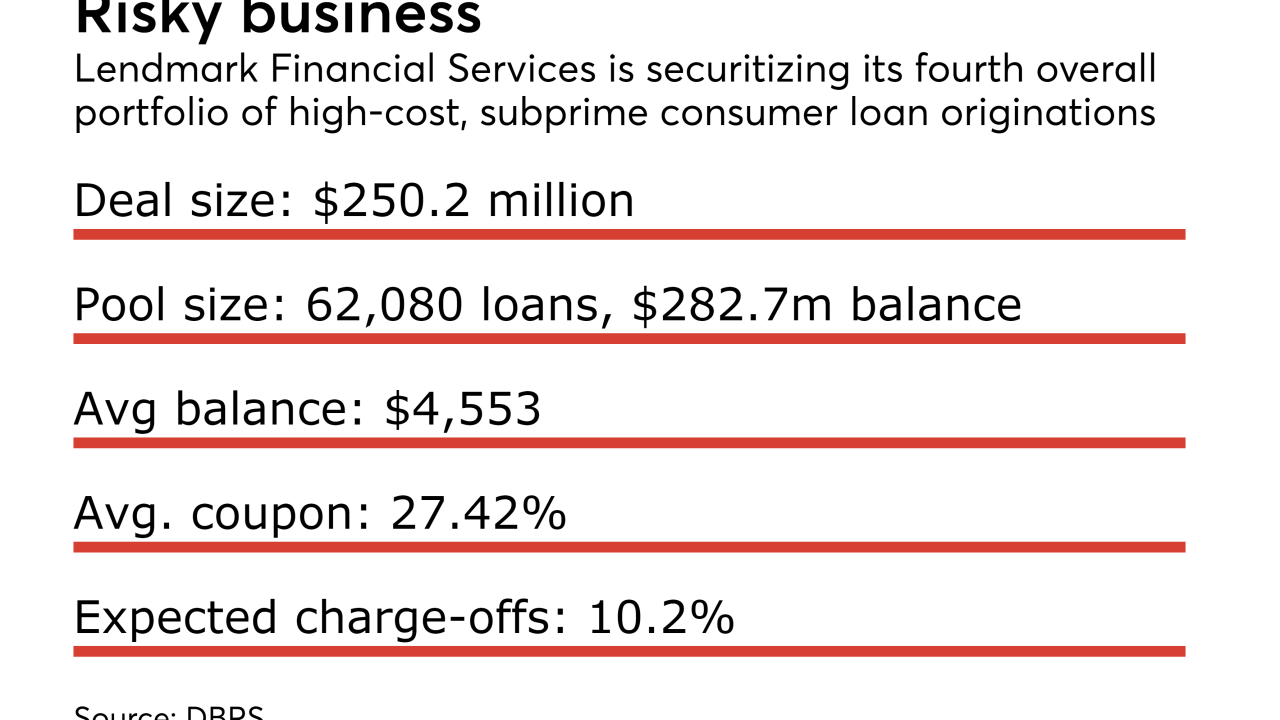

The company increased the concentration of sub-550 Beacon score borrowers to more than 13%, and cut the share of prime 700-plus loans by more than two-thirds from its prior deal.

November 8 -

A large portion of the collateral for both IH 2014-SFR2 and IH 2014-SFR3 is being rolled into a new securitization, IH 2017-SFR2.

November 1 -

Most of the 181 jets used as collateral were acquired from GE Capital Corp. in 2015; proceeds from prepayments and liquidations can be used to acquire additional aircraft.

September 27 -

A $507.6 million first mortgage on the Hotel del Coronado, a 130-year-old landmark with 1,400 linear feet of direct ocean frontage, is being securitized in BBCMS 2017-DELC. Barclays is the loan seller.

August 15