CMBS investors booking high-end hotels

At one time, big loans like the $470 million mortgage on the Orlando Hilton, the $189 million mortgage on the Turtle Bay Resort in Oahu, or the $189 million mortgage on the Renaissance Aruba Resort & Casino were routinely whacked up into multiple conduit offerings. But it has become increasingly attractive to securitize these mortgages on their own in what are known as single-asset, single-borrower deals. This kind of financing is shorter term than loans sold to CMBS conduits, and it is floating-rate — a sweet spot in a rising-interest-rate environment.

Joseph Franzetti, senior vice president for capital markets at Berkadia Commercial Mortgage, a mortgage brokerage, said that there was an 80-basis-point reduction in the spreads on the least risky tranches of notes issued in single-asset, single-borrower deals over the past year or so.

“CMBS became a much more attractive rate avenue for borrowers who want to take on floating-rate debt,” Franzetti said.

Last year, most loans used in single-asset or single-borrower securitizations refinanced existing debt, but this year, M&A is also a driver, according to Erin Stafford, a managing director at the credit rating agency DBRS.

“There are new borrowers that have acquired major portfolios,” Stafford said.

One of the reasons there are so many of these deals to finance hotels is there has been so much growth in the underlying cash flow of trophy properties, Stafford said. “Some of it has to do with a shift in consumer behavior; they are looking more toward experiences as opposed to acquiring goods.”

In a lot of portfolios that DBRS rates, “the sponsors [borrowers] have put a lot of capital back into the properties, in the range of $8,000 to $20,000 per key, on a regular basis,” she said. It makes a lot of sense to take out floating-rate debt in order to capitalize on potential future growth.

The rush of deals comes despite emerging signs of oversupply in the broader hotel market. Last month, Fitch Ratings warned that is has seen an increase in the volume of securitized hotel loans transferring to special servicing in seven of the top U.S. metropolitan markets. Nevertheless, Fitch expects revenue in the broader U.S. hotel market to grow through the end of 2018, albeit slowly, and that the impact of oversupply on mortgage bonds will be limited this year.

Resorts are not the only kinds of hotels being financed via single-asset, single-borrower deals.

Single-asset-, single-borrower financing is not limited to resort hotels. Recent deals have also financed the acquisition of portfolios of hotels by the real estate investment trusts Colony Northstar and Ashford Hospitality Trust, among others.

Franzetti said there are few alternatives to CMBS financing available for these kinds of acquisitions. Insurance companies sometimes co-underwrite “club” loans for large buildings, but it can be hard to get them comfortable with a portfolio of assets.

There have also been several securitizations of large loans backed by multifamily and office properties.

Hilton Orlando transaction

Proceeds were used to repay approximately $376.1 million of existing debt, which includes a $345.9 million first mortgage previously securitized in HILT 2014-ORL and $30.2 million of mezzanine debt; pay closing costs and return approximately $90.8 million of sponsor equity.

The new loan was securitized in a transaction called The Hilton Orlando Trust 2018-ORL.

Renaissance Aruba recapitalized

Caribbean Property Group originally owned 100% of the property, but its stake was written down to 11.6% when it defaulted on a mezzanine loan; Five Mile, the mezzanine lender, had that debt converted debt into equity.

Ashford refinances hotel portfolio

Proceeds were used to refinance prior debt of $378.9 million, funded $5.8 million of upfront reserves, facilitated a $2.4 million cash-equity distribution and covered approximately $7.9 million of closing costs, according to DBRS.

Seven of the hotels are affiliated with Hilton, IHG or Starwood, and operate under four flags (Embassy Suites by Hilton, Crowne Plaza, Hilton and Sheraton), and one operates as an independent hotel.

Red Roof Inn owners refinance

Westmont Hospitality Group (through two affiliates) secured a $360 million first mortgage and $40 million mezzanine loan from Barclays and Morgan Stanley that is secured by a portfolio of 89 Red Roof locations in 25 states. Proceeds were used to refinance debt taken out in 2015 to buy out a Stamford, Conn., firm that partnered in Westmont’s $575.5 million acquisition of the Red Roof franchise in 2011.

Cashout refi of extended-stay hotels

Starwood acquired the properties in two separate transactions in 2013 and 2015.

Loan proceeds were used to refinance $381 million of existing debt, return $70.5 million of equity to the sponsor, cover closing costs of approximately $18 million, and fund a $1 million reserve to address inadequate parking at the Independence Boulevard property.

The prior debt was securitized in the CSMC 2015-TOWN securitization, according to DBRS.

Colony Northstar cash-in refinancing

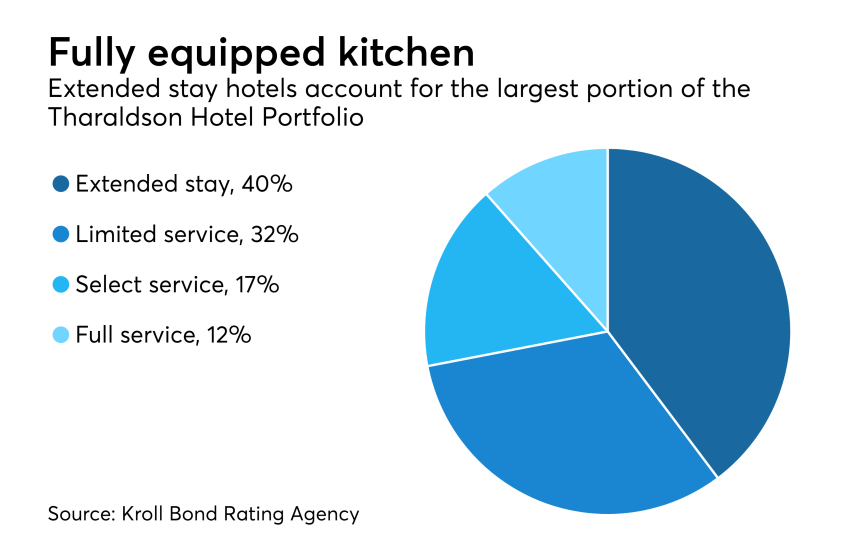

In November, the company obtained a $960 million mortgage from JPMorgan Chase and Deutsche Bank. The proceeds, along with $80 million of mezzanine financing provided by the same two banks and $23.5 million of cash equity, were used to refinance approximately $895.9 million of existing debt. It was securitized in a 2013 transaction and was transferred to special servicing in June 2017 because the previous sponsor was unable to retire the debt, according to Kroll Bond Rating Agency.

Following the transfer, Colony NorthStar, which was a junior mezzanine lender at the time, took ownership of the portfolio, and the loan was returned to the master servicer in October 2017 after a one-year maturity extension.

Blackstone's big plans for Oahu's northern shore

The Turtle Bay Resort is the only full-service hotel and resort located on the northern shore of the Hawaiian island of Oahu, an area well known for its natural setting.

In December, an affiliate of the private-equity firm obtained a $189 million mortgage from Citigroup. Proceeds, along with $52.9 million of mezzanine debt and $101.3 million of sponsor equity, were used to acquire the Turtle Bay Resort for $332.5 million and pay closing costs. The seller was a bank syndicate that took control of the property in 2010, according to Kroll Bond Rating Agency.

The first mortgage, which pays interest, and no principal, for its entire extended term of seven years, is being used as collateral for Turtle Bay Resort Trust CGCMT 2018-TBR.

Blackstone appears to have big plans: The site has been approved for the development of 725 hotel, condominium hotel, and single-family units. But these units will be located on non-collateral land on both the east and west sides of the subject hotel, so mortgage bondholders may not benefit.

Natixis' double-header

Natixis Commercial Mortgage Securities Trust 2018-285M is backed by a $235 million five-year, fixed-rate commercial mortgage on 285 Madison Avenue, a 511,208-square foot building in Midtown Manhattan. The borrower, RFR, is a joint venture between real estate moguls Aby Rosen and Michael Fuchs, who used the proceeds to refinance the building, cashing out approximately $127.3 million in the process.

The second offering, Natixis Commercial Mortgage Securities Trust 2018-TECH is backed by a $150 million, five-year, floating-rate mortgage secured by five adjacent office and research and development properties located in Santa Clara, Calif. The borrower is indirectly owned and controlled by Brett Lipman, Farshid Shokouhi, and Ivan Reitman, who also serve as the loan's nonrecourse carveout guarantors.