-

The private-equity giant has secured a $900 million single-asset commercial loan to finance its investment in three studios where Netflix and Walt Disney will produce original programming for their streaming services.

August 7 -

The private equity megalith's mortgage trust made a second-quarter net income of over $17.5 million and $85.2 million in core earnings.

July 30 -

The net assets in Blackstone Real Estate Income Master Fund declined to $553M on May 31 from $773M at year-end 2019.

July 17 -

As Las Vegas opens back up to tourists, MBS investors are being asked to roll the dice on the lodging industry that has been conspicuously absent from recent conduit deals amid the COVID-19 outbreak.

June 15 -

The private equity firm's REIT arm is seeking to price a second CRE loan portfolio for May, this time led by an industrial portfolio of warehouses and logistics centers. No hotel or shopping mall loans are included.

May 20 -

Sellers are currently willing to concede discounts of around 5%, while bidders are hoping for about 20% off pre-pandemic prices. That estimated gap, which is likely wider in specific cases, has put a freeze on deals.

May 19 -

Blackstone Real Estate Partners is planning a $1.7 billion bond sale secured by a commercial mortgage loan that financed its newly acquired controlling interests in Great Wolf Lodge waterpark entertainment resort properties.

December 11 -

BX Commercial Mortgage Trust 2019-XL, via Citigroup, features 11 note classes backed by a floating-rate, first-lien mortgage on 406 Blackstone-owned properties with a tenant roster of over 2,000 lessees — including Home Depot, UPS, FedEx and Amazon.

October 7 -

The loans in the deal are for timeshares in the 52-story Elara condo and hotel tower managed by Hilton Resorts Corp.

August 11 -

Blackstone's real estate affiliate and property management firm SITE Centers Corp. acquired the 12 centers across seven states in 2014.

June 21 -

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

April 30 -

Schwarzman says a dramatic change in tax policy under Democratic lawmakers or a rise in interest rates by the Federal Reserve could be a shock to the economy.

April 29 -

Stonyrock Partners will focus on buying stakes in asset managers focused on middle-market strategies.

April 23 -

The buyers obtained a $597 million mortgage and $53 million of mezzanine financing from Deutsche Bank and Wells Fargo to purchase the JW Marriott Grande Lakes and Ritz-Carlton Grande Lakes.

December 13 -

A $215 million commercial mortgage that was used to acquire the Ritz-Carlton Kapalua is being used as collateral for a transaction called GS Mortgage Securities 2018-LUAU

November 5 -

Invitation Homes 2018-SFR4 recycles collateral from Colony American Homes 2015-SFR1 (53.9%) and Colony Starwood Homes 2016-SFR1 (46.1%).

October 23 -

A growing number of asset managers are waking up to the opportunity to lend to small and medium-sized companies, and much of this direct lending is making its way into the securitization market.

October 2 -

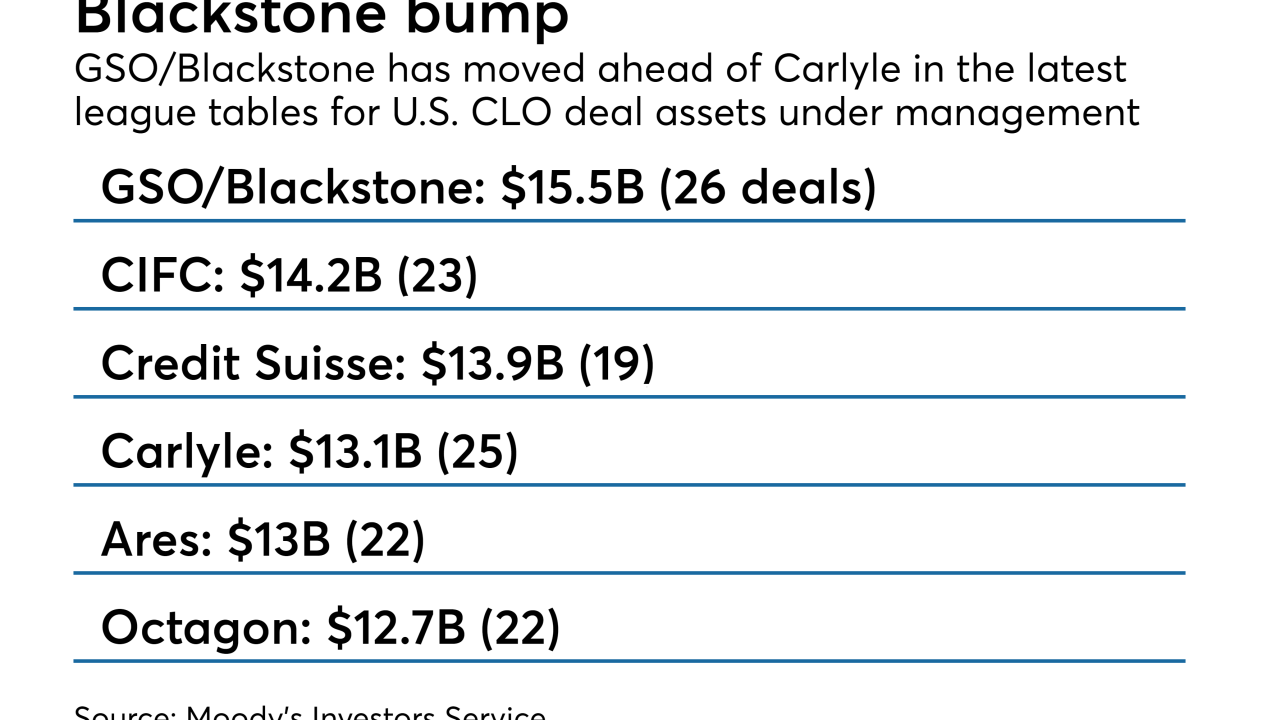

The distressed-debt manager now manages 26 U.S. CLOs totaling $15.5 billion, the most of any domestic CLO market manager.

August 13 -

La Quinta is spinning off a portfolio of 2014 hotels into a real estate investment trust called CorePoint; the REIT obtained a $1.035 billion mortgage from JPMorgan Chase that is being used as collateral for mortgage bonds.

June 25 -

Like the sponsor's February transaction, this one is backed by midsize and larger business jets, a volatile asset class; it amortizes more slowly and has looser restrictions on extending the terms of leases and loans.

June 18