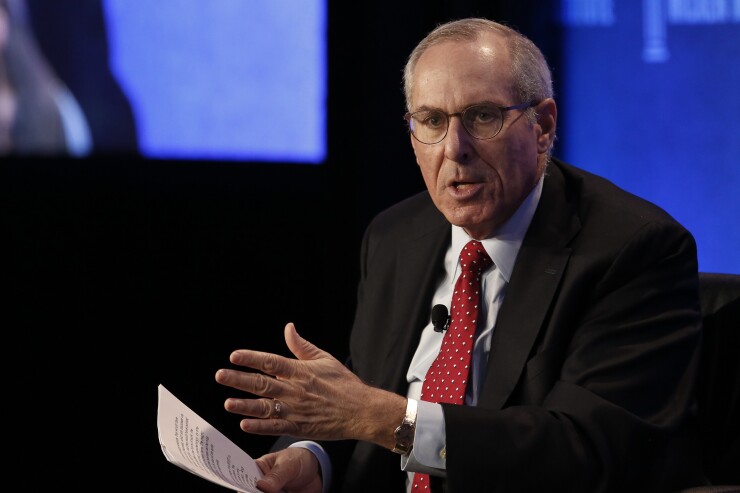

Removing the implicit guarantee for Freddie Mac's unsecured debt would have consequences for the housing finance system, according to Freddie CEO Don Layton.

Speaking at a structured finance industry conference in Las Vegas Monday, Layton said that Freddie, along with sister company Fannie Mae, relies on unsecured debt to fund its purchases of delinquent loans out of pools of collateral for mortgage bonds. Loans that are subsequently modified stay on Freddie's balance sheet, rather than in a securitization trust.

The two government-sponsored enterprises could not continue to do this if they had to issue unsecured debt without the implicit guarantee because their funding costs woud rise.

Layton, who took the helm in 2012, after Freddie was put in conservatorship, said that the company had previously used unlimited access to unsecured borrowing inappropriately, to build an investment portfolio that was larger than the balance sheet of the Federal Reserve. At the peak, Freddie and Fannie each had some $800 billion of mortgage bonds, most of it discretionary. This investment portfolio became Freddie's primary source of profits.

The GSEs "profited from money that was very cheap and it wasn't what they were there for," Layton said.

In reaction, some people in policy circles are pushing to restrict the implicit guarantee to the mortgage bonds that the GSE issues.

"Let's go through what that means," the CEO said. "We could use mortgages as collateral for borrowing, but it would be a lot more expensive. Could we buy back all of the loans that are 120 days delinquent? No way. This is a government-sized program."

Freddie has now run down its investment portfolio to the point where it is only used to run the guarantee business. "End of story," Layton said. If the GSE loses the implicit guarantee for its unsecured debt, "things will change," he said. "People should understand that. Zero as a policy reaction has consequences that I don’t think the system would like. A lot of MBS investors don’t want to hear you won’t buy a mortgage out of [a trust]. It will change prepayment speeds. Do people understand that?”

Layton, who is set to retire later this year, stopped short of endorsing any policy. "My job is to tell them what those consequences would be and let them deal with it," he said.