The Bancorp may be best known for issuing prepaid cards, but it is relying on another strategy to boost its financial results.

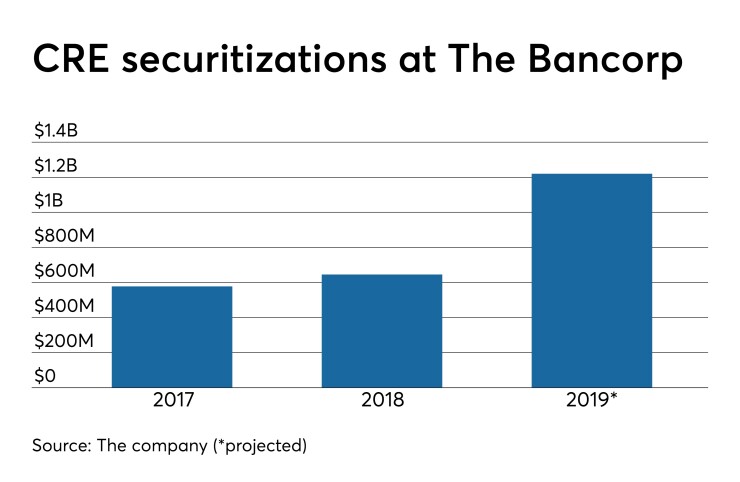

The Wilmington, Del., company has ramped up its dealings in commercial real estate in recent years, including a decision to sponsor its own securitizations. It has bundled five deals totaling $1.7 billion since 2016.

A sixth, totaling more than $700 million, should go to market in coming weeks, CEO Damian Kozlowski said Friday during the $4.6 billion-asset company’s second-quarter conference call. It would follow a $518.3 securitization in March.

“We kind of like where we are with the product,” Kozlowski said.

The Bancorp is one of several banks securitizing more CRE originations.

The $6.5 billion-asset Dime Community Bancshares in Brooklyn, N.Y., completed a

The trend comes at a time when many other lenders have become

For The Bancorp, the amount of fee income from CRE securitizations increased by 9% in 2018 from a year earlier, totaling $20.4 million. The business added another $10.2 million in the first half of 2019.

Cards and payments remain a big driver of noninterest income for the company, accounting for $36.8 million in fees through June 30.

While the securitizations include office, hotel and retail properties, the lion’s share involves multifamily, which made up roughly 80% of the March transaction. The nationwide business aims for a “sweet spot” of $750 million to $800 million per securitization, Kozlowski said.

The focus on multifamily seems well timed, said Edward Mermelstein, a New York lawyer and real estate broker.

“Demographics are pointing to the rental market getting stronger,” Mermelstein said, adding that multifamily projects in California and Texas are performing well. “It all comes down to risk tolerance. If you can handle the risk of taking the lead, you can become the go-to lender for that space.”

Mermelstein pointed to Bank OZK in Little Rock, Ark., which has established itself as a national leader in condominium lending.

Bank OZK, however, has struggled with underwriting concerns in recent months. The $23 billion-asset company’s shares

The Bancorp has so far avoided asset-quality pitfalls in its CRE operations, with Kroll Bond Rating Agency noting that only one loan in the first four securitizations has become delinquent.

“That means they aren’t being stupid, and that’s a good thing,” said Karl Augenstein, executive director at Capco in San Francisco.

While it is unusual for a company the size of The Bancorp to generate significant securitization volume, Augenstein said success should usher in more business.

“Once you’re plugged in, people are going to start sending you deals,” Augenstein said.

Kozlowski, who became the company's president and CEO in 2016, has addressed a number of legacy issues since taking over the top post.

The company was hit with a consent order, and agreed to pay a $172,000 civil money penalty, in 2012 tied to its supervision of third-party relationships, internal auditing and risk management. The order was amended in 2015.

The Federal Deposit Insurance Corp. issued The Bancorp a

The company also paid a $2 million civil money penalty in 2017 tied to its dealings with a third-party payment processor.

While selling CRE loans removes the specter of long-term credit risk, the process isn’t hazard-free, industry observers note.

Investors can hold The Bancorp financially responsible if it breaches any representations or warrantees. The company could also be left holding hundreds of millions of CRE loans on its books if the market dries up before they are securitized and sold.

Such concerns seem relatively remote for now. With interest rates seemingly poised to fall, borrowers' credit costs are likely to decline faster than tenants’ occupancy costs, Mermelstein said.

“Assuming the economy keeps humming along, that cash engine just keeps working,” Augenstein said.