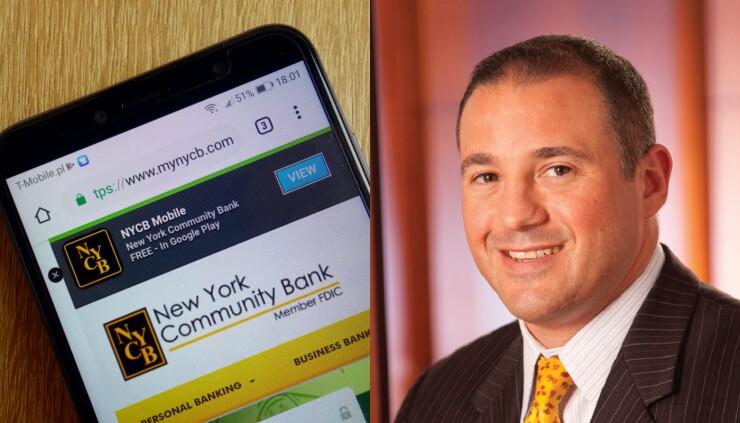

The turmoil at New York Community Bancorp continued on Wednesday, as the Long Island-based lender announced a leadership shakeup after a sharp sell-off in its shares.

The appointment of Alessandro DiNello, the former president and CEO of Flagstar Bancorp, as executive chairman came just hours after New York Community sought to reassure investors about

DiNello had been serving as nonexecutive chairman of New York Community since December 2022,

DiNello focused on three themes: what he characterized as New York Community's "strong liquidity position;" his view that the $116.3 billion-asset company needs to do "whatever it takes" to build capital, even if it means selling off parts of the business; and the possibility that the bank will have to remix the composition of its loan portfolio to reduce risk.

"This bank remains strong and will get itself back on the right track," DiNello told analysts.

He said that New York Community has seen "virtually no deposit outflow" from its 420-branch, multistate retail franchise, and that total deposits have increased since the end of 2023. While the company's liquidity position is already strong, it is "committed to building liquidity further," he added.

Meanwhile, the Hicksville, New York-based bank's common equity tier 1 ratio will be a "special focus," DiNello said. As of Dec. 31, that ratio was 9.1%. Management is targeting 10%, and a

In addition, the company will be "laser-focused" on reducing its commercial real estate portfolio as quickly as it can, DiNello said. He added that New York Community has already started exploring ways to reduce its CRE concentration.

"We will build a financial plan that gradually builds capital — no ifs, ands or buts," DiNello said. "If we must shrink, then we'll shrink. If we must sell non-strategic assets, then we'll do that."

Bloomberg News

The actions announced by New York Community late Tuesday and early Wednesday came after the company's share price plunged by more than 59% over the previous week. The stock finished up 6.7% Wednesday after a volatile day of trading.

In a press release early in the day, New York Community said that DiNello "will work alongside" President and CEO Thomas Cangemi and the rest of the senior executive leadership team "to improve all aspects of the bank's operations."

During the call with analysts, Cangemi, who has been the company's main public voice since

In response to a question about whether New York Community executives are considering raising more capital, DiNello said it's "another option" on the table.

"We have no plan to do it right at the moment, but it's certainly something that will be on our minds going forward," he said. "And I believe that we could if we needed to. But at this point, we haven't made any decision on that."

DiNello, who joined Troy, Michigan-based Flagstar in 1979, became CEO of the company in 2013 and remained in that post until its acquisition by New York Community. In conjunction with his role as nonexecutive chairman of New York Community, he sat on the board of directors' executive, board credit and technology committees, according to a biography on New York Community's website.

On Tuesday evening, New York Community provided a mid-quarter update about its deposit base, which some investors had been seeking. The company said that it had $83 billion of deposits as of Monday — which was up nearly 2% from $81.4 billion on Dec. 31, 2023.

The company also said that 72% of its deposits were insured and collateralized. In its top 20 deposit relationships, 90% of balances were fully insured or collateralized, the bank added.

On Wednesday morning, New York Community executives were asked how often they will update investors about the company's liquidity position. Chief Financial Officer John Pinto responded: "As we see changes in the deposit base, we'll put out information to ensure that what we're seeing is out in the marketplace."

One factor that could help New York Community weather the storm: the name of its holding company is likely unfamiliar to many of its depositors. New York Community has long operated branches under names such as Queens County Savings Bank, Garden State Community Bank and Desert Community Bank, and

On Wednesday, stock analysts said the company's mid-quarter update about its deposits is a positive sign that clients are sticking with the company.

Ebrahim Poonawala, an analyst at Bank of America Securities, said the update should "soothe concerns" about the bank's health. Still, he downgraded New York Community from a buy rating to neutral.

New York Community's strategic outlook is now "muddied," and its profitability will likely take a hit, as it is forced to pay more to hold onto its depositors, Poonawala wrote in a note to clients.

"While we believe that the bank has enough liquidity to navigate the current period … the elevated headline risk has the potential to influence customer behavior, leading to a greater than-expected increase in the cost of deposits," Poonawala wrote.

Other problems have also been piling up.

On Tuesday, New York Community was hit with a proposed class-action lawsuit filed on behalf of shareholders. The complaint, which names Cangemi and Pinto as co-defendants, alleges that the bank made materially false or misleading statements, and also failed to disclose certain material adverse facts.

Among the information that the bank is alleged to have withheld from investors: higher charge-offs and deterioration in its office loan portfolio. New York Community did not comment on the suit.

Also on Tuesday, Moody's Investors Service downgraded the bank's long-term issuer rating by two notches.

In a press release issued before DiNello was named executive chairman, Cangemi downplayed the impact of the Moody's downgrade, saying that New York Community's deposit ratings from Moody's, Fitch Ratings and DBRS are still investment grade. The ratings downgrade from Moody's "is not expected to have a material impact on our contractual arrangements," he said.

New York Community is also dealing with the recent departure of Chief Risk Officer Nicholas Munson. Earlier this week, the company confirmed that Munson left the role in early 2024.

On Wednesday's call, DiNello said New York Community is close to hiring a new chief risk officer and a new chief audit executive. The company is in a position to announce a new chief risk officer "in the very near future," and it is "in final discussions" with its top candidate for the chief audit executive role, he said.

The company did not say who is handling the responsibilities of either role on a temporary basis.

New York Community has been reeling since issuing its fourth-quarter earnings report on Jan. 31. The bank reported a quarterly net loss of $260 million, driven by a large reserve build to protect against souring loans. It also surprised investors by cutting its dividend by 70% — a move that executives said was necessary in order to build capital.

On Wednesday, when an analyst asked DiNello if the bank's regulators forced its hand, requiring it to take the actions it announced last week, he seemed reluctant to answer directly.

"We made some changes in the way we risk-weighted our loan portfolio and came to the conclusion that we needed to take action, and we did," he said. "This speculation of why and when and who — Look, we did the right thing, and we're going to go forward now."